How To Calculate A Car Lease

So, you're thinking about leasing a car? Smart move! Leasing can be a great option if you want to drive a new car every few years without the long-term commitment of ownership. But understanding the numbers behind a lease is crucial to getting a good deal and avoiding surprises down the road. Think of it like understanding the schematics before tackling a complex engine rebuild – you wouldn't dive in blind, would you?

Purpose: Decoding the Lease Agreement

Why bother understanding how a car lease is calculated? Simple: knowledge is power. A lease agreement is a complex document filled with terms that can be confusing, even for seasoned car owners. By understanding the underlying calculations, you can:

- Negotiate a better deal: Knowing how the monthly payment is derived allows you to identify areas where you can potentially negotiate, such as the money factor or residual value.

- Avoid hidden fees: You'll be able to spot any inflated fees or charges that may be tacked on to the lease.

- Compare lease offers effectively: Understanding the components of a lease allows you to compare different offers apples-to-apples, rather than just focusing on the monthly payment.

- Make informed decisions: You'll be able to assess whether leasing is truly the best option for your needs and budget, compared to buying a car.

Just like understanding a wiring diagram helps you diagnose electrical issues, understanding lease calculations allows you to diagnose potential financial pitfalls.

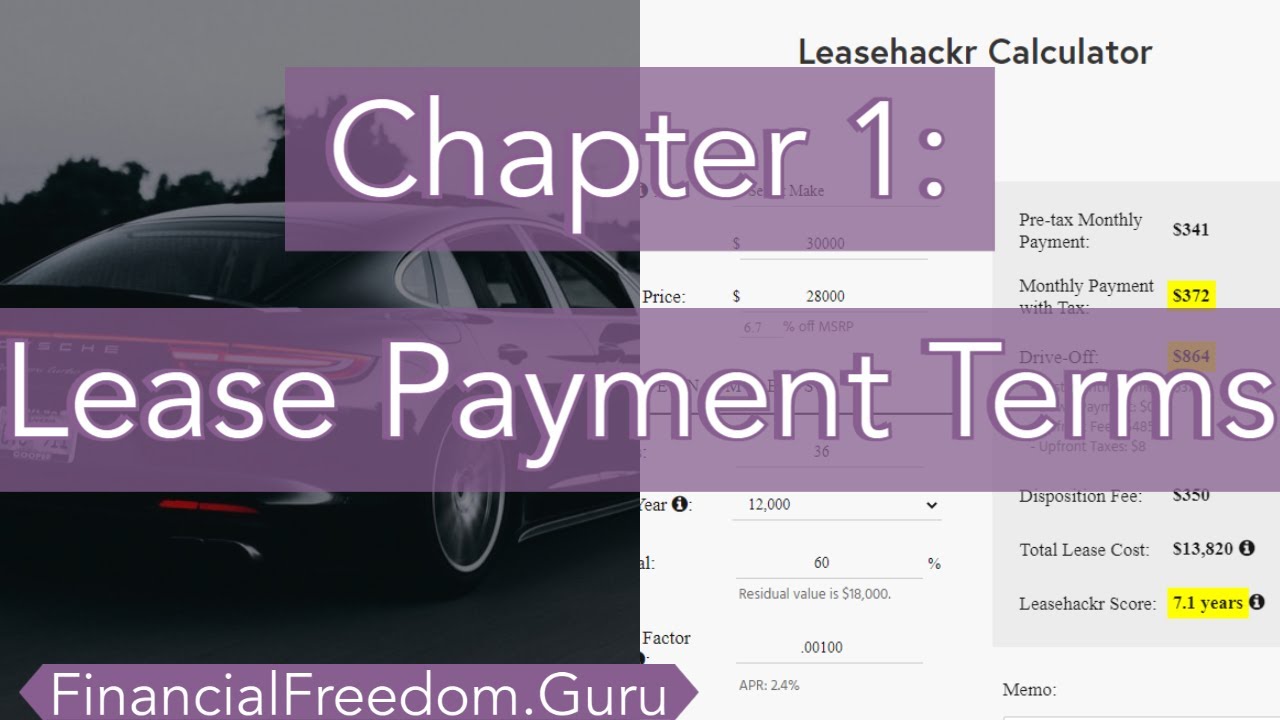

Key Specs and Main Parts of a Car Lease Calculation

Let's break down the key components that make up a car lease calculation. These are the variables that influence your monthly payment. Understanding these is like understanding the different cylinders and their function in your engine – each plays a critical role.

1. MSRP (Manufacturer's Suggested Retail Price)

This is the sticker price of the car, before any discounts or incentives. It's the starting point for negotiations, similar to the listed price on engine components before you start haggling with the supplier. You almost never pay the full MSRP.

