How To Check Credit Score Usaa

Understanding your credit score is crucial in today's financial landscape. It's a three-digit number that summarizes your creditworthiness and plays a significant role in your ability to secure loans, mortgages, and even insurance policies. USAA, a financial services group primarily serving the military community, offers its members access to credit score monitoring and reporting. This guide will walk you through the process of checking your credit score through USAA, explaining the underlying concepts and empowering you to interpret the information you receive.

Purpose of Checking Your Credit Score

Why bother checking your credit score through USAA or any other service? There are several compelling reasons:

- Early Detection of Fraud: Monitoring your credit report allows you to identify any unauthorized activity, such as fraudulent accounts opened in your name. This is critical for preventing identity theft.

- Negotiating Better Interest Rates: A higher credit score translates to lower interest rates on loans and credit cards. Knowing your score allows you to negotiate more favorable terms.

- Improving Your Creditworthiness: Understanding the factors that influence your credit score allows you to take proactive steps to improve it, such as paying bills on time and reducing your credit utilization ratio.

- Preparation for Major Purchases: Before applying for a mortgage or auto loan, it's wise to check your credit score to understand your chances of approval and the interest rate you're likely to receive.

- Ensuring Accuracy: Credit reports sometimes contain errors. Checking your report allows you to identify and dispute any inaccuracies that could negatively impact your score.

Key Specs and Main Parts of a Credit Report

A credit report is a detailed record of your credit history, compiled by credit reporting agencies (also known as credit bureaus). The main parts include:

- Personal Information: Your name, address, Social Security number, and date of birth.

- Credit Accounts: A list of your credit cards, loans, and other credit accounts, including the account number, credit limit or loan amount, balance, payment history, and account status (open or closed).

- Public Records: Information from public records, such as bankruptcies, tax liens, and judgments.

- Inquiries: A list of companies that have accessed your credit report. There are two types of inquiries: hard inquiries (which can slightly lower your score) and soft inquiries (which don't affect your score).

- Collections Accounts: Debts that have been turned over to a collection agency.

