How To Get 0 Apr On A Car Loan

Securing a 0% APR (Annual Percentage Rate) car loan is the holy grail for savvy car buyers. It effectively means you're borrowing money without paying any interest, significantly reducing the total cost of your vehicle. While it sounds too good to be true, it's achievable under specific circumstances. This article will delve into the factors that influence APR, the qualifications lenders look for, and strategies to maximize your chances of getting that coveted 0% APR.

Understanding the 0% APR Landscape

First, let's be clear: 0% APR car loans aren't offered out of the goodness of lenders' hearts. They're primarily marketing incentives used by manufacturers and dealerships to stimulate sales, especially for specific models or during periods of slow demand. The cost of the interest is often absorbed by the manufacturer or dealer, who see it as an investment in moving inventory.

Purpose: Understanding how to obtain a 0% APR loan is crucial for minimizing your overall car purchase cost. It's also valuable for understanding the intricacies of auto financing and negotiating better terms, even if you don't qualify for the absolute best rate. Think of it as optimizing your engine for peak performance – you want to understand all the variables to get the best possible outcome.

Key Specs and Main Parts (of Loan Qualification)

The "parts" of loan qualification are the key factors lenders assess. These can be broken down into several core areas:

- Credit Score: This is arguably the most crucial factor. Lenders use your credit score (typically a FICO score) to gauge your creditworthiness – your history of repaying debts. A high credit score, generally above 700 (and ideally above 750 or even 800 for a 0% offer), demonstrates a low risk of default.

- Credit History: It's not just the score; it's the history behind it. Lenders will examine the length of your credit history, the types of credit accounts you've held (credit cards, loans, etc.), and your payment history. Consistent, on-time payments are essential. Negative marks, such as late payments, collections, or bankruptcies, significantly reduce your chances. Think of it like your car's maintenance record; a history of neglecting oil changes will make it less reliable.

- Down Payment: A substantial down payment demonstrates your financial commitment and reduces the lender's risk. The larger the down payment, the better your chances of securing a favorable rate. Lenders often look for at least 10-20% down. This is like using premium fuel in your car; it improves performance.

- Loan Term: 0% APR offers are often tied to shorter loan terms, such as 36 or 48 months. This means higher monthly payments, but you're paying off the principal faster. Lenders prefer shorter terms because they recoup their investment more quickly.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI indicates that you have more disposable income and are less likely to struggle with loan repayments. Lenders typically prefer a DTI below 43%.

- Vehicle Eligibility: As mentioned earlier, 0% APR offers are usually limited to specific vehicle models, often those the manufacturer is trying to move quickly. These offers change frequently, so it's crucial to research what's currently available.

- Manufacturer Incentives & Regional Offers: Always check the manufacturer's website for current incentive programs. Loan incentives often depend on geographic region, so verify the offers that are valid in your area.

"Symbols" - Understanding Lender Jargon

Think of lender jargon like the symbols on a wiring diagram. It's essential to understand what they mean:

