How To Cancel A Discover Payment

Let's talk about something that, while not strictly automotive, is crucial for managing your finances in today's world: canceling a Discover payment. Just like understanding your car's electrical system allows you to troubleshoot issues and perform repairs, understanding how payment cancellations work gives you control over your finances and allows you to rectify errors. This article will provide a detailed, technically-sound, yet approachable guide to the ins and outs of canceling a Discover payment.

Purpose: Financial Control in Your Hands

Why should you, as a mechanically inclined individual, care about canceling a Discover payment? Think of it as diagnosing and fixing a problem in your financial system. Sometimes, things go wrong. Maybe you authorized the wrong amount, perhaps you realized the service you paid for wasn't delivered as promised, or maybe there's even unauthorized activity. Knowing how to cancel a payment empowers you to take corrective action, prevent financial loss, and maintain the integrity of your credit card account. Just like you wouldn't let a faulty sensor ruin your engine, you shouldn't let an incorrect payment drain your wallet.

Key Specs and Main Parts of a Discover Payment

Before we dive into the cancellation process, let's define some key terms and understand the “main components” involved in a Discover payment transaction. This is analogous to understanding the key components of your car’s ignition system before attempting a repair.

- Authorization: This is the initial approval from Discover for a transaction. Think of it as the spark plug firing in your engine. The authorization holds the funds against your available credit.

- Posting: This is when the transaction officially clears your account and the funds are transferred to the merchant. This is akin to the pistons firing and driving the crankshaft.

- Pending Transactions: These are authorized transactions that haven't yet posted. They show up on your online statement but haven't fully cleared. They are waiting in the wings, like a pre-combustion chamber waiting for ignition.

- Merchant: The business or individual receiving the payment. Your local auto parts store, for example.

- Discover Card: Your credit card issued by Discover. It's the key to accessing your credit line.

- Statement: A record of all transactions made during a billing cycle. Think of it as a detailed logbook of your car's performance.

Symbols and Indicators: Reading the Financial Gauges

Unlike electrical diagrams with standardized symbols, financial transactions use textual descriptions and status indicators. However, they communicate critical information, much like the gauges on your dashboard. Here are some common indicators:

- "Pending": As mentioned before, this indicates that the transaction is authorized but not yet posted.

- "Posted": The transaction has cleared and the funds have been transferred.

- "Authorized": The initial approval for the transaction.

- "Reversed": A transaction that has been cancelled or refunded.

How It Works: The Cancellation Process – A Step-by-Step Guide

The ability to cancel a Discover payment depends heavily on its status (pending vs. posted) and the type of transaction. Here's a breakdown of the process:

Canceling a Pending Transaction

This is the easiest scenario. If the transaction is still pending, you have a higher chance of successfully canceling it. Think of it as catching a loose wire before it shorts out the system.

