How Much Is Gap Insurance Cost

Let's talk about GAP insurance cost, a crucial aspect of car ownership often overlooked until it's desperately needed. This isn't just about saving a few bucks; it's about understanding the financial safety net that GAP insurance provides and making informed decisions. Think of this as understanding the schematics of a financial system designed to protect you when things go south with your vehicle.

Purpose of Understanding GAP Insurance Cost

Why bother diving into the cost of GAP insurance? Because ignorance can be incredibly expensive. Understanding the factors influencing GAP insurance premiums allows you to:

- Make informed decisions when purchasing a vehicle: Weigh the cost of GAP insurance against the potential financial risk.

- Negotiate better deals: Knowledge is power. Knowing how GAP insurance is priced can help you negotiate with dealers or insurance providers.

- Avoid unnecessary expenses: Sometimes, GAP insurance might not be necessary, and understanding the calculations will help you realize that.

In essence, understanding GAP insurance cost empowers you to manage your financial risk associated with vehicle ownership effectively.

Key Specs and Main Parts of GAP Insurance Cost Calculation

The cost of GAP insurance isn't pulled out of thin air. It's based on several key factors. Let's break them down:

1. Vehicle Depreciation Rate

This is the single biggest factor. Depreciation refers to the decrease in your vehicle's value over time. New cars depreciate the fastest, particularly in the first few years. Vehicles with historically high depreciation rates will typically result in higher GAP insurance premiums. Think of it like this: a limited-edition sports car might hold its value relatively well, while a mass-produced sedan will depreciate more rapidly.

2. Loan-to-Value (LTV) Ratio

This is the ratio of the loan amount to the vehicle's value. A higher LTV ratio signifies a greater risk for the insurer. If you finance 100% (or even more, including taxes and fees) of the vehicle's price, your LTV is high, and your GAP insurance premium will likely be higher. Putting a larger down payment reduces your LTV and, consequently, the risk for the insurer. In essence, it represents how much you *owe* compared to what the car is *worth*.

3. Loan Term

Longer loan terms mean you'll be underwater (owing more than the car is worth) for a longer period. This extended exposure translates to a higher risk for the GAP insurance provider, resulting in potentially higher premiums. A shorter loan term reduces this risk and could lower the cost of GAP insurance.

4. Credit Score

Your credit score plays a significant role, just like it does with your loan interest rate. A lower credit score generally indicates a higher risk of default, leading to higher GAP insurance premiums. A better credit score demonstrates responsible financial behavior and can result in lower premiums.

5. Insurance Provider

Different insurance providers have different underwriting criteria and pricing models. Some may specialize in certain types of vehicles or credit profiles. Therefore, it's essential to shop around and compare quotes from multiple providers to find the best deal.

6. Source of GAP Insurance

You can obtain GAP insurance from several sources, each with potentially different pricing:

- Dealership: Often rolled into your loan, which can increase the overall cost due to interest.

- Directly from your auto insurance provider: May offer a more competitive rate.

- Independent GAP insurance companies: Worth exploring to compare options.

How It Works: Calculating GAP Insurance Cost

While the exact formula is proprietary and varies by insurer, the general principle is to assess the risk and price the coverage accordingly. The insurer will use statistical models that consider the factors mentioned above to estimate the potential payout and set the premium. A simplified (but inaccurate) formula to illustrate the concept could be:

GAP Insurance Cost ≈ (Vehicle Depreciation Rate * LTV Ratio * Loan Term Factor) + Credit Score Adjustment + Provider-Specific Margin

This is a highly simplified example, but it highlights the relationship between the key factors and the overall cost. Remember that each element is carefully evaluated by the insurer to determine the final premium.

Real-World Use: Basic Troubleshooting Tips for GAP Insurance Costs

What if you're facing high GAP insurance quotes? Here are some troubleshooting tips:

- Increase Your Down Payment: This lowers your LTV ratio significantly.

- Shorten Your Loan Term: This reduces the period you're underwater on the loan.

- Improve Your Credit Score: Even a small improvement can make a difference. Check your credit report for errors and address any outstanding debts.

- Shop Around for Quotes: Compare quotes from multiple providers, including your auto insurance company and independent GAP insurance providers.

- Consider Skipping GAP Insurance (Sometimes): If you're putting down a large down payment, have a short loan term, or your vehicle doesn't depreciate quickly, GAP insurance might not be worth the cost. Carefully evaluate your situation.

Safety Considerations

While GAP insurance itself isn't inherently dangerous, there are potential risks associated with how it's often sold and financed:

- Avoid Rolling GAP Insurance into Your Loan: This increases the overall cost due to interest charges. Paying for it upfront is generally cheaper.

- Read the Fine Print: Understand the terms and conditions of your GAP insurance policy, including any exclusions or limitations.

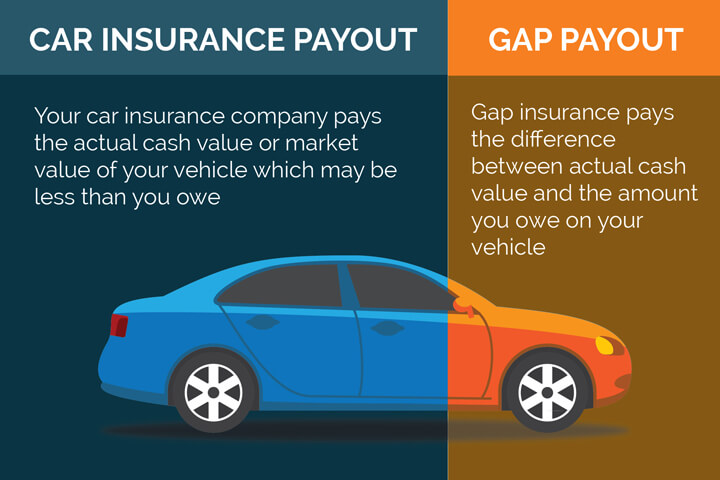

- Ensure You Understand What's Covered: GAP insurance typically covers the *difference* between the vehicle's actual cash value (ACV) and what you owe on the loan after your primary insurance pays out. It doesn't cover things like mechanical repairs, deductibles, or extended warranties.

Don't let high-pressure sales tactics rush you into a decision you later regret. Do your homework and choose the option that best fits your financial situation and risk tolerance. Understanding your coverage is paramount.

Conclusion

Understanding the cost of GAP insurance is about empowerment. It gives you the knowledge to navigate the complexities of vehicle financing and protect yourself from potentially significant financial losses. By considering the factors influencing premiums, troubleshooting high quotes, and understanding the safety aspects, you can make informed decisions that safeguard your financial well-being.

Remember, this article provides a general overview. Individual circumstances may vary, so it's always best to consult with a qualified financial advisor or insurance professional for personalized advice.