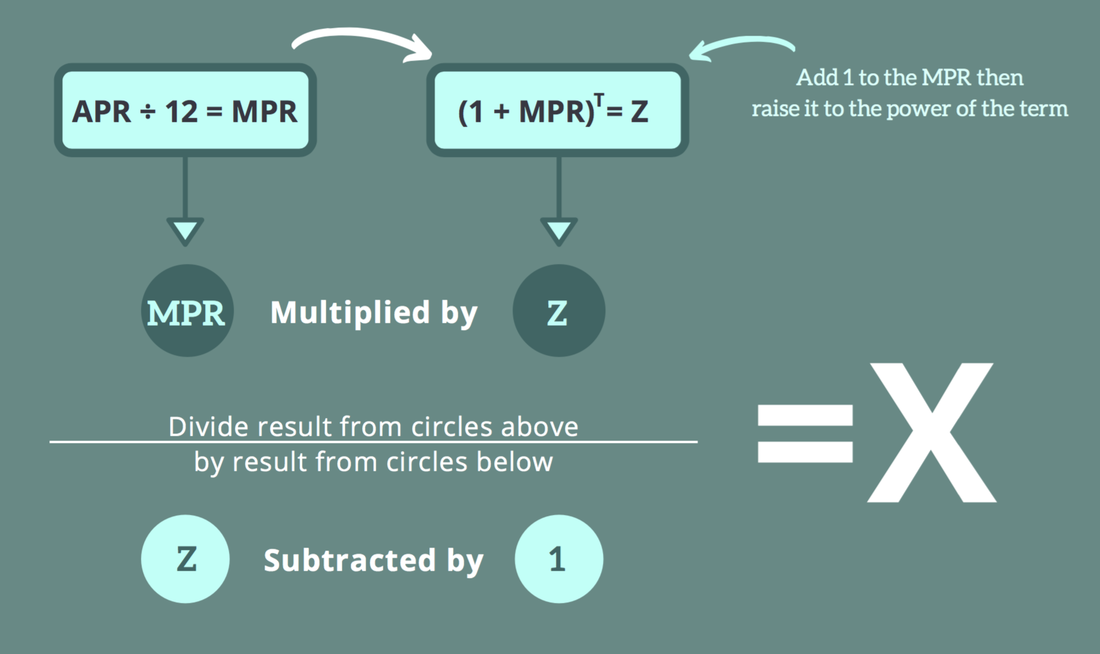

- APR (Annual Percentage Rate): The total cost of borrowing money, expressed as an annual rate. It includes the interest rate plus any fees associated with the loan.

- Creditworthiness: A measure of your ability and willingness to repay a debt.

- Prime Rate: The interest rate that commercial banks charge their most creditworthy customers. Auto loan rates are often expressed as a margin above the prime rate.

- Incentive: A promotional offer designed to encourage sales, like a 0% APR loan or a cash rebate.

- Loan Term: The length of time you have to repay the loan, typically expressed in months.

- Principal: The original amount of money borrowed.

How It Works: The Lender's Perspective

Lenders make money on loans through interest payments. Offering a 0% APR loan means they forgo this interest income. So, why do they do it? The key is that they make money elsewhere. Dealers might sell you add-ons, service packages, or higher-priced models that yield a greater profit. Manufacturers, in turn, sell more vehicles. Also, they are hoping to earn your customer loyalty and future business. They are betting that even if they don't profit directly from interest on this loan, they'll benefit in other ways. The dealership may still get compensation from the manufacturer to make up for the lack of interest revenue.

The "calculation" a lender makes goes something like this: "Can we afford to offer a 0% APR on this vehicle to this customer (based on their credit profile) and still achieve our overall sales and profitability goals?"

Real-World Use: Troubleshooting Your Loan Application

Let's say you've applied for a 0% APR loan and been rejected. What can you do? Here's a basic troubleshooting guide:

- Check Your Credit Report: Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, TransUnion). Look for errors or inaccuracies that could be negatively impacting your score. Dispute any errors you find.

- Improve Your Credit Score: Pay down existing debt, especially credit card balances. Make all payments on time, every time. Consider becoming an authorized user on a responsible credit cardholder's account.

- Increase Your Down Payment: Save up more money to put towards the down payment. This reduces the lender's risk and increases your chances of approval.

- Shop Around: Don't settle for the first offer you receive. Get quotes from multiple lenders, including banks, credit unions, and online lenders. A "soft" credit inquiry (one that doesn't impact your credit score) is used for pre-approval.

- Negotiate: Don't be afraid to negotiate with the dealer. If they won't budge on the APR, try negotiating the price of the vehicle or other fees. Remember, everything is negotiable.

- Consider a Co-signer: If your credit is borderline, a co-signer with good credit may improve your chances of approval.

- Understand the Fine Print: Make sure you understand all the terms and conditions of the loan before signing anything. Pay close attention to any fees or penalties.

Safety: Avoiding Loan Scams and Pitfalls

Just like working on a car, loan applications also carry risks. Be wary of the following:

- Too-Good-To-Be-True Offers: If an offer sounds too good to be true, it probably is. Be especially cautious of lenders who pressure you to sign quickly or who don't fully disclose all the terms and conditions.

- Hidden Fees: Always ask about all fees associated with the loan, including origination fees, prepayment penalties, and late payment fees.

- Predatory Lending: Avoid lenders who charge excessively high interest rates or fees or who use aggressive or deceptive lending practices.

- Identity Theft: Protect your personal and financial information. Be cautious about sharing sensitive information online or over the phone.

Remember: A reputable lender will be transparent about their terms and willing to answer all your questions. If you feel uncomfortable or pressured, walk away.

Successfully securing a 0% APR car loan requires diligent planning, a strong credit profile, and a willingness to shop around. While it's not always easy, the potential savings make it a worthwhile pursuit. Think of it as tuning your financial engine for maximum efficiency.

We have a detailed document covering all the key strategies on securing auto loan with low APR, including case studies and updated resource links. You can download it here.