How Much Was Gold In 2010

Let's delve into the question of how much gold cost in 2010. Now, I know what you might be thinking: "Why is this relevant to car guys like us?" Well, understanding commodity prices, even precious metals like gold, can give you a broader perspective on economic factors that subtly influence everything from the cost of materials used in car manufacturing (think electrical wiring, catalytic converters) to the overall economic climate affecting your disposable income for mods and repairs. It's about seeing the bigger picture, just like understanding the interconnectedness of your car's systems helps you diagnose problems more effectively.

Purpose: Why Understand Gold Prices?

Looking back at historical gold prices, particularly a specific year like 2010, isn't just about idle curiosity. It's about understanding economic trends. These trends directly affect:

- Material Costs: Raw material prices impact the cost of car parts. Higher gold prices can translate to increased costs in certain electronic components and other parts.

- Economic Stability: Gold is often seen as a safe-haven asset. Its price movements can reflect broader economic anxieties or optimism, influencing investment decisions that ripple through various sectors, including the automotive industry.

- Investment Diversification: Understanding gold can inform your own investment strategies, particularly if you're looking to diversify beyond just keeping your money in the bank. Just as you diversify your car collection, you can diversify your investments.

Key Specs and Main Parts: Understanding the Numbers

When we talk about gold prices, we're typically referring to the spot price. This is the current market price at which gold can be bought or sold for immediate delivery. It's a fluctuating number, influenced by a myriad of factors.

Key Specifications we'll be looking at include:

- Units of Measure: Gold is typically priced in troy ounces (not your standard ounce!). A troy ounce is approximately 31.1035 grams.

- Currency: The most common currency for quoting gold prices is the US dollar (USD).

- High/Low Prices: The highest and lowest prices reached during the year. These give you a sense of the price volatility.

- Average Price: The average price for the year, providing a general sense of the price level.

In 2010, the average price of gold was around $1224.53 per troy ounce. However, prices fluctuated significantly throughout the year. The year started around $1100 per ounce and climbed steadily, hitting a peak of over $1400 towards the end of the year. This volatility is important to understand.

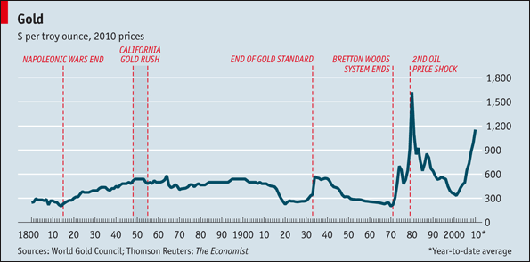

Symbols and Conventions: Deciphering the Charts

While we're not dealing with a wiring diagram here, visualizing gold prices often involves charts. Understanding these charts is crucial for interpreting the data.

- X-axis: Represents time (days, months, years).

- Y-axis: Represents the price of gold (usually in USD per troy ounce).

- Lines: A continuous line shows the price movement over time. A steep incline indicates a rapid price increase, while a decline shows a price decrease.

- Candlestick Charts: A more detailed type of chart. Each "candlestick" represents a specific time period (e.g., one day). The body of the candlestick shows the range between the opening and closing prices. If the body is filled (usually red), the closing price was lower than the opening price; if the body is hollow (usually green or white), the closing price was higher than the opening price. The "wicks" or "shadows" extending above and below the body show the highest and lowest prices reached during that period.

How It Works: The Forces Behind Gold Prices

Many factors influence the price of gold, similar to how various parameters affect your car's performance. Here are some key drivers:

- Supply and Demand: This is the fundamental driver. Limited supply and high demand drive prices up. Demand can come from jewelry manufacturing, industrial applications (electronics, etc.), and investment purposes.

- Interest Rates: Gold tends to perform inversely to interest rates. When interest rates are low, investors often turn to gold as a store of value, increasing demand and pushing prices up.

- Inflation: Gold is often seen as a hedge against inflation. As inflation rises, investors may buy gold to protect their wealth, again increasing demand.

- Geopolitical Instability: In times of political or economic uncertainty, investors often flock to gold as a safe haven, driving up its price. Think of it like bracing your car for extreme weather.

- Currency Fluctuations: The strength of the US dollar can impact gold prices. A weaker dollar can make gold more attractive to investors holding other currencies, increasing demand.

Real-World Use: Basic "Troubleshooting" with Gold Prices

Thinking about using gold prices in a real-world scenario? Here's a simplified example:

Let's say you are restoring a classic car from the 1970s. Some of the original electrical components contain small amounts of gold. If you know the approximate gold content of these components and the historical gold prices, you can estimate the value of the salvaged gold. This can help you determine if it's worth the effort to extract the gold or simply dispose of the components.

Another scenario: you're considering investing in precious metals. By examining historical gold prices and understanding the factors that influence them, you can make more informed investment decisions. Just like researching before buying a new turbocharger!

Safety: Risks and Volatility

While investing in gold doesn't involve physical risks like working on a hot engine, there are financial risks. Volatility is the biggest one. Gold prices can fluctuate significantly, and you could lose money if you buy at a high price and sell at a low price.

Also, be wary of scams. Just like there are shady mechanics out there, there are unscrupulous dealers selling fake gold or misleading investment schemes. Always do your research and deal with reputable sources.

Finally, remember that past performance is not indicative of future results. Just because gold performed well in the past doesn't guarantee it will do so in the future.

So, to recap, in 2010 gold averaged around $1224.53 an ounce and experienced significant price fluctuations. Understanding these price movements and the factors that influence them provides valuable insights into the broader economic landscape, which indirectly affects the automotive world and your own financial well-being. Think of it as another data point in your toolbox, helping you make more informed decisions, whether it's buying parts, planning your next mod, or managing your investments.

We have a detailed chart of gold prices for 2010. Understanding the information in this article will help you better understand and interpret the data in the diagram. We can provide you with access to it if you need it.