How Much Is Gap Insurance Refund

Understanding how much you might be entitled to as a GAP insurance refund can feel as complex as deciphering a wiring diagram. Many car owners only scratch the surface of this financial safety net. This guide will break down the key aspects, helping you understand the calculation and reclaim what's rightfully yours. Think of this as a "how-to" manual for navigating the often-murky waters of GAP insurance refunds.

Purpose of Understanding GAP Insurance Refunds

Why bother understanding the refund process? Several reasons. First, you could be owed money! Many people cancel their GAP insurance policy early or pay off their car loans ahead of schedule, entitling them to a partial refund. Second, knowing the calculation prevents dealerships or lenders from shortchanging you. Finally, it empowers you to make informed decisions about GAP insurance in the future.

Key Specs and Main Parts of a GAP Insurance Policy

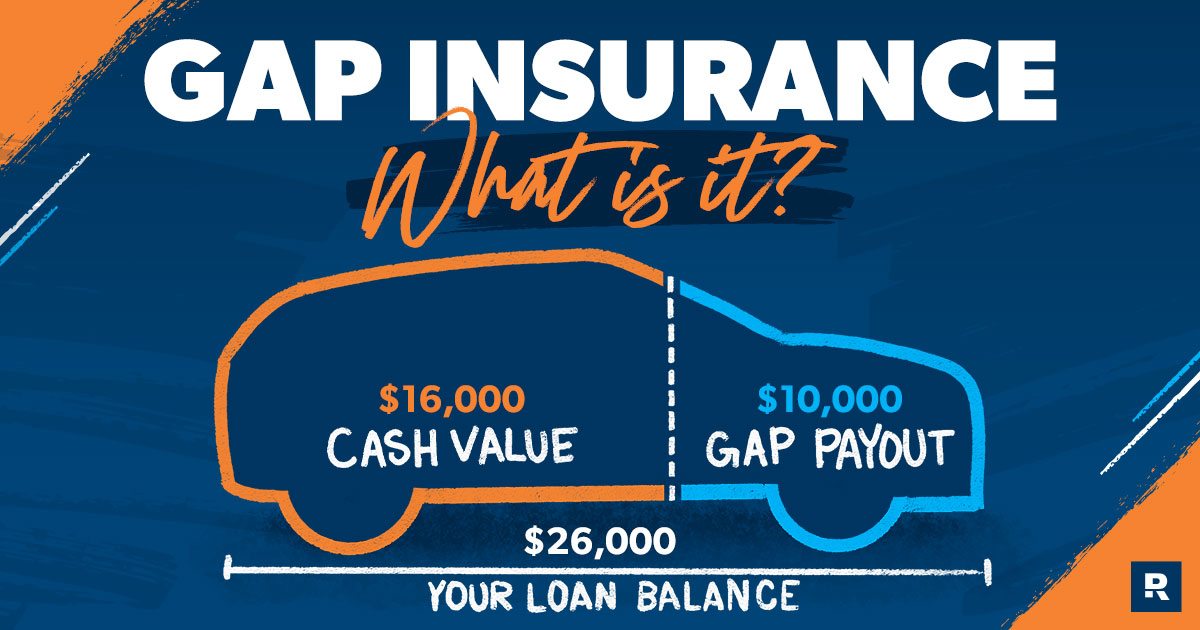

Before diving into refunds, let's solidify the fundamentals of GAP insurance itself. GAP stands for Guaranteed Asset Protection. It covers the "gap" between what you owe on your car loan and what the car is actually worth (its actual cash value or ACV) if it's totaled or stolen. Here are the key specs and components:

- Loan Amount: The original amount you borrowed to purchase the vehicle.

- ACV (Actual Cash Value): The fair market value of your car at the time of loss, determined by factors like age, mileage, and condition. Insurance companies use sources like Kelley Blue Book or NADA guides to estimate this.

- Outstanding Loan Balance: The remaining amount you owe on your car loan at the time of loss or cancellation.

- GAP Coverage Limit: The maximum amount your GAP insurance policy will pay out. Most policies have a limit, so review yours carefully.

- Refundable Premium: The portion of your GAP insurance premium that you may be entitled to receive back if you cancel the policy early or pay off your loan ahead of schedule.

- Cancellation Fee (if applicable): Some policies may have a small cancellation fee, which will be deducted from your refund.

