How Much Will Gap Insurance Pay

Let's talk GAP insurance. You're a car enthusiast, maybe you've tinkered with engines, replaced brakes, and understand the intricacies of your vehicle. GAP insurance might seem like just another line item on your insurance policy, but understanding how it works can save you a significant financial headache. Think of this explanation as the detailed schematic you'd want before tackling a complex engine rebuild - it gives you the information you need to understand the system and how to navigate it effectively.

Purpose of Understanding GAP Insurance Payouts

Why delve into the details of GAP (Guaranteed Auto Protection) insurance? It's simple: being informed empowers you. If your car is totaled (declared a total loss by the insurance company due to damage beyond repair), or stolen and never recovered, knowing how GAP insurance calculates its payout can help you:

- Avoid financial shock: Understand the potential shortfall between what your primary insurance pays and what you still owe on your loan.

- Negotiate effectively: Armed with knowledge, you can better understand your insurer's calculations and potentially challenge them if necessary.

- Make informed decisions: When purchasing a vehicle, you can assess if GAP insurance is truly necessary for your specific situation.

Essentially, understanding GAP insurance allows you to protect yourself from the financial burden of depreciation and outstanding loan balances, particularly important if you've heavily modified your vehicle or financed it for a longer term.

Key Specs and Main Parts of a GAP Insurance Calculation

Here's a breakdown of the key components involved in determining a GAP insurance payout. Consider these as the crucial measurements and specifications you need before starting any car repair job:

1. Actual Cash Value (ACV)

The ACV is the fair market value of your vehicle immediately before it was totaled or stolen. This is *not* what you paid for the car, but rather what a similar vehicle with similar mileage and condition would sell for on the market. Insurance companies use resources like Kelley Blue Book, NADAguides, and local market data to determine the ACV.

2. Outstanding Loan Balance

This is the total amount you owe to the lender on your car loan at the time of the incident. It includes the principal balance, accrued interest, and any other outstanding fees permitted by your loan agreement. Make sure you obtain an official loan payoff statement from your lender.

3. Primary Insurance Settlement

This is the amount your primary car insurance company pays out to cover the loss of your vehicle. This payment is usually based on the ACV of the vehicle, less your deductible.

4. GAP Insurance Coverage Limit

Most GAP insurance policies have a maximum payout limit, often capped at a specific dollar amount (e.g., $50,000) or a percentage of the vehicle's original purchase price (e.g., 150%). This is a critical detail to understand when purchasing GAP insurance.

5. Deductible (If Applicable)

Some GAP insurance policies require you to pay a deductible before the coverage kicks in. This deductible is subtracted from the GAP insurance payout.

