How To Calculate A Lease Payment

Leasing a vehicle can be a smart way to drive a newer car without the long-term commitment of buying. However, understanding how your lease payment is calculated is crucial for making informed decisions and negotiating effectively. This article will break down the components of a lease payment, empowering you with the knowledge to analyze lease deals like a pro.

Purpose: Decoding the Lease Equation

Why bother understanding the lease payment calculation? Several reasons. First, it allows you to compare different lease offers apples-to-apples. Dealers might present seemingly attractive monthly payments, but understanding the underlying calculations reveals the true cost. Second, it empowers you to negotiate. Knowing how each factor impacts your payment gives you leverage to push for better terms. Finally, understanding the lease payment allows you to predict how changes in factors like mileage allowances or residual value will affect your monthly cost.

Key Specs and Main Parts of a Lease Calculation

The lease payment calculation hinges on several key components. We'll define each one:

- MSRP (Manufacturer's Suggested Retail Price): The sticker price of the vehicle. This is the starting point for negotiations.

- Capitalized Cost (Cap Cost): The agreed-upon price of the vehicle for the lease. This is usually lower than the MSRP, especially if you negotiate a discount or use incentives. Think of this as the "selling price" for the lease.

- Capitalized Cost Reduction (Cap Cost Reduction): Any upfront payments you make that reduce the capitalized cost. This includes cash down payments, trade-in equity, and rebates. Important: Understand that a cap cost reduction only benefits you if the total lease cost is lower than a lease with zero cap cost reduction.

- Adjusted Capitalized Cost: The capitalized cost minus the capitalized cost reduction. This is the basis for calculating depreciation.

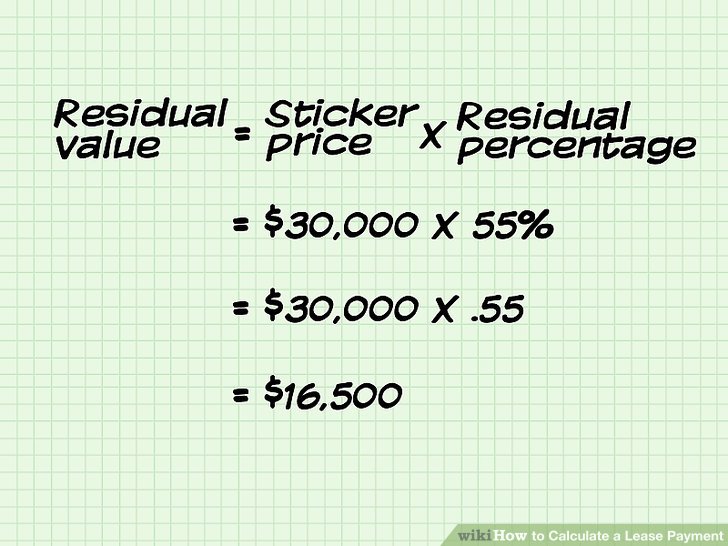

- Residual Value: An estimate of the vehicle's worth at the end of the lease term, expressed as a percentage of the MSRP. This is determined by the leasing company, often based on industry data and projections. A higher residual value results in a lower monthly payment, as you're only paying for the depreciation during the lease term.

- Depreciation: The difference between the adjusted capitalized cost and the residual value. This is the amount of value the vehicle loses during the lease, and you're essentially paying for this loss over the lease term.

- Money Factor: A decimal number that represents the interest rate charged on the lease. It's often a very small number (e.g., 0.0025). To approximate the annual interest rate, multiply the money factor by 2400. For example, a money factor of 0.0025 equates to an interest rate of approximately 6%.

- Lease Rate: The approximate interest rate on the lease, derived from the Money Factor.

- Rent Charge: The total amount of interest you'll pay over the lease term. Calculated using the Money Factor, Adjusted Capitalized Cost, and Residual Value.

- Lease Term: The length of the lease, typically expressed in months (e.g., 24 months, 36 months, 48 months).