How a GAP Insurance Refund is Calculated

The calculation for a GAP insurance refund is generally pro-rata. This means the refund is based on the unused portion of your policy. Here's the basic formula:

Refundable Premium = (Original GAP Premium / Total Policy Term) * Remaining Policy Term

Let's break this down with an example:

Suppose you purchased GAP insurance for $500 (Original GAP Premium) with a 60-month policy term (Total Policy Term). After 24 months, you pay off your car loan and cancel the GAP policy. The Remaining Policy Term is 36 months (60 - 24).

Using the formula:

Refundable Premium = ($500 / 60) * 36 = $300

Therefore, you would be entitled to a refund of approximately $300. However, remember to check your policy for any cancellation fees or specific refund clauses that might affect the final amount.

Some policies may use a slightly different calculation method, such as the "rule of 78" or other actuarial methods. These methods front-load the premium, meaning you receive a smaller refund early in the policy term and a larger refund later on. Always refer to your policy documentation for the precise calculation method used.

Real-World Use: Basic Troubleshooting Tips

Here's some practical advice when dealing with GAP insurance refunds:

- Review Your Policy: The most crucial step is to carefully read your GAP insurance policy. It outlines the terms, conditions, cancellation policy, and refund calculation method.

- Keep Records: Maintain copies of your loan documents, GAP insurance policy, and any correspondence with the dealership or lender.

- Contact the Right Party: Typically, you'll need to contact the dealership, lender, or GAP insurance provider to initiate the cancellation and refund process. Confirm the correct contact information from your policy documents.

- Document Everything: Keep a record of all conversations, dates, and names of people you speak with. Send written requests for cancellation and refunds via certified mail to ensure proof of delivery.

- Dispute Incorrect Calculations: If you believe the refund calculation is incorrect, politely but firmly dispute it with the provider. Provide supporting documentation to back up your claim. If the dispute is unresolved, consider contacting your state's insurance department or consumer protection agency.

Safety Considerations

While GAP insurance refunds aren't inherently dangerous, be cautious of the following:

- High-Pressure Sales Tactics: Dealerships might pressure you into purchasing GAP insurance. While it can be beneficial, don't feel obligated. Research and compare options before making a decision.

- Unclear Policy Terms: Insist on a clear explanation of the policy terms, especially the cancellation and refund policies. If the terms are ambiguous or confusing, seek clarification before signing.

- Fraudulent Claims: Be wary of offers to handle your GAP insurance refund for a fee. These services are often unnecessary and potentially fraudulent. It's best to handle the cancellation and refund process yourself.

Common Pitfalls and How to Avoid Them

Missing the Deadline: Many policies have deadlines for canceling and receiving a refund. Miss these, and you're likely out of luck. Always check your policy for specific timelines.

Failing to Provide Necessary Documentation: The insurer will require proof of loan payoff or early termination. Gather all necessary documentation (loan payoff statement, policy documents, etc.) before contacting the provider. A delay in providing the documentation will only delay your refund.

Ignoring Cancellation Fees: Some policies have cancellation fees that can eat into your refund amount. Be aware of these fees and factor them into your calculation.

Assuming Automatic Refund: Don't assume the refund will be automatically processed. You usually need to proactively request cancellation and the refund.

Overlooking State Regulations: State laws can impact GAP insurance regulations and refund policies. Familiarize yourself with the specific laws in your state.

When GAP Insurance Might Not Be Worth It

While GAP insurance can be valuable, it's not always necessary. Consider these situations:

- Large Down Payment: If you made a substantial down payment (20% or more), the "gap" between your loan balance and the car's value is likely smaller.

- Short Loan Term: With a shorter loan term, the car's depreciation has less time to outpace your loan payoff.

- Paying Off Your Car Quickly: If you're aggressively paying down your car loan, the risk of being "upside down" decreases.

- Purchasing a Low-Depreciation Vehicle: Some vehicles hold their value better than others. If you're buying a model known for its strong resale value, the need for GAP insurance may be reduced.

Ultimately, the decision to purchase GAP insurance is a personal one. Weigh the costs and benefits based on your individual circumstances.

We have a detailed GAP insurance policy diagram available for download, which illustrates these concepts visually. This diagram includes timelines, calculation examples, and a simplified refund request process. It can be a valuable resource for further understanding GAP insurance refunds.