How To Check Credit Score On Usaa

Alright, let's dive into checking your credit score with USAA. Just like understanding the schematic diagram of your engine helps you diagnose problems and optimize performance, understanding your credit score and how to access it is crucial for financial health. Think of your credit score as a health report for your financial life. It determines the interest rates you’ll pay on loans, your ability to get approved for credit cards, and even impacts things like insurance rates and rental applications. Fortunately, USAA provides options for monitoring and checking your credit score, similar to having the right diagnostic tools for your car.

Purpose – Why Checking Your Credit Score Matters

Why bother checking your credit score with USAA? There are several critical reasons, much like why you'd want to understand your car's diagnostic codes before a major issue arises. It’s all about preventative maintenance and informed decision-making.

- Early Problem Detection: Just like catching a misfire early prevents engine damage, spotting a dip in your credit score early allows you to address any issues before they severely impact your financial life. This could be due to identity theft, errors on your credit report, or missed payments.

- Negotiating Power: A good credit score, like a well-maintained engine, puts you in a strong negotiating position when applying for loans or credit cards. You can secure better interest rates and terms, saving you money in the long run.

- Financial Planning: Knowing your credit score is essential for long-term financial planning. Whether you're saving for a down payment on a house, investing in a new business, or planning for retirement, your credit score plays a vital role.

- Error Identification: Just as a wiring diagram helps you find shorts and open circuits, regularly checking your credit report allows you to identify and correct any errors that may be negatively impacting your score.

Key Specs and Main Parts (of Credit Score Monitoring)

Understanding the "specs" of credit score monitoring is vital. Here's a breakdown of the key components you'll encounter when accessing your credit score through USAA or any other service:

Credit Bureaus:

The three major credit bureaus – Equifax, Experian, and TransUnion – are the main entities tracking your credit history. USAA often partners with one or more of these bureaus to provide credit score access and monitoring. Think of them as the 'manufacturers' of your credit report.

Credit Score Models:

The most widely used credit score model is FICO (Fair Isaac Corporation). VantageScore is another common model. Each model uses a slightly different algorithm to calculate your score based on the information in your credit report. Similar to how different engine tuning software might calculate timing advance.

Credit Report:

Your credit report is a detailed record of your credit history, including payment history, outstanding debts, credit utilization, and public records. This is like the detailed service record for your car, it outlines every repair, service and problem it has encountered over its lifetime.

Credit Monitoring:

Credit monitoring services notify you of changes to your credit report, such as new accounts opened in your name or changes to your credit score. This is like having an alarm system on your car.

Factors Affecting Your Credit Score:

- Payment History (35%): Paying your bills on time is the most important factor.

- Amounts Owed (30%): This refers to your credit utilization ratio (the amount of credit you're using compared to your total credit limit). Keeping this below 30% is generally recommended. Think of this as keeping the load on your engine within safe limits.

- Length of Credit History (15%): A longer credit history generally results in a higher score.

- New Credit (10%): Opening too many new accounts in a short period can lower your score.

- Credit Mix (10%): Having a mix of different types of credit (credit cards, loans, etc.) can be beneficial.

