How To Get 0 Interest Car Loan

Securing a 0% interest car loan, often referred to as a "zero percent APR" loan, is akin to finding the Holy Grail in the automotive finance world. It's an incredibly attractive option, effectively allowing you to purchase a vehicle and pay it off over time without incurring any interest charges. This article dissects the process of obtaining such a loan, outlining the strategies, credit requirements, and market factors involved.

Understanding the Landscape: It's Not Just About the Rate

Before diving into the specifics, it's crucial to understand that 0% APR car loans are promotional offers, not standard financing options. They are typically offered by manufacturers (or their captive finance companies) to incentivize sales of specific models or clear out existing inventory. Think of them as sophisticated marketing tools, designed to move metal off the lots.

Key Specs and Main Parts of the Offer

When evaluating a 0% APR offer, scrutinize the following components:

- Vehicle Eligibility: These offers are rarely available on all models. They are usually restricted to specific vehicles that the manufacturer wants to move quickly. Often these are vehicles that are about to be redesigned or end-of-year models.

- Loan Term: The loan term, or the duration of the loan, is often shorter than standard auto loans. Don't expect to get a 0% APR loan for 72 months; 36 or 48 months are more common. A shorter term means higher monthly payments.

- Credit Score Requirements: This is the biggest hurdle. Zero percent APR loans are typically reserved for borrowers with exceptional credit. We’re talking scores in the "super-prime" range, generally 740 or higher. Lenders use credit scores as a key indicator of your creditworthiness, predicting how likely you are to repay the loan.

- Down Payment: A substantial down payment might be required. The lender wants to minimize their risk, and a larger down payment reduces the loan-to-value (LTV) ratio.

- In Lieu of Other Incentives: 0% APR offers often preclude you from taking advantage of other rebates or incentives. You may have to choose between the 0% financing and a cash rebate. Run the numbers to see which offer saves you more money overall.

- Dealer Fees and Add-ons: Be vigilant about dealer fees and add-ons, such as extended warranties or paint protection. Dealers might try to make up for the lost interest revenue by inflating these costs. Always negotiate these separately.

Symbols: Decoding the Fine Print

Understanding the "symbols," or rather, the terminology used in the offer, is critical. Here's a breakdown:

- APR (Annual Percentage Rate): This is the actual annual cost of the loan, including interest and fees, expressed as a percentage. With a 0% APR loan, the APR is literally zero.

- MSRP (Manufacturer's Suggested Retail Price): This is the sticker price of the vehicle. It's a starting point for negotiation, not a fixed price.

- Loan-to-Value (LTV): This is the ratio of the loan amount to the value of the vehicle. A lower LTV is better for the lender and increases your chances of approval.

- Credit Bureau: Companies like Equifax, Experian, and TransUnion collect and maintain credit information. Lenders will pull your credit report from one or more of these bureaus.

- Credit Score: A three-digit number (typically ranging from 300 to 850) that represents your creditworthiness. Higher scores indicate lower risk.

How It Works: The Path to Zero Percent

Here's a step-by-step guide to navigating the process of obtaining a 0% APR car loan:

- Check Your Credit: Before even setting foot in a dealership, obtain your credit report from all three major credit bureaus. Review it carefully for any errors or inaccuracies. Dispute any errors promptly, as they can negatively impact your score. Focus on improving your credit utilization ratio (the amount of credit you're using compared to your total available credit) and making all payments on time.

- Research Eligible Vehicles: Identify the vehicles that are currently being offered with 0% APR financing. This information is typically available on the manufacturer's website or through automotive news outlets.

- Get Pre-Approved (Potentially): While not always necessary, getting pre-approved for a standard auto loan from your bank or credit union can give you leverage during negotiations. It also provides a baseline interest rate to compare against the 0% APR offer. Note that pre-approval can sometimes hurt your credit slightly through a hard inquiry.

- Shop Around: Even if you're focused on a specific vehicle, visit multiple dealerships. Each dealership may have slightly different financing terms or be willing to negotiate further.

- Negotiate the Price: Remember that the 0% APR is just one component of the overall deal. Negotiate the price of the vehicle independently of the financing. Don't let the dealer distract you with the attractive interest rate while padding the price of the car.

- Read the Fine Print: Before signing any paperwork, carefully review all the terms and conditions of the loan. Pay close attention to the loan term, the total amount financed, any fees, and any penalties for late payments.

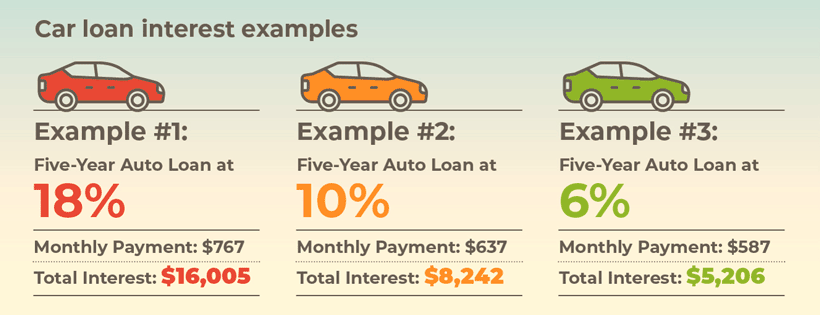

- Consider the Alternatives: Sometimes, taking a cash rebate and financing the vehicle at a slightly higher interest rate might be more advantageous, especially if you have a trade-in. Use an online loan calculator to compare different scenarios.

Real-World Use: Troubleshooting the "Impossible" Loan

Even with excellent credit, securing a 0% APR loan can be challenging. Here are some common issues and potential solutions:

- Rejection Despite Good Credit: Even with a high credit score, you might be rejected if you have a thin credit history (limited credit accounts or short credit history). In this case, consider adding a secured credit card or becoming an authorized user on a family member's credit card to build your credit history.

- Dealer Add-ons: The dealer might try to add unnecessary add-ons to the loan. Never feel pressured to accept add-ons you don't want. Politely decline them. If they insist, be prepared to walk away.

- Shorter Loan Terms: The shorter loan terms can result in unaffordable monthly payments. If this is the case, you might need to consider a different vehicle or a standard auto loan with a longer term, even if it means paying interest.

- Hidden Fees: Be wary of any "hidden" fees, such as documentation fees or processing fees. These fees should be clearly disclosed upfront. Challenge any fees that seem excessive or unjustified.

Safety: Avoiding the Financing Pitfalls

The riskiest component of any car loan, including a 0% APR loan, is the potential for overextending yourself financially. Ensure that you can comfortably afford the monthly payments, insurance, and maintenance costs associated with the vehicle. Never take out a loan that you can't realistically repay. Defaulting on a car loan can severely damage your credit and lead to repossession.

Another pitfall is focusing solely on the interest rate and neglecting other aspects of the deal, such as the price of the vehicle or the value of your trade-in. Remember, the dealer's primary goal is to maximize their profit. Be an informed and assertive negotiator.

In Conclusion

Obtaining a 0% APR car loan is a challenging but potentially rewarding endeavor. By understanding the requirements, preparing your credit, and negotiating effectively, you can increase your chances of success. Remember to prioritize your financial well-being and make informed decisions. These loans are not the right path for everybody. Sometimes a small rebate and a slightly higher interest rate are the best options for saving money. Also note that 0% interest loans are subject to credit approval.

For a detailed decision-making diagram to help you decide if a 0% interest loan is the right path for you, we have that file available for download. The link will be included in a separate communication, allowing you to further analyze the process.