How Much Is Car Payment On 30000

Let's talk about car payments. Specifically, how much you're likely to pay monthly on a $30,000 vehicle. This isn't just about the sticker price; it's about understanding the factors that drastically affect your financial outlay. Think of this as dissecting the engine of a car loan – knowing the components allows you to tune it for optimal performance (in this case, minimal expense). This guide is tailored for experienced DIYers who are comfortable with financial terminology and want a detailed breakdown, not just a ballpark figure.

Understanding the Key Factors

Calculating a car payment isn't as simple as dividing the price by the loan term. Several factors come into play, each influencing the final number.

1. Principal Loan Amount

This is the base amount you're borrowing: $30,000 in our case. Keep in mind that this might be slightly lower if you have a trade-in or a down payment.

2. Interest Rate (APR)

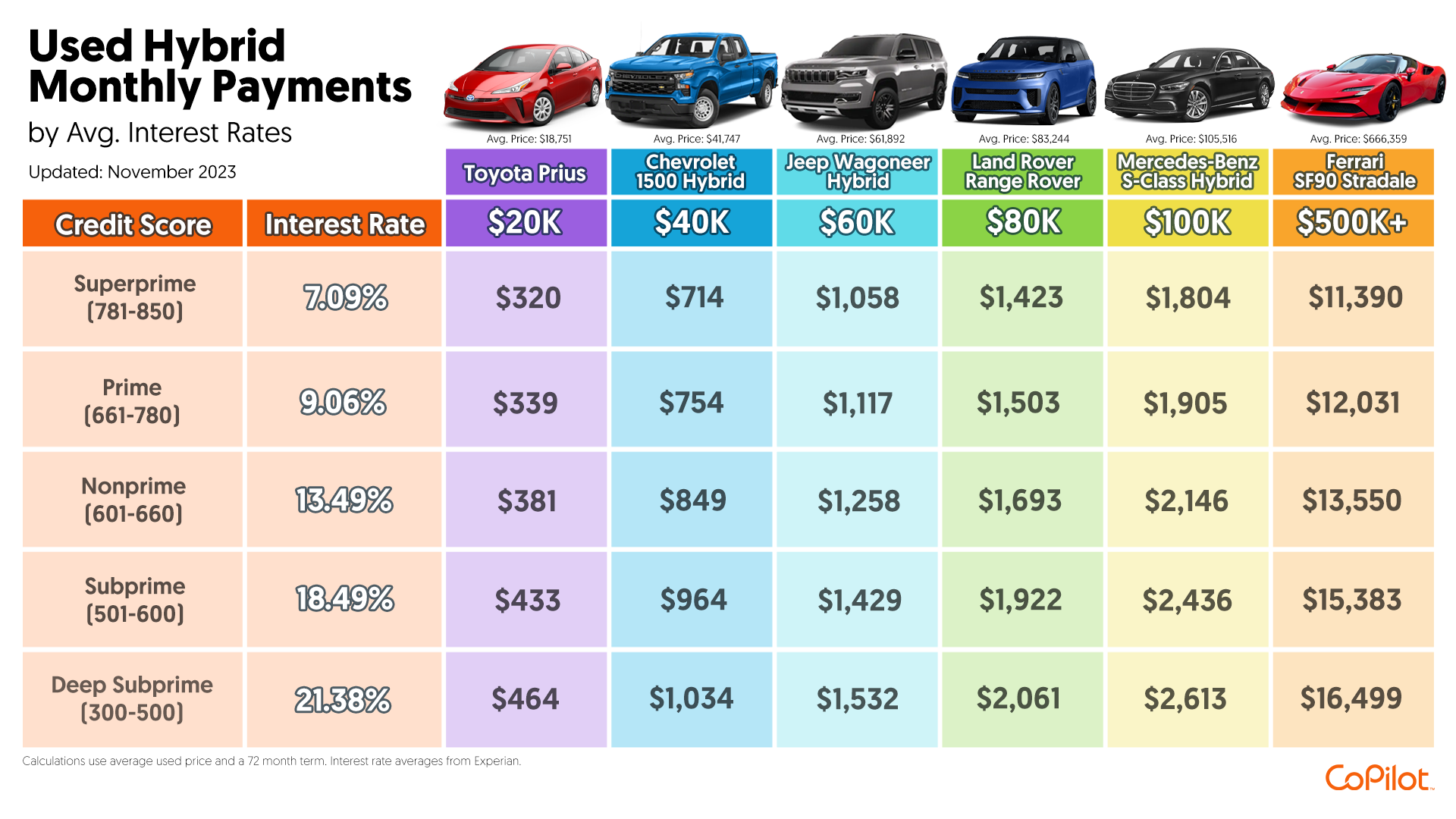

The APR, or Annual Percentage Rate, is the single most influential factor. It's the cost of borrowing the money, expressed as an annual percentage. A seemingly small difference in APR can lead to significant savings or losses over the loan term. For example, a 3% APR will result in far less interest paid than a 7% APR. Understanding how the interest rate is determined and how it affects your overall costs is crucial. Consider that your credit score is a primary factor determining the interest rate.