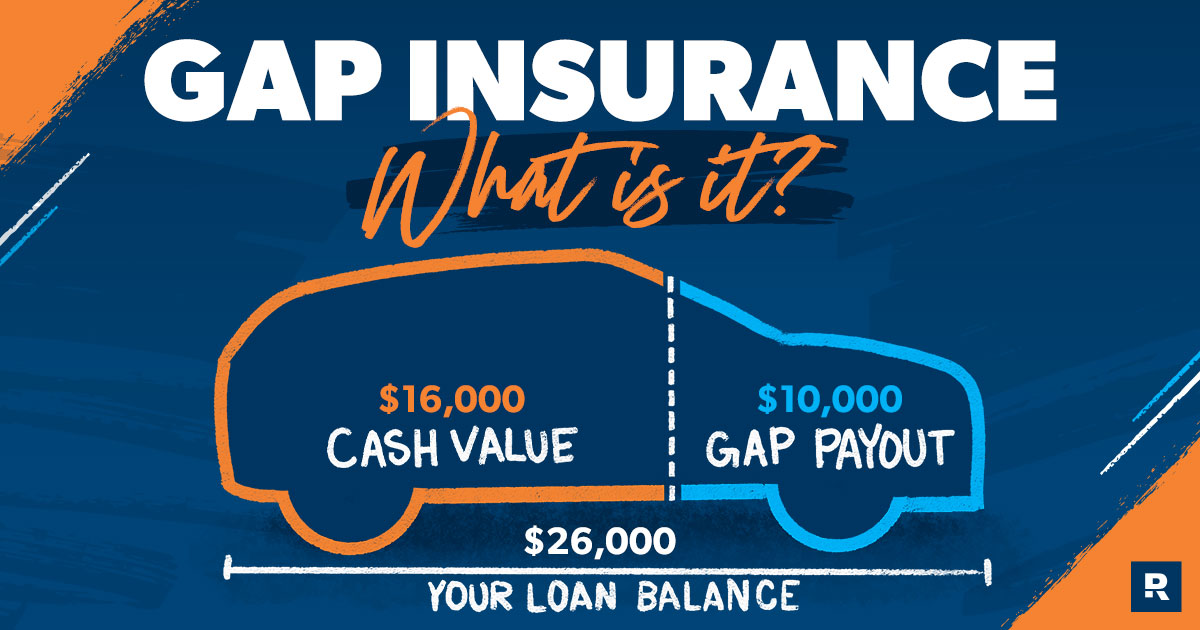

The Calculation Formula: How GAP Insurance Works

The basic formula for calculating the GAP insurance payout is as follows:

GAP Insurance Payout = Outstanding Loan Balance - Primary Insurance Settlement - Deductible (If Applicable)

However, remember the coverage limit. If the result of the above calculation exceeds the policy's coverage limit, you will only receive the maximum amount allowed by the policy.

Example:

Let's say:

- Outstanding Loan Balance: $25,000

- ACV (and Primary Insurance Settlement): $20,000

- GAP Insurance Coverage Limit: $10,000

- GAP Insurance Deductible: $0

Then:

GAP Insurance Payout = $25,000 - $20,000 - $0 = $5,000

In this case, your GAP insurance would pay out $5,000, covering the "gap" between what you owed and what your primary insurance paid.

Real-World Use: Basic Troubleshooting Tips

Like diagnosing a car problem, resolving GAP insurance issues involves careful investigation:

- Dispute the ACV: If you believe your insurance company's ACV calculation is too low, provide evidence to support your claim. This could include recent sales of similar vehicles in your area or documented improvements you've made to the car. Remember, modifications generally *don't* increase the ACV; they are usually lost value.

- Review Your Loan Agreement: Carefully examine your loan agreement for any clauses that might affect your loan balance, such as early payoff penalties.

- Understand Your GAP Insurance Policy: Read the fine print of your GAP insurance policy. Pay attention to exclusions, limitations, and the claims process.

- Double-Check Calculations: Ensure your insurance company's calculations are accurate. Mistakes can happen.

Safety: Components Excluded from GAP Coverage

While GAP insurance provides vital protection, it's crucial to understand what it typically doesn't cover. This is like knowing which components are sensitive and require extra care during engine work:

- Negative Equity Rolled Over: If you rolled negative equity from a previous car loan into your current loan, GAP insurance often doesn't cover this portion.

- Dealer Add-ons: Items like extended warranties or service contracts added to your loan are generally not covered by GAP insurance.

- Late Payment Fees and Penalties: GAP insurance will not cover any late payment fees or penalties you've incurred on your car loan.

- Bodily Injury or Property Damage: GAP insurance is solely for the vehicle itself. It does not cover any injuries or damage to other property.

- Modifications: This is huge for car enthusiasts. Aftermarket modifications that *aren't* factored into the ACV are usually *not* covered by GAP insurance. Consider this carefully before heavily modifying a vehicle with a loan.

We Have the File - And More Resources Are Available

This explanation provides a solid foundation for understanding GAP insurance payouts. We have a more detailed diagram available for download that visually represents the calculation process. Additionally, your insurance company and lender are valuable resources for clarifying any specific questions or concerns you may have. Remember, knowledge is power when it comes to protecting your financial interests. Don't hesitate to reach out for clarification and ensure you're fully informed about your coverage. Good luck, and happy motoring!