How To Figure Payments On A Car

So, you're looking to dive into the nitty-gritty of car payment calculations, huh? Excellent! Whether you're trying to score the best deal on a new ride, refinance an existing loan, or just plain understand where all that money is going each month, knowing how to break down a car payment is a valuable skill. This isn't just about plugging numbers into an online calculator – it's about understanding the underlying formulas and factors that drive your monthly bill. Think of it as understanding the engine, not just driving the car.

Purpose: Decoding the Auto Loan

Why bother with all this math? Simple: knowledge is power. Understanding the mechanics of a car loan empowers you in several ways:

- Negotiation: When you know how payments are calculated, you can negotiate more effectively with dealers. You'll be able to challenge their figures and ensure you're getting a fair interest rate and loan terms.

- Refinancing: If interest rates drop, you can assess whether refinancing your loan makes sense. Knowing the underlying calculations helps you determine if the savings are worthwhile.

- Budgeting: Understanding the principal-interest breakdown of your payments lets you budget more accurately. You can see how much you're actually paying off the loan versus how much is going towards interest.

- Avoiding Scams: Unfortunately, shady dealerships sometimes try to manipulate loan terms. Knowing the math helps you spot these scams and protect yourself.

This article provides a breakdown of the formula used to calculate car payments, explaining each component and how they interact. We’ll explore real-world scenarios and basic troubleshooting to empower you to make informed financial decisions about your vehicle.

Key Specs and Main Parts of the Car Loan Formula

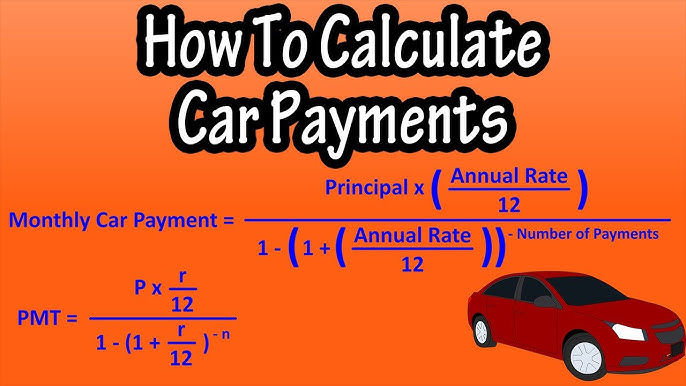

The core formula for calculating a car payment is based on an amortizing loan, which means the loan is paid off in regular installments over a fixed period. Here's the formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly payment

- P = Principal loan amount (the amount you borrow)

- i = Monthly interest rate (annual interest rate divided by 12)

- n = Number of months in the loan term

Let's break down each of these components in more detail:

Principal Loan Amount (P)

This is the initial amount you borrow. It's the price of the car minus any down payment, trade-in value, or rebates. Make sure you're clear on what the "out-the-door" price of the car is before factoring in any of these reductions. Dealers sometimes play games by quoting prices that already include incentives you may not qualify for.

Monthly Interest Rate (i)

The interest rate is the cost of borrowing money, expressed as a percentage. It's crucial to understand that the interest rate quoted is usually an annual rate (APR – Annual Percentage Rate). To use it in the formula, you need to convert it to a monthly rate by dividing the APR by 12. For example, if the APR is 6%, the monthly interest rate is 0.06 / 12 = 0.005.

Number of Months (n)

This is the total number of months you have to repay the loan. Common loan terms are 36 months (3 years), 48 months (4 years), 60 months (5 years), and 72 months (6 years). Longer loan terms mean lower monthly payments, but you'll end up paying significantly more in interest over the life of the loan.

Dissecting the Formula: How It Works

Now, let's plug some numbers into the formula to see how it works in practice. Suppose you're borrowing $25,000 (P) at an APR of 6% (i = 0.005 monthly) for 60 months (n).

First, calculate (1 + i)^n : (1 + 0.005)^60 = 1.34885

Then, calculate i(1 + i)^n : 0.005 * 1.34885 = 0.00674

Next, calculate (1 + i)^n – 1 : 1.34885 - 1 = 0.34885

Finally, calculate M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1] : M = $25,000 * 0.00674 / 0.34885 = $482.66

Therefore, your estimated monthly payment would be $482.66.

Important Note: This formula doesn't include sales tax, registration fees, or other ancillary charges. These will increase your total monthly payment.

Real-World Use: Troubleshooting Discrepancies

So, you've run the numbers and the dealer's quoted payment is higher than what you calculated. What do you do? Here's a basic troubleshooting checklist:

- Verify the Principal: Ensure the principal loan amount matches the agreed-upon price of the car minus your down payment, trade-in, and any rebates. Question any discrepancies.

- Check the APR: Double-check the annual percentage rate. Even a small difference in the APR can significantly impact your monthly payment. Get quotes from multiple lenders (banks, credit unions) to compare rates.

- Confirm the Loan Term: Make sure the loan term (number of months) is what you agreed to. Dealers sometimes try to slip in longer terms to lower the monthly payment, but this will cost you more in the long run.

- Ask About Add-ons: Are there any add-ons included in the loan, such as extended warranties or gap insurance? These increase the principal amount and, consequently, the monthly payment. Decide if you actually need these products before agreeing to them.

- Calculate It Yourself: Use the formula (or a reliable online calculator) to independently verify the dealer's calculations. Don't be afraid to challenge them if their figures don't add up.

Safety: Risky Loan Components

Certain aspects of car loans can be financially risky. Be especially cautious about:

- Long Loan Terms: While a longer loan term lowers your monthly payment, you'll pay significantly more in interest over the life of the loan. You also risk being "upside down" on your loan, meaning you owe more than the car is worth, for a longer period.

- High APRs: A high APR means you're paying a significant amount in interest. Shop around for the best rates, especially if you have less-than-perfect credit.

- Add-ons You Don't Need: Avoid unnecessary add-ons like extended warranties, paint protection, or fabric protection. These often have high markups and may not be worth the cost.

- Variable Interest Rates: Most car loans have fixed interest rates, meaning the rate stays the same throughout the loan term. However, some loans have variable rates, which can fluctuate based on market conditions. These can be risky because your monthly payment could increase unexpectedly.

- Balloon Payments: Some loans have a large "balloon" payment due at the end of the loan term. This can be difficult to pay off and may require you to refinance, potentially at a higher interest rate.

Understanding the formula for calculating car payments is an essential tool for any informed car buyer. By understanding the components of the formula and how they interact, you can negotiate effectively, avoid scams, and make smart financial decisions. Remember to shop around for the best rates, carefully consider the loan term, and avoid unnecessary add-ons.

We have a spreadsheet with the car payment formula built-in that can make calculating easier. You can download it and play around with the numbers. Knowing your options is always the best way to make a purchase.