How To Figure Car Lease Payments

So, you're thinking about leasing a car. Smart move – for some folks, it's a great way to get behind the wheel of a new vehicle without the long-term commitment of ownership. But understanding a car lease is like understanding any complex machine: you need to know the underlying principles to make informed decisions. This guide will break down how car lease payments are calculated, giving you the power to negotiate a better deal. Consider this your advanced driver's education on vehicle financing.

The Why: Mastering the Lease Equation

Why bother diving into the nitty-gritty of lease payment calculations? Simple: knowledge is power. Dealerships aren't always transparent, and knowing how the numbers work lets you:

- Spot hidden fees and inflated costs: Don't get blindsided by charges you weren't expecting.

- Negotiate effectively: Armed with understanding, you can challenge unfavorable terms and potentially lower your monthly payment.

- Compare lease offers accurately: See beyond the advertised payment and evaluate the true cost of different leases.

- Avoid getting scammed: Unfortunately, some dealerships prey on those who don't understand the process.

Think of it like diagnosing a misfire. You wouldn't just blindly replace parts, would you? You'd use a diagnostic tool to understand the root cause. Understanding lease calculations is your diagnostic tool in the world of car leasing.

Key Specs and Main Parts: The Lease Payment Breakdown

The lease payment is the sum of several components. Let's break down the key players:

- Capitalized Cost (Cap Cost): This is essentially the negotiated price of the vehicle. Think of it like the sticker price, but hopefully lower after you've haggled.

- Adjusted Capitalized Cost: This is the Cap Cost minus any down payment, trade-in credit, or rebates. Essentially, it's the amount you're financing through the lease.

- Residual Value: The estimated value of the car at the end of the lease term, as determined by the leasing company (usually the manufacturer's captive finance arm, like Ford Credit or BMW Financial Services). This is a crucial number, as it directly impacts your payment. A higher residual value means a lower monthly payment.

- Depreciation Fee: This is the difference between the Adjusted Capitalized Cost and the Residual Value. It represents the amount the car is expected to depreciate during the lease term. This is one of the core components of the monthly lease payment. The larger the difference between Cap Cost and Residual, the higher the Depreciation Fee will be.

- Money Factor: Also known as the lease factor, this is the leasing company's interest rate, expressed as a small decimal. To find the approximate annual interest rate, multiply the money factor by 2400. For example, a money factor of 0.0015 would be approximately 3.6% APR (0.0015 * 2400 = 3.6).

- Rent Charge (Finance Charge): This is the interest paid on the lease. It's calculated by multiplying the sum of the Adjusted Capitalized Cost and the Residual Value by the Money Factor. This is the lender making their money on the deal.

- Base Monthly Payment: This is the sum of the Depreciation Fee and the Rent Charge.

- Taxes and Fees: This includes sales tax, registration fees, and other government charges. These are added to the Base Monthly Payment to arrive at the total monthly payment.

The Formula: Putting It All Together

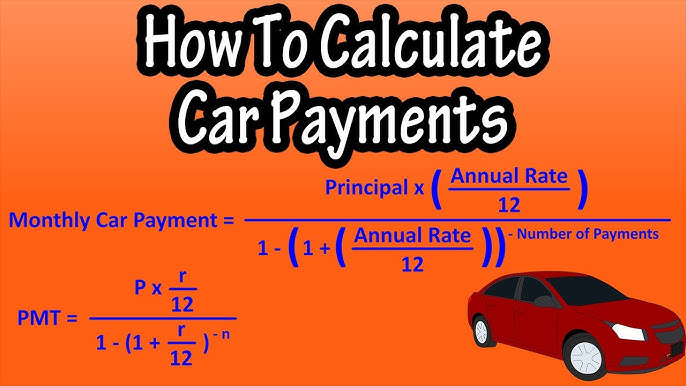

Here's the formula to calculate the base monthly lease payment:

Base Monthly Payment = (Adjusted Capitalized Cost - Residual Value) / Lease Term (in months) + (Adjusted Capitalized Cost + Residual Value) * Money Factor

And the grand total:

Total Monthly Payment = Base Monthly Payment + Taxes and Fees

While dealerships use software to calculate these figures, understanding the formula empowers you to scrutinize their numbers.

How It Works: The Lease Process in Detail

Let's walk through a simplified example:

Assume you're leasing a car with the following:

- Capitalized Cost: $35,000

- Down Payment: $2,000

- Adjusted Capitalized Cost: $33,000 ($35,000 - $2,000)

- Residual Value (after 36 months): $22,000

- Money Factor: 0.00125 (approximately 3% APR)

- Lease Term: 36 months

- Sales Tax: 6%

Here's how the payment breaks down:

- Depreciation Fee: ($33,000 - $22,000) / 36 = $305.56

- Rent Charge: ($33,000 + $22,000) * 0.00125 = $68.75

- Base Monthly Payment: $305.56 + $68.75 = $374.31

- Sales Tax: $374.31 * 0.06 = $22.46

- Total Monthly Payment: $374.31 + $22.46 = $396.77

This example assumes no other fees. Real-world leases may include acquisition fees, disposition fees, and other charges that can impact the final payment.

Real-World Use: Troubleshooting Lease Deals

Here are some things to watch out for and how to deal with them:

- Inflated Capitalized Cost: Dealers sometimes mark up the price of the car before applying lease incentives. Research the car's market value and negotiate the capitalized cost down.

- Low Residual Value: A lower residual value increases the depreciation fee and your monthly payment. Shop around at different dealerships. Different leasing companies may use slightly different residual values. Also consider leasing a make/model of vehicle that holds it's value.

- High Money Factor: This is the dealer's hidden profit center. A higher money factor translates to a higher interest rate. Negotiate the money factor or, better yet, secure pre-approved financing from your bank or credit union to give you leverage.

- Hidden Fees: Be wary of add-on fees like document fees or excessive wear-and-tear waivers. Ask for a complete breakdown of all fees before signing anything.

Troubleshooting Tip: Use an online lease calculator (there are many available) to double-check the dealership's calculations. If the numbers don't match, ask for clarification.

Safety: Areas of Financial Risk

The most significant risk with leasing is excess mileage. Lease agreements specify a maximum number of miles you can drive per year (typically 10,000, 12,000, or 15,000). Exceeding this limit results in a per-mile charge, which can add up quickly. Another risk is excessive wear and tear. The leasing company will inspect the car at the end of the lease and charge you for any damage beyond normal wear and tear.

Always consider early termination fees. Breaking a lease early can be very expensive, as you'll likely be responsible for the remaining payments and potentially additional penalties. Lease-transfer services can sometimes help avoid these fees, but they aren't always successful and can involve additional costs.

We've Got the Diagram

Understanding the mechanics of a car lease empowers you to make informed decisions. While we've covered the basics here, the world of car leasing is complex. We have a detailed lease payment diagram available for download, further breaking down each component and illustrating the relationships between them. It provides an even deeper understanding of the calculations involved.

Armed with this knowledge, you're well-equipped to navigate the car leasing process like a pro. Good luck and happy negotiating!