2. Capitalized Cost (Cap Cost)

This is the negotiated price of the car after any discounts, rebates, or incentives. Think of it as the final price you agree upon with the dealer. It's the adjusted MSRP. It's what the lease is based on, not the MSRP. This is a crucial number to negotiate down.

3. Residual Value

This is the estimated value of the car at the end of the lease term. It's expressed as a percentage of the MSRP. The higher the residual value, the lower your monthly payment, as you're only paying for the depreciation during the lease term. This is usually set by the manufacturer and less negotiable than the cap cost.

4. Money Factor

This is the interest rate charged on the lease. It's expressed as a small decimal, like 0.0025. To convert it to an annual interest rate, multiply it by 2400. So, 0.0025 * 2400 = 6% APR. This is another area where negotiation can be fruitful. Dealers often mark up the money factor, so knowing the base rate is essential. Think of it as the cost of borrowing the car, similar to the interest rate on a loan for a turbocharger upgrade.

5. Lease Term

This is the length of the lease, typically expressed in months (e.g., 24, 36, or 48 months). Shorter lease terms usually result in higher monthly payments, but you'll turn the car in sooner. Longer lease terms result in lower monthly payments, but you'll be stuck with the car longer and potentially face higher mileage penalties if you exceed your allotted mileage.

6. Down Payment (Capitalized Cost Reduction)

This is the amount of money you pay upfront at the beginning of the lease. While it lowers your monthly payment, it's generally not recommended to put a large down payment on a lease. If the car is totaled, you won't get that money back. It's better to roll that down payment into a slightly higher monthly payment. Think of it as buying a very expensive air freshener for the duration of the lease – you don't get it back when the lease is over.

7. Taxes, Fees, and Other Charges

These can include sales tax, registration fees, acquisition fees (charged by the leasing company), disposition fees (charged at the end of the lease), and other miscellaneous charges. Be sure to scrutinize these carefully to ensure they are legitimate.

How It Works: The Lease Calculation Formula

Here's the basic formula for calculating a car lease:

Monthly Payment = (Depreciation + Finance Charge) + Taxes

Where:

- Depreciation = (Capitalized Cost - Residual Value) / Lease Term

- Finance Charge = (Capitalized Cost + Residual Value) * Money Factor

Let's break this down with an example:

Assume a car with an MSRP of $35,000.

- Capitalized Cost: $32,000 (after negotiation)

- Residual Value: $21,000 (60% of MSRP)

- Money Factor: 0.0025 (6% APR)

- Lease Term: 36 months

1. Calculate Depreciation:

Depreciation = ($32,000 - $21,000) / 36 = $305.56

2. Calculate Finance Charge:

Finance Charge = ($32,000 + $21,000) * 0.0025 = $132.50

3. Calculate Monthly Payment (excluding taxes):

Monthly Payment = $305.56 + $132.50 = $438.06

4. Add Taxes:

If your sales tax rate is 7%, then the tax amount would be $438.06 * 0.07 = $30.66.

Final Monthly Payment (including taxes) = $438.06 + $30.66 = $468.72

Real-World Use: Troubleshooting Lease Offers

Okay, so you've got the formula. How do you use it in the real world to evaluate a lease offer?

- Too good to be true? If the monthly payment seems exceptionally low, double-check the numbers. Are they inflating the residual value? Are they burying extra fees in the fine print?

- High Money Factor? Negotiate the money factor down. Compare the dealer's quoted money factor to the base rate offered by the manufacturer's financing arm (e.g., BMW Financial Services, Mercedes-Benz Financial Services). There's always room for movement here.

- Hidden Fees? Scrutinize the fees and charges. Are there any "administration fees" or "document fees" that seem excessive? Challenge them.

- Mileage Limits: Be realistic about your driving habits. Exceeding the mileage limit can result in hefty per-mile charges at the end of the lease. It's often cheaper to buy more miles upfront.

Safety: Watch Out for These Risky Components

Leasing isn't without its risks. Just like some parts of your car are more prone to failure, certain aspects of a lease require extra attention:

- Early Termination: Terminating a lease early can be very expensive. You'll typically be responsible for paying the remaining lease payments, plus potentially a termination fee.

- Excess Wear and Tear: You'll be charged for any excessive wear and tear at the end of the lease. Be sure to understand what constitutes "excessive" wear and tear.

- Mileage Penalties: As mentioned earlier, exceeding your mileage limit can result in significant charges.

- Gap Insurance: Consider purchasing gap insurance, which covers the difference between the car's market value and the amount you owe on the lease if the car is totaled.

Think of gap insurance like a roll cage – it's there to protect you in a worst-case scenario.

Remember, leasing can be a financially sound choice, but it demands careful analysis and negotiation. Approach it with the same diligence you would use when upgrading your car’s performance.