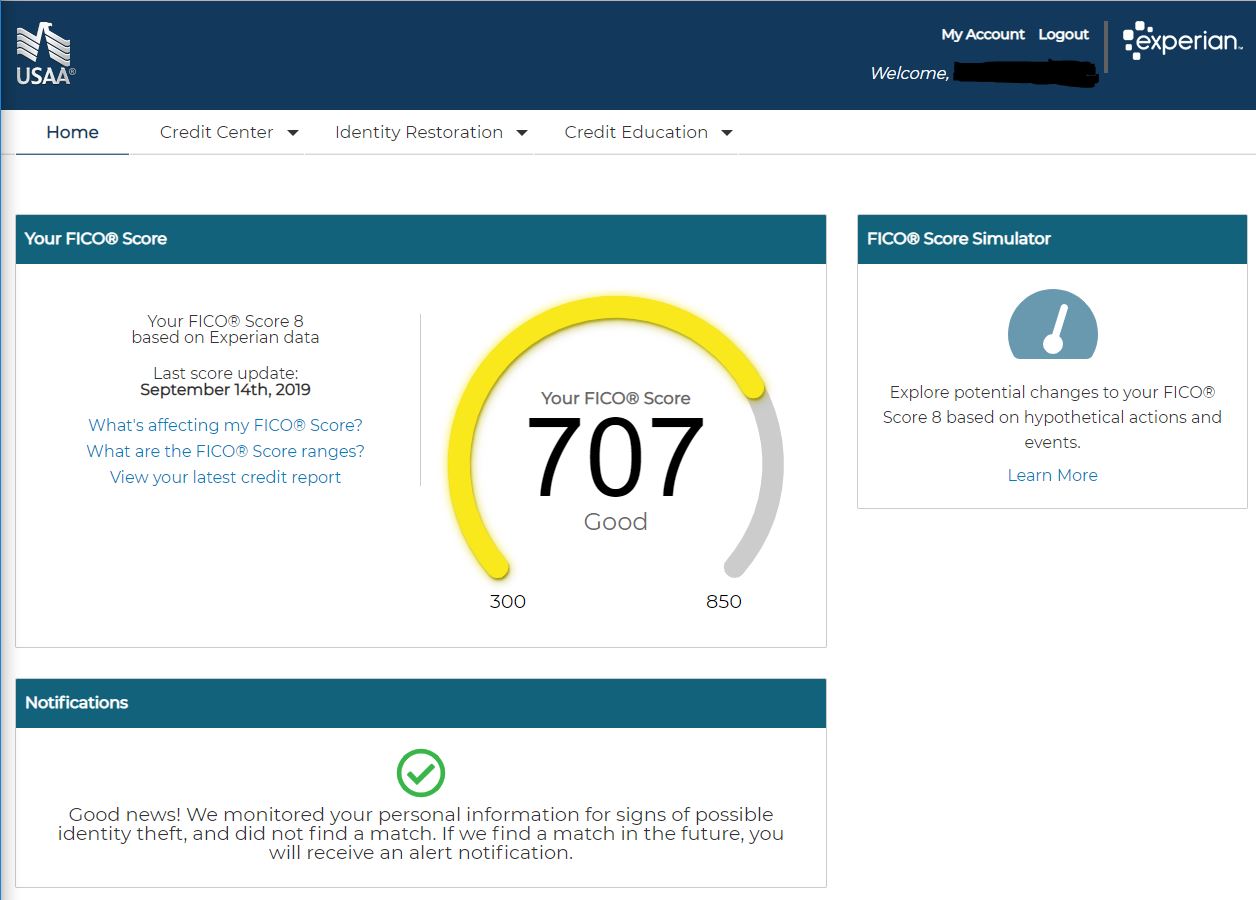

Credit scores, like the FICO score (Fair Isaac Corporation) and VantageScore, are calculated using the information in your credit report. These scores typically range from 300 to 850, with higher scores indicating better creditworthiness. While USAA provides access to your credit score, the specifics of the score (e.g., which model, like FICO 8 or VantageScore 3.0) will be detailed within your USAA account or accompanying documentation. This information is essential for comparing scores across different platforms.

Symbols and Terminology

Understanding the terminology and symbols used in credit reports is crucial for interpreting the information effectively:

- Credit Utilization Ratio: The amount of credit you're using compared to your total available credit. Ideally, this should be below 30%. It's calculated as (Total Credit Card Balances) / (Total Credit Card Limits).

- Payment History: A record of whether you've made payments on time. This is the most important factor in determining your credit score.

- Credit Mix: The variety of credit accounts you have (e.g., credit cards, installment loans, mortgages). A healthy credit mix can positively impact your score.

- Length of Credit History: The amount of time you've had credit accounts open. A longer credit history generally leads to a higher score.

- "OK" or "+" Symbol: Indicates that the account is in good standing and payments are being made on time.

- "L" Symbol: May indicate a late payment. Check the account details for specifics on the payment history.

- Collections: Accounts that have been sent to a collection agency due to non-payment. These can significantly lower your credit score.

How Checking Your Credit Score Through USAA Works

USAA partners with credit monitoring services to provide its members with access to their credit scores and reports. Here's a general overview of how it works:

- Accessing the Credit Monitoring Service: Log in to your USAA account online or through the mobile app. Navigate to the "Products" or "Financial Tools" section, and look for the "Credit Monitoring" or "Credit Score" option.

- Enrollment: You may need to enroll in the credit monitoring service if you haven't already done so. This typically involves verifying your identity.

- Credit Score Display: Once enrolled, you'll be able to view your credit score, which is usually updated monthly. The specific credit score model used (e.g., FICO or VantageScore) will be displayed.

- Credit Report Access: USAA often provides access to your credit report from one or more of the three major credit bureaus (Equifax, Experian, and TransUnion). You are entitled to a free credit report from each bureau once a year at AnnualCreditReport.com.

- Alerts and Notifications: The credit monitoring service may provide alerts when there are changes to your credit report, such as new accounts opened or late payments reported.

Real-World Use and Basic Troubleshooting Tips

Checking your credit score through USAA isn't just about seeing a number; it's about understanding your financial standing and taking action when necessary.

- Score Discrepancies: If you notice a significant difference between your credit score from USAA and other sources, it could be due to different credit score models being used or errors in your credit report. Investigate further by obtaining your credit reports from all three bureaus and comparing them.

- Negative Information: If your credit report contains negative information, such as late payments or collections accounts, focus on improving your payment habits and exploring options for debt management or consolidation.

- Fraudulent Activity: If you suspect fraudulent activity, immediately contact the credit bureaus and the affected creditors to report the fraud and take steps to protect your identity.

- Improving Your Score: To improve your credit score, focus on paying bills on time, keeping your credit utilization ratio low, and avoiding opening too many new credit accounts at once. Consider secured credit cards to rebuild credit if necessary.

- Contacting USAA Support: If you encounter technical issues or have questions about the credit monitoring service, contact USAA's customer support for assistance.

Safety Considerations

While checking your credit score is generally safe, it's important to be aware of potential risks:

- Phishing Scams: Be wary of emails or phone calls claiming to be from USAA or a credit bureau requesting your personal information. These could be phishing scams designed to steal your identity. Always access your credit score and report through the official USAA website or app.

- Data Breaches: Credit bureaus and financial institutions are potential targets for data breaches. Regularly monitor your credit report for any suspicious activity and consider placing a credit freeze on your accounts to prevent unauthorized access. A credit freeze restricts access to your credit report, making it more difficult for identity thieves to open new accounts in your name.

- Using Unsecured Networks: Avoid accessing your credit score or report on unsecured Wi-Fi networks, as this could expose your personal information to hackers.

Checking your credit score through USAA is a valuable tool for managing your financial health. By understanding the key concepts and taking proactive steps, you can improve your creditworthiness and achieve your financial goals.

We have a sample credit report explanation file that provides a detailed breakdown of each section and how it impacts your score. You can download this diagram to further enhance your understanding of credit reports.