How Much Will A Lease Cost

So, you're thinking about leasing a car and want to understand the nuts and bolts of the costs involved? Excellent. Leases can seem opaque, but breaking down the financial components reveals a predictable structure. This isn't just about getting the best deal; it's about understanding the commitments you're making.

Purpose: Demystifying Lease Costs

Understanding lease costs isn't just about haggling a lower monthly payment. It’s about ensuring you understand where that payment comes from, avoiding unexpected fees at the end of the lease, and potentially identifying opportunities to negotiate more favorable terms. It allows you to compare different lease offers on a true apples-to-apples basis, taking into account not just the headline monthly payment but also the long-term implications of each offer. Knowing the terminology and calculations enables informed decision-making and prevents financial surprises.

Key Specs and Main Parts of a Lease Calculation

Let's break down the key elements that determine your lease payment. Think of this as the blueprint for your financial commitment.

- MSRP (Manufacturer's Suggested Retail Price): This is the sticker price of the vehicle. It's the starting point for negotiations, though it rarely represents the actual selling price.

- Selling Price: This is the price you and the dealer agree upon after any negotiations. It's crucial to get this number as low as possible. A lower selling price directly translates to a lower lease payment.

- Residual Value: This is the predicted value of the car at the end of the lease term. It's expressed as a percentage of the MSRP. Higher residual values are generally better because you're only paying for the depreciation of the vehicle over the lease term, not its full value. The leasing company is essentially betting on what they can sell the car for in 2-3 years.

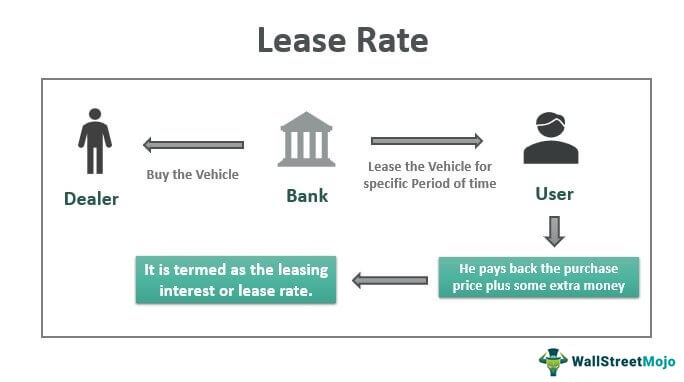

- Money Factor: This is essentially the interest rate you're paying on the lease. It's a decimal (e.g., 0.0025), which needs to be multiplied by 2400 to get the equivalent annual interest rate. This is another crucial area for negotiation. Dealers often mark this up.

- Lease Term: This is the length of the lease, usually expressed in months (e.g., 24, 36, or 48 months).

- Capitalized Cost Reduction (Cap Cost Reduction): This is essentially your down payment. It reduces the amount you're financing. While a lower monthly payment might be tempting with a large cap cost reduction, it's generally not recommended, as you lose that money if the car is totaled or stolen.

- Acquisition Fee: This is a fee charged by the leasing company to cover the costs of setting up the lease. It's typically non-negotiable.

- Disposition Fee: This is a fee charged at the end of the lease to cover the costs of preparing the car for resale. This is *usually* non-negotiable, but understanding it prevents surprises later.

- Sales Tax: This varies depending on your state and is usually calculated on the monthly payment.

How It Works: The Lease Payment Formula

Now, let's put these components together to understand how your monthly lease payment is calculated.

The basic formula is:

Monthly Payment = (Depreciation + Finance Charge) + Sales Tax

Let's break down Depreciation and Finance Charge:

Depreciation Calculation:

Depreciation is the difference between the adjusted capitalized cost (selling price minus cap cost reduction) and the residual value, divided by the number of months in the lease term.

Depreciation = (Adjusted Capitalized Cost - Residual Value) / Lease Term

Example:

- Selling Price: $35,000

- Cap Cost Reduction: $2,000

- Adjusted Capitalized Cost: $33,000

- Residual Value (after 36 months): $22,000

- Lease Term: 36 months

- Depreciation = ($33,000 - $22,000) / 36 = $305.56

Finance Charge Calculation:

The finance charge is calculated by multiplying the money factor by the sum of the adjusted capitalized cost and the residual value.

Finance Charge = Money Factor x (Adjusted Capitalized Cost + Residual Value)

Example:

- Money Factor: 0.0015

- Adjusted Capitalized Cost: $33,000

- Residual Value: $22,000

- Finance Charge = 0.0015 x ($33,000 + $22,000) = $82.50

Putting it all Together:

Now, add the Depreciation and Finance Charge:

Monthly Payment (before tax) = $305.56 + $82.50 = $388.06

Finally, add sales tax. Let's assume a 6% sales tax rate:

Sales Tax = $388.06 x 0.06 = $23.28

Total Monthly Payment = $388.06 + $23.28 = $411.34

Real-World Use: Basic Troubleshooting & Negotiation

Now that you understand the calculation, you can use this knowledge to troubleshoot and negotiate:

- High Monthly Payment: If your monthly payment seems too high, break down the calculation. Focus on the selling price and the money factor. Negotiate a lower selling price or a lower money factor. Ask the dealer to show you the calculations they're using.

- Residual Value Concerns: Research the residual value independently. Sites like Edmunds and Kelley Blue Book provide residual value information. If the dealer's residual value seems low, challenge it. A low residual value increases your monthly payment.

- Hidden Fees: Be aware of acquisition and disposition fees. While often non-negotiable, knowing about them prevents surprises. Read the lease agreement carefully and look for any other hidden fees.

- Cap Cost Reduction Temptation: Resist the urge to make a large down payment (cap cost reduction). It lowers your monthly payment, but it's risky.

Symbols and Terminology

Here are some common symbols and terms you might encounter when discussing leases:

- APR: Annual Percentage Rate. While not directly used in lease calculations, understanding APR helps compare a lease to a loan.

- Money Factor Conversion: Multiply the money factor by 2400 to get the approximate equivalent APR.

- Mileage Allowance: This is the number of miles you're allowed to drive each year without incurring penalties. Exceeding the mileage allowance can result in significant fees per mile.

- Wear and Tear: Leases typically have standards for acceptable wear and tear. Exceeding these standards can result in charges at the end of the lease.

Safety Considerations

While leasing doesn't involve physical components like your engine, there are financial "pressure points" to be aware of:

- Excessive Mileage: Exceeding your mileage allowance can result in significant penalties at the end of the lease. Monitor your mileage carefully.

- Excessive Wear and Tear: Carefully inspect the car before returning it at the end of the lease. Address any significant wear and tear to avoid charges.

- Early Termination: Terminating a lease early can be very expensive. Understand the early termination penalties before signing the lease agreement.

- Gap Insurance: Consider gap insurance, especially if you make a down payment. Gap insurance covers the difference between what you owe on the lease and what the insurance company pays out if the car is totaled or stolen.

Final Thoughts

Understanding the mechanics of a lease, the calculations and associated terminology will greatly help you get a better deal. A lease is nothing more than a loan with extra requirements that make it appear more confusing.