Symbols & How It Works within USAA

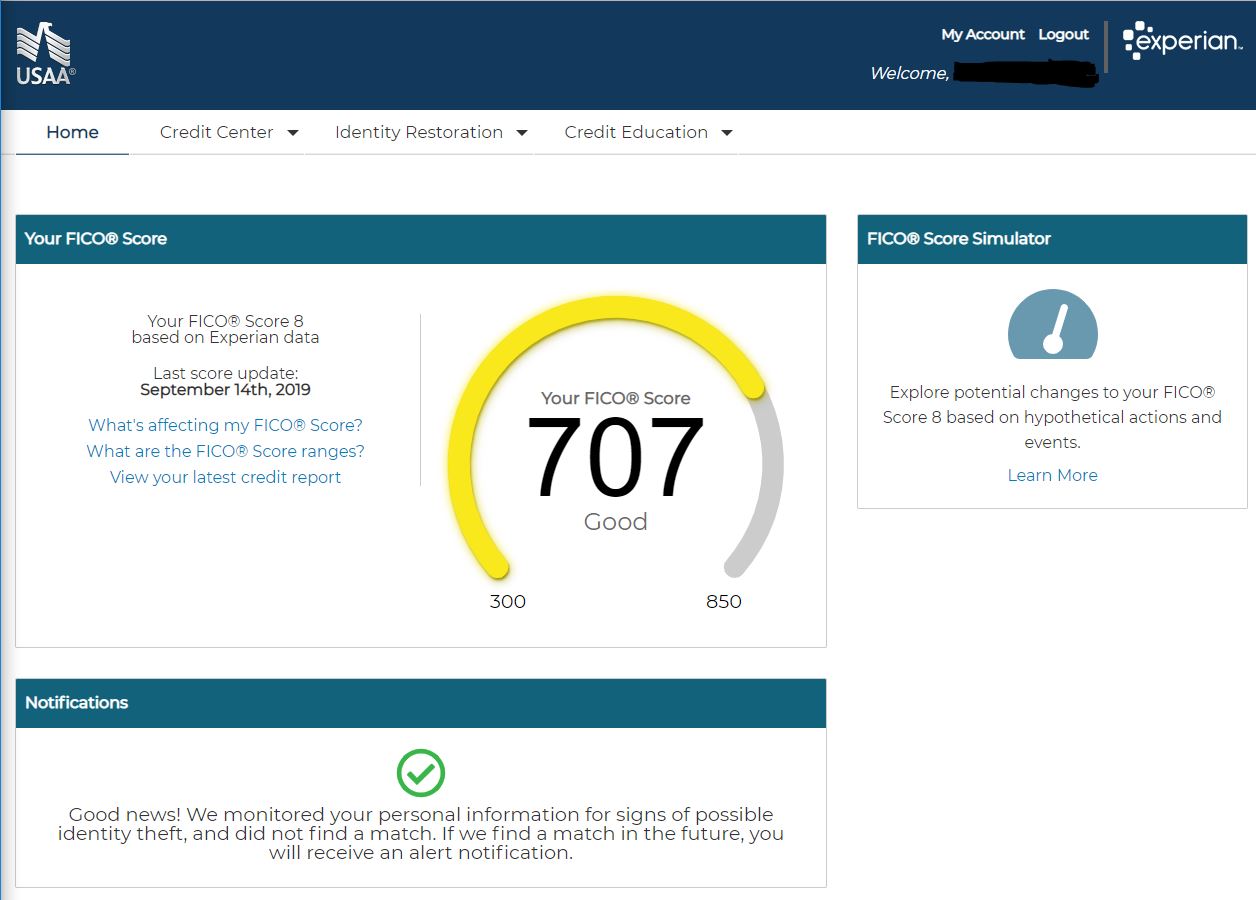

USAA typically offers credit score access and monitoring through its online portal or mobile app. The specific symbols and interface may vary slightly, but here's a general overview:

Symbols & Interface Elements:

- Credit Score Display: This is the main numerical representation of your creditworthiness, often displayed prominently with a color-coded indicator (e.g., green for excellent, yellow for fair, red for poor).

- Credit Report Summary: A summary of key information from your credit report, such as the number of accounts, inquiries, and derogatory marks.

- Credit Score Factors: A breakdown of the factors that are influencing your credit score, highlighting areas where you're doing well and areas where you could improve.

- Alerts: Notifications about changes to your credit report or score.

- Links to Credit Bureaus: Direct links to the websites of the major credit bureaus, where you can access your full credit report and dispute errors.

How it Works:

- Accessing the Service: Log in to your USAA account online or through the mobile app.

- Locating the Credit Score Feature: Navigate to the section related to financial management or credit monitoring. Look for keywords like "Credit Score," "Credit Monitoring," or "Financial Health."

- Authentication: You may need to verify your identity to access your credit score.

- Viewing Your Score and Report: Once authenticated, you'll be able to view your credit score and a summary of your credit report.

- Setting Up Alerts: Configure alerts to notify you of any changes to your credit report or score.

Real-World Use – Basic Troubleshooting Tips

Just like with car repair, it's helpful to know basic troubleshooting tips. If your credit score is lower than expected, or if you see something suspicious on your credit report, here's what to do:

- Review Your Credit Report Carefully: Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com.

- Dispute Errors: If you find any errors on your credit report, dispute them with the credit bureau that issued the report. Provide documentation to support your claim.

- Pay Down Debt: Reducing your credit utilization ratio can significantly improve your credit score.

- Make Payments on Time: Ensure that you're paying all your bills on time, every time. Set up automatic payments if necessary.

- Avoid Opening Too Many New Accounts: Opening too many new accounts in a short period can lower your score.

- Consider a Secured Credit Card: If you have a limited credit history, a secured credit card can help you build credit.

Safety – Highlight Risky Components (Potential Scams)

Just as you'd avoid working on a running engine or handling exposed high-voltage wires without proper precautions, be aware of potential scams related to credit score monitoring.

- Phishing Scams: Be wary of emails or phone calls claiming to be from USAA or a credit bureau asking for your personal information. Always access your credit score and report directly through the official USAA website or AnnualCreditReport.com.

- "Credit Repair" Scams: Avoid companies that promise to "fix" your credit score quickly. These companies often engage in illegal or unethical practices.

- Unsecured Websites: Never enter your personal information on websites that are not secure (look for "https" in the address bar).

- Requests for Upfront Fees: Be wary of credit repair services that require you to pay upfront fees before providing any services.

Checking your credit score with USAA is a smart move, providing insight into your financial standing and enabling proactive financial management. By understanding the 'diagram' of your credit health, you're better equipped to maintain and improve it. It's about having the right tools and knowledge to keep your financial engine running smoothly.

We have a generalized file available that outlines the process and provides sample screenshots; while it's not a perfect "diagram" in the same way a wiring schematic is for your car, it provides a good visual guide. Consider it a supplement to this explanation, and keep an eye on the official USAA documentation for any changes to their credit monitoring offerings. Remember, maintaining a healthy credit score is an ongoing process, just like maintaining your car!