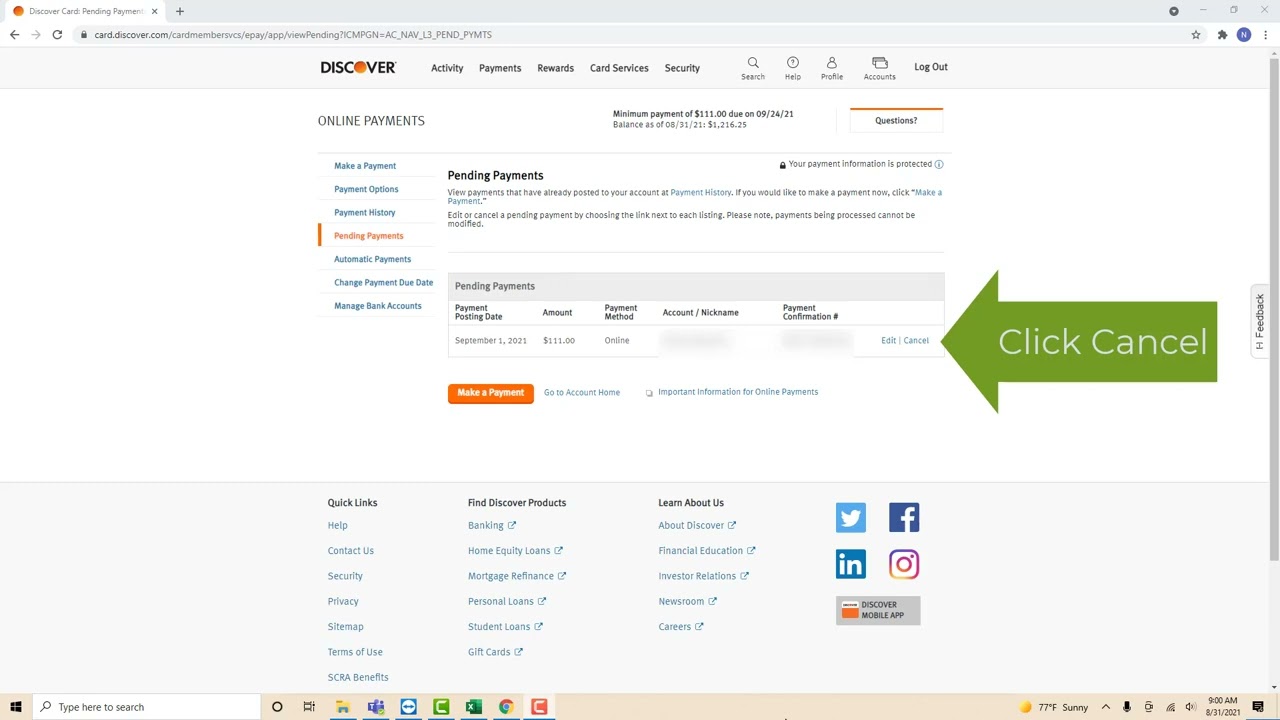

- Check Your Online Statement: Log into your Discover account online or through the mobile app. Locate the pending transaction you want to cancel.

- Contact Discover Immediately: Call the number on the back of your card. Explain the situation clearly and concisely. Let them know you want to cancel the pending transaction. The quicker you act, the better.

- Provide Details: Be prepared to provide details about the transaction, such as the date, amount, merchant, and any relevant information. Just like a mechanic needs detailed information to diagnose a problem, Discover needs this information to locate and cancel the transaction.

- Confirmation: Ask for a confirmation number or email confirming the cancellation request. This serves as your "invoice" for the cancellation, similar to a receipt after a repair.

Canceling a Posted Transaction

Canceling a posted transaction is more complex and often involves a dispute. This is like trying to fix a problem after the damage is already done, but it's still possible.

- Contact the Merchant First: Before contacting Discover, attempt to resolve the issue directly with the merchant. Explain your reason for wanting to cancel the payment and see if they are willing to issue a refund. This is like trying a simple fix before tearing apart the engine. Document all communication with the merchant.

- File a Dispute with Discover: If the merchant is uncooperative, you'll need to file a dispute with Discover. You can do this online, through the mobile app, or by calling customer service.

- Gather Evidence: Just like you need tools and materials to fix a car, you'll need evidence to support your dispute. This could include receipts, contracts, emails, photos, or any other documentation that explains why you believe the charge is incorrect or fraudulent.

- Fill Out the Dispute Form: Complete the dispute form accurately and thoroughly. Provide all the necessary information and attach your supporting documentation.

- Discover's Investigation: Discover will investigate your dispute. This may involve contacting the merchant and gathering additional information.

- Resolution: Discover will notify you of their decision. If they rule in your favor, the charge will be reversed and your account will be credited.

Real-World Use: Troubleshooting Common Issues

Just like troubleshooting a car problem, here are some tips for addressing common payment cancellation issues:

- Unauthorized Transactions: If you see a transaction you don't recognize, report it to Discover immediately. Do not wait. Time is of the essence.

- Duplicate Charges: If you're charged twice for the same item, contact the merchant and Discover.

- Incorrect Amount: If the amount charged is different from what you authorized, contact the merchant and Discover.

- Services Not Rendered: If you paid for a service that wasn't provided, contact the merchant and, if necessary, file a dispute.

Safety: Proceed with Caution

While canceling a payment is usually straightforward, there are some things to keep in mind. Just like handling flammable fluids in your garage requires caution, handling your finances requires a similar approach.

- Don't Abuse the System: Don't file disputes for legitimate charges simply because you regret the purchase. This can damage your credit score and lead to account closure.

- Be Honest and Accurate: Provide accurate information when filing a dispute. False claims can have serious consequences.

- Keep Records: Keep records of all communication with the merchant and Discover. This will be helpful if you need to escalate the issue.

- Phishing Scams: Be wary of phishing scams. Discover will never ask for your personal information via email or text message. Always access your account directly through the Discover website or mobile app.

Remember, cancelling a payment is a tool to protect your finances, not a way to avoid paying legitimate debts.

The process of reversing a payment is similar to returning a faulty car part – you need to demonstrate why the initial transaction was flawed and present valid reasons for a refund or cancellation. Document everything diligently, just as you would when documenting a repair job on your car. This record-keeping is essential for a successful resolution.

We have a detailed flowchart illustrating the Discover payment cancellation process. It outlines the steps involved in canceling both pending and posted transactions, including dispute resolution procedures. This diagram provides a visual representation of the information discussed in this article, making it easier to understand the process and navigate potential issues. This diagram is available for download to help you navigate the process even further. Just like a wiring diagram helps you troubleshoot electrical issues, this flowchart will guide you through the payment cancellation process.