How To Calculate Car Lease Price

So, you're thinking about leasing a car? That's a big decision, and understanding how the lease price is calculated is crucial to getting a good deal. Dealerships can sometimes make the numbers seem opaque, but the good news is that the core calculation is pretty straightforward. This article breaks down the components of a car lease and shows you how to calculate the monthly payment, empowering you to negotiate effectively.

Purpose: Understanding the Lease Agreement

Why bother understanding how a car lease price is calculated? Think of it like understanding the torque specs on your lug nuts. You could just tighten them until they feel "right," but you risk damaging the wheel studs or having a wheel come loose on the highway. Similarly, blindly accepting a lease deal without understanding the underlying math could leave you paying more than you should. Knowledge is power, and in this case, it's financial power. Knowing how the numbers work allows you to:

- Verify the Dealership's Calculations: Ensure they aren't padding the numbers or making errors.

- Compare Different Lease Offers: Apples-to-apples comparisons become much easier.

- Negotiate Effectively: Knowing the key variables gives you leverage to push for better terms.

- Avoid Hidden Costs: Identify potential fees and charges that could increase the overall cost of the lease.

Key Specs and Main Parts of a Lease Calculation

The core of a lease calculation revolves around a few key terms. Let's define them before we dive into the formula:

- MSRP (Manufacturer's Suggested Retail Price): The sticker price of the car. This is the manufacturer's recommended price before any discounts or incentives.

- Capitalized Cost (Cap Cost): The agreed-upon price of the car for the lease. This is usually negotiable and can be lower than the MSRP if you negotiate a discount or if the dealer offers rebates.

- Residual Value: The estimated value of the car at the end of the lease term. This is determined by the leasing company (the bank or finance arm of the manufacturer). It is a percentage of the MSRP. A higher residual value translates to lower monthly payments.

- Money Factor: Essentially the interest rate of the lease, but expressed as a very small decimal. To convert it to an approximate annual percentage rate (APR), multiply it by 2400. For example, a money factor of 0.00125 is equivalent to an APR of 3%.

- Lease Term: The length of the lease, usually expressed in months (e.g., 24 months, 36 months, 48 months).

- Acquisition Fee: A fee charged by the leasing company to initiate the lease.

- Disposition Fee: A fee charged at the end of the lease to cover the cost of preparing the car for resale.

- Sales Tax: Varies by state and is usually added to the monthly payment.

The Lease Payment Formula

Now for the main event: the formula to calculate the monthly lease payment:

Monthly Payment = (Depreciation + Finance Charge + Sales Tax)

Let's break down each component:

Depreciation

Depreciation represents the difference between the Capitalized Cost and the Residual Value, spread out over the lease term. This is how much value the car "loses" during your lease.

Depreciation = (Capitalized Cost - Residual Value) / Lease Term

Finance Charge

The Finance Charge is essentially the interest you pay on the depreciated value of the car. It's calculated using the Money Factor.

Finance Charge = (Capitalized Cost + Residual Value) * Money Factor

Sales Tax

Sales Tax is applied to the sum of the Depreciation and Finance Charge. This depends on your local tax laws.

Sales Tax = (Depreciation + Finance Charge) * Sales Tax Rate

Real-World Use: Basic Troubleshooting Tips

Let's say you're presented with a lease offer. Here's how to use this knowledge to troubleshoot and potentially negotiate a better deal:

- High Capitalized Cost: If the Capitalized Cost is close to the MSRP, negotiate a lower price. Point out incentives, rebates, or comparable offers from other dealerships. Think of it like haggling for parts at a swap meet – don't be afraid to walk away if the price isn't right.

- Low Residual Value: A lower Residual Value will increase your monthly payments. Research the car's market value after a few years. Sites like Kelley Blue Book and Edmunds can help. If the dealer's Residual Value seems significantly lower than the market value, question it.

- High Money Factor: Compare the Money Factor to current interest rates. If it seems excessively high, try to negotiate it down. A good credit score will give you more leverage. Banks want to earn your business.

- Hidden Fees: Watch out for inflated Acquisition or Disposition Fees. These are sometimes negotiable, but not always. Be sure to ask the dealership for a complete breakdown of all fees before signing anything.

Example:

Let's assume the following:

- MSRP: $30,000

- Capitalized Cost: $28,000

- Residual Value: $20,000 (66.67% of MSRP)

- Money Factor: 0.0015

- Lease Term: 36 months

- Sales Tax Rate: 6%

Calculations:

- Depreciation = ($28,000 - $20,000) / 36 = $222.22

- Finance Charge = ($28,000 + $20,000) * 0.0015 = $72

- Sales Tax = ($222.22 + $72) * 0.06 = $17.65

- Monthly Payment = $222.22 + $72 + $17.65 = $311.87

Safety: Financial Pitfalls to Avoid

Leasing isn't inherently dangerous, but there are definitely potential pitfalls to watch out for:

- Excessive Mileage: Leases usually come with mileage limits. Exceeding those limits can result in significant per-mile charges at the end of the lease. Estimate your annual mileage carefully before signing the lease.

- Excessive Wear and Tear: Leasing companies have standards for acceptable wear and tear. Dings, dents, and interior damage can result in charges at the end of the lease. Treat the car with care.

- Early Termination: Terminating a lease early can be very expensive. You'll likely be responsible for paying the remaining lease payments, plus any penalties. Consider the commitment before signing the lease.

- Gap Insurance: Consider purchasing Gap Insurance. If the car is totaled or stolen, the insurance company may only pay the current market value, which could be less than the remaining balance on the lease. Gap Insurance covers the difference.

By understanding the lease calculation and being aware of these potential pitfalls, you can approach leasing with confidence and avoid getting burned.

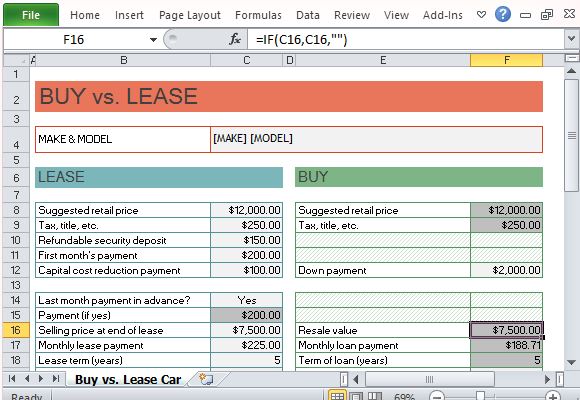

We have a downloadable, interactive spreadsheet that automates these calculations and lets you plug in your own numbers to compare different lease scenarios. Contact us to access this valuable tool and empower your car leasing decisions. Don't just trust the dealer; verify the numbers yourself!