3. Loan Term

The loan term is the length of time you have to repay the loan, typically expressed in months (e.g., 36 months, 60 months, 72 months). A longer term means lower monthly payments, but you'll pay significantly more in interest over the life of the loan. A shorter term means higher monthly payments, but you'll pay less interest overall. There's a trade-off. Choosing a loan term that fits your budget and allows you to pay off the loan faster is essential.

4. Sales Tax

The sales tax rate varies by state and sometimes even by locality. It's a percentage of the vehicle's purchase price that you'll need to pay upfront or rolled into the loan. Failing to factor in sales tax can throw off your budget considerably.

5. Fees and Add-ons

Dealerships often tack on various fees, such as documentation fees, registration fees, and destination charges. Be wary of unnecessary add-ons like extended warranties or paint protection, which can significantly increase the loan amount. Negotiating these fees or opting out of add-ons can save you money.

The Formula: Calculating Your Car Payment

The standard formula for calculating a loan payment is as follows:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly payment

- P = Principal loan amount ($30,000)

- i = Monthly interest rate (Annual interest rate / 12)

- n = Number of months in the loan term

Let's illustrate this with a couple of examples:

Scenario 1: $30,000 loan at 5% APR for 60 months

i = 0.05 / 12 = 0.004167

n = 60

M = 30000 [ 0.004167(1 + 0.004167)^60 ] / [ (1 + 0.004167)^60 – 1]

M ≈ $566.04

Scenario 2: $30,000 loan at 7% APR for 72 months

i = 0.07 / 12 = 0.005833

n = 72

M = 30000 [ 0.005833(1 + 0.005833)^72 ] / [ (1 + 0.005833)^72 – 1]

M ≈ $508.09

Notice how a slightly higher interest rate and a longer loan term result in a lower monthly payment but significantly more interest paid over the loan's lifespan. In the first scenario you pay $3,962.40 in interest over 5 years. In the second you pay $6,582.48 in interest over 6 years.

Real-World Use: Estimating and Managing Your Car Payment

While the formula provides accurate results, several online car loan calculators can simplify the process. These calculators allow you to adjust the principal, interest rate, and loan term to see how they affect your monthly payment.

Troubleshooting Tips:

- High Monthly Payment: If your estimated monthly payment is too high, consider increasing your down payment, opting for a longer loan term (be mindful of the increased interest), or negotiating a lower price on the vehicle.

- Unexpected Fees: Scrutinize the loan agreement for hidden fees. Don't hesitate to question or negotiate any charges you don't understand.

- Credit Score Impact: Regularly check your credit score. A higher credit score can qualify you for a lower interest rate, saving you thousands of dollars over the loan term.

- Refinancing: If interest rates drop after you've taken out the loan, consider refinancing to secure a lower APR.

Safety and Financial Responsibility

Taking on a car loan is a significant financial commitment. It's crucial to assess your budget realistically and ensure you can comfortably afford the monthly payments. Defaulting on a car loan can negatively impact your credit score and potentially lead to repossession of the vehicle.

Risky Components:

- Variable Interest Rates: Avoid loans with variable interest rates, as your monthly payments could increase unexpectedly.

- Long Loan Terms: While a longer loan term reduces monthly payments, it significantly increases the total interest paid.

- Overextending Yourself: Don't buy a car you can't afford, even if the monthly payments seem manageable. Consider the long-term financial implications.

Before committing to a car loan, take the time to understand all the factors involved and make an informed decision that aligns with your financial goals. Remember, it's not just about the monthly payment; it's about the total cost of ownership, including insurance, maintenance, and fuel.

We've prepared a detailed financial analysis spreadsheet that will help you model different scenarios and loan options. This spreadsheet includes features such as amortization schedules and total interest paid calculations, allowing for in-depth cost comparisons.

If you're interested in receiving a copy of this spreadsheet, please let us know.