- Monthly Depreciation: The depreciation divided by the lease term.

- Monthly Rent Charge: The rent charge divided by the lease term.

- Base Monthly Payment: The sum of the monthly depreciation and the monthly rent charge.

- Sales Tax: Your local sales tax rate applied to the base monthly payment.

- Monthly Lease Payment: The base monthly payment plus sales tax.

How It Works: The Lease Payment Formula

The core of the lease payment calculation is fairly straightforward:

- Calculate Depreciation: Adjusted Capitalized Cost - Residual Value = Depreciation

- Calculate the Rent Charge: (Adjusted Capitalized Cost + Residual Value) * Money Factor * Lease Term

- Calculate Base Monthly Payment: (Depreciation / Lease Term) + (Rent Charge / Lease Term)

- Calculate Monthly Payment: Base Monthly Payment + Sales Tax

Example: Let's say you're leasing a car with:

- MSRP: $35,000

- Capitalized Cost: $33,000 (after negotiation)

- Cap Cost Reduction: $2,000 (trade-in)

- Adjusted Capitalized Cost: $31,000

- Residual Value: $21,000 (60% of MSRP)

- Money Factor: 0.0020

- Lease Term: 36 months

- Sales Tax: 6%

- Depreciation: $31,000 - $21,000 = $10,000

- Rent Charge: ($31,000 + $21,000) * 0.0020 * 36 = $3,744

- Base Monthly Payment: ($10,000 / 36) + ($3,744 / 36) = $277.78 + $104 = $381.78

- Monthly Payment: $381.78 + (6% of $381.78) = $381.78 + $22.91 = $404.69

Therefore, your estimated monthly lease payment would be $404.69.

Real-World Use: Decoding Lease Quotes and Troubleshooting

Armed with this knowledge, you can now dissect lease quotes from dealerships. Here's what to look for:

- Verify the Numbers: Make sure the numbers in the lease quote match what you've calculated. If there are discrepancies, ask the dealer for clarification.

- Question the Residual Value: A lower-than-expected residual value will inflate your monthly payment. Research the typical residual values for similar vehicles. Services like ALG (Automotive Lease Guide) provide residual value forecasts.

- Negotiate the Capitalized Cost: Just like buying a car, you can negotiate the capitalized cost. Research the market value of the vehicle and aim for a price below MSRP.

- Be Wary of High Money Factors: A high money factor means you're paying more in interest. Try to negotiate a lower money factor. You can also compare lease rates from different leasing companies.

- Understand the Fine Print: Read the lease agreement carefully, paying attention to mileage allowances, excess mileage charges, and early termination penalties.

- Watch out for hidden fees: Acquisition fees, disposition fees, and other administrative fees can add to the overall cost of the lease. Negotiate to have these fees reduced or waived.

Troubleshooting Tips:

- High Monthly Payment: If the monthly payment is higher than expected, double-check all the numbers in the calculation. Pay close attention to the capitalized cost, residual value, and money factor.

- Unexplained Fees: Question any fees that are not clearly explained in the lease agreement.

- Conflicting Information: If you receive conflicting information from the dealer, ask for clarification in writing.

Safety: The Devil is in the Details

While calculating a lease payment doesn't involve physical risk like working on a car's engine, there are financial risks to be aware of.

- Excess Mileage Charges: Exceeding your mileage allowance can result in hefty charges per mile. Carefully estimate your annual mileage needs.

- Early Termination Penalties: Ending a lease early can be very expensive. Be sure you're committed to the lease term before signing the agreement.

- Wear and Tear Charges: Leasing companies typically charge for excessive wear and tear at the end of the lease. Familiarize yourself with the leasing company's wear and tear guidelines.

- Down Payments on Leases: Putting a large down payment on a lease is risky. If the car is totaled, you likely won't get that money back from your insurance.

Understanding how to calculate a lease payment is a powerful tool that puts you in control of the leasing process. By verifying the numbers and negotiating effectively, you can ensure you're getting a fair deal. Remember, knowledge is power!