How To Find My Gap Insurance

Alright, let's talk about finding your Gap Insurance information. Unlike a wiring diagram or a torque spec, there's no single "Gap Insurance Diagram" to download. Think of this more like a treasure hunt for information – we’re not looking for a physical part, but rather the *documentation* that proves you have Gap Insurance and details its coverage.

Purpose: Why Finding Your Gap Insurance Matters

You might be thinking, "Why bother?" Well, knowing where to find your Gap Insurance details is absolutely crucial, especially after the worst-case scenario: your vehicle is totaled or stolen. Here's why:

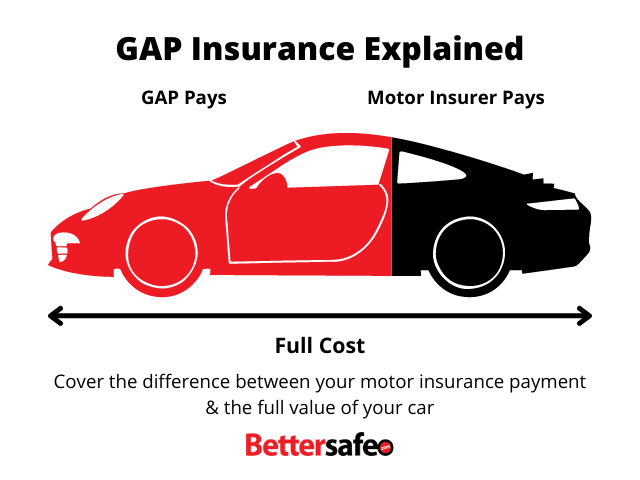

- Financial Protection: Gap Insurance, or Guaranteed Asset Protection, bridges the “gap” between what your insurance company pays out for a totaled vehicle and the amount you still owe on your car loan. Let's say you owe $20,000 on your loan, but your insurance company only values the totaled vehicle at $15,000. Without Gap Insurance, you're still on the hook for that $5,000.

- Loan Payoff Assistance: Quickly accessing your Gap Insurance details allows you to initiate the claim process and potentially avoid further accruing interest on your car loan.

- Coverage Verification: Knowing the specifics of your policy – the coverage limits, deductible (if any), and the claims process – helps you understand exactly what protection you have. There might be limitations you're unaware of, such as exclusions for specific causes of loss.

Consider this analogous to needing to locate a specific fuse on your vehicle at night. The fuse box diagram is there to guide you to the correct slot quickly and efficiently. Without it, you might fumble around in the dark, potentially making the problem worse. Similarly, finding your Gap Insurance proactively prevents you from scrambling when you need it most.

Key Specs and Main Documentation

Instead of "parts", we're looking for the key documents that prove your coverage. Here's where to find them:

- Your Car Loan Agreement: This is the most likely place to find details about your Gap Insurance. Review it carefully. The Gap Insurance details will often be listed as a separate add-on or as part of a broader "protection package." Look for headings like "Gap Insurance," "GAP Waiver," "Debt Cancellation Agreement," or similar.

- Separate Gap Insurance Policy: In some cases, Gap Insurance is sold as a standalone policy, separate from the loan agreement. If so, you'll have a dedicated insurance document, likely with a policy number and coverage details.

- Dealership Paperwork: When you purchased your vehicle, the dealer may have included details about the Gap Insurance within the overall sales paperwork. Dig through those files!

- Finance Company Website/App: Most finance companies have online portals or apps where you can access your loan documents and account details. Check for any mention of Gap Insurance there.

- Insurance Agent (If Applicable): If you purchased Gap Insurance through your auto insurance agent, contact them. They should have a record of your policy.

Here are the key specs you're looking for:

- Policy Number: Unique identifier for your Gap Insurance.

- Coverage Amount/Limit: The maximum amount the insurance will pay out.

- Deductible (if any): The amount you're responsible for paying before the insurance kicks in.

- Covered Causes of Loss: The specific events (e.g., theft, collision) that are covered.

- Exclusions: The events or situations that are *not* covered. For example, some policies exclude losses due to fraud or intentional damage.

- Claims Process: The steps you need to take to file a claim. This includes who to contact and what documents you'll need.

- Contact Information: Phone number and address for the Gap Insurance provider.

"Symbols" – Understanding the Legal Jargon

Legal documents can be confusing. Here's how to decipher some common "symbols" (aka, legal terms):

- Indemnification: This means the insurance company will compensate you for a loss, up to the coverage limits.

- Subrogation: This allows the insurance company to pursue legal action against a third party who caused the loss (e.g., if another driver was at fault in an accident).

- Waiver: In some cases, Gap Insurance is actually structured as a "debt waiver," meaning the finance company agrees to waive the remaining debt if your vehicle is totaled.

- Effective Date/Expiration Date: Know when your coverage begins and ends!

How It Works: The Gap Insurance Claim Process

The general process usually looks like this:

- Vehicle is Totaled/Stolen: File a claim with your primary auto insurance company.

- Insurance Settlement: Your insurance company determines the actual cash value (ACV) of your vehicle and pays you that amount (minus your deductible).

- Gap Insurance Claim: Contact your Gap Insurance provider (using the contact information you found in your documentation). Provide them with your primary insurance settlement details, loan information, and any other required documentation.

- Gap Insurance Payment: The Gap Insurance company calculates the "gap" between your loan balance and the insurance settlement and pays off the remaining balance (up to the policy limits).

Real-World Use: Basic Troubleshooting

Let's say you can't find your Gap Insurance details. Here's what to do:

- Contact the Dealership: Even if you don't have the paperwork, the dealership where you bought the car should have a record of whether you purchased Gap Insurance.

- Contact the Finance Company: They are your next best bet. They should have details about any add-on products you purchased with your loan.

- Check Your Bank Statements: Look for any payments to a Gap Insurance provider around the time you purchased your vehicle.

If the Gap insurance was purchased by you independantly of the original lender, contacting them is paramount. This is the case if you refinanced the vehicle and purchased new Gap Insurance during this transaction.

Safety: Avoiding Scams and Understanding Limitations

Gap Insurance is generally a safe and legitimate product, but be aware of these potential pitfalls:

- Unnecessary Coverage: If you put down a large down payment on your car (20% or more), you may not need Gap Insurance because the "gap" between the loan balance and the vehicle's value is already small. Carefully consider the value proposition before purchasing.

- Exclusions: Always read the fine print! Some policies have exclusions that could leave you unprotected.

- Scams: Be wary of unsolicited offers for Gap Insurance, especially those that seem too good to be true. Always deal with reputable providers.

- Duplicate Coverage: Double-check that you are not paying for a second, unneeded Gap Insurance product. This is common when refinancing vehicles.

Finding your Gap Insurance details is a crucial task that can save you a significant amount of money and stress if your vehicle is ever totaled or stolen. Take the time to locate your documentation and understand your coverage. It's an investment in your financial security.

Unfortunately, as we mentioned earlier, there's no singular diagram to download for finding your Gap Insurance. We do have expertise in automotive finance and risk management, so if you're struggling to locate your details or understand your policy, reach out. We may be able to offer guidance based on your specific situation. While we can't directly provide a downloadable diagram for locating it, we can assist with some of the information.