How To Go About Leasing A Car

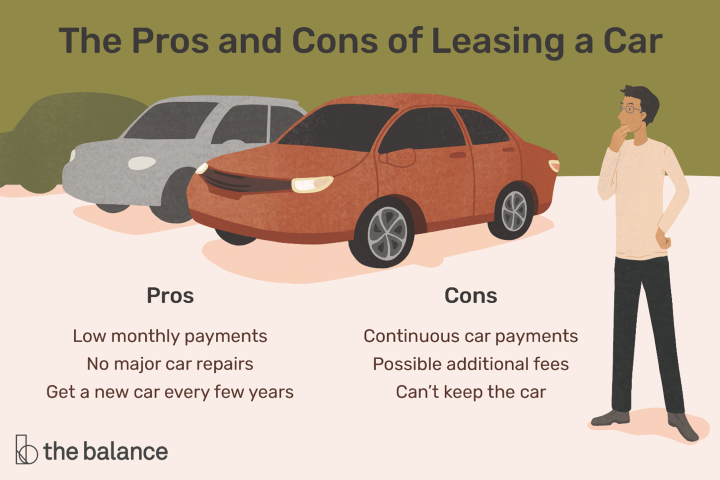

So, you're thinking about leasing a car? Great! It can be a smart move if you understand the game. Think of it like understanding the schematics of your engine – you need to know the inputs, the processes, and the outputs to avoid a major breakdown. Leasing isn't just renting; it's a financial contract with specific terms, and knowing those terms is crucial. This guide will break down the entire leasing process so you can make an informed decision, just like you would when deciding which aftermarket turbo to install.

Purpose: Understanding the Lease Agreement

Why bother understanding the leasing process? Well, ignoring the details is like slapping on a performance chip without knowing your engine's limits. You could end up with blown head gaskets (financial ruin!) if you’re not careful. Understanding the lease agreement allows you to:

- Negotiate a better deal.

- Avoid hidden fees and penalties.

- Understand your responsibilities during the lease term.

- Make an informed decision about whether leasing is right for you.

Ultimately, knowledge is power. Just like knowing the correct torque specs for your wheels, understanding your lease empowers you to make the best choices for your situation.

Key Specs and Main Parts of a Lease

Think of these as the critical dimensions and components of your leasing engine:

- MSRP (Manufacturer's Suggested Retail Price): The sticker price of the vehicle. This is the starting point for negotiations, but it's rarely what you'll actually pay.

- Capitalized Cost (Cap Cost): This is the agreed-upon price of the vehicle at the start of the lease. Think of it as the adjusted selling price after you’ve negotiated discounts and applied rebates. A lower cap cost means lower monthly payments.

- Capitalized Cost Reduction: This is the amount you reduce the cap cost by paying cash upfront, trading in a vehicle, or using rebates. Basically, it’s your down payment (though it's not technically called that in a lease).

- Residual Value: The estimated value of the vehicle at the end of the lease term, determined by the leasing company. This is a critical number because it directly impacts your monthly payments. A higher residual value translates to lower payments.

- Money Factor: This is essentially the interest rate you're paying on the lease. It's expressed as a decimal (e.g., 0.0025). To find the approximate annual interest rate, multiply the money factor by 2400. (0.0025 * 2400 = 6% APR).

- Lease Term: The length of the lease, usually expressed in months (e.g., 24 months, 36 months).

- Mileage Allowance: The number of miles you're allowed to drive each year. Exceeding this limit results in per-mile charges at the end of the lease.

- Disposition Fee: A fee charged at the end of the lease to cover the cost of preparing the vehicle for resale. This fee can sometimes be negotiated or waived.

Lease Symbols and Terminology

The lease agreement itself is like a wiring diagram. Here’s how to decipher some of the key elements:

- Paragraph Structure: Each paragraph outlines a specific aspect of the lease agreement, such as payment terms, maintenance responsibilities, and termination clauses. Read each section carefully.

- Fine Print: This is where the devil often resides. Pay close attention to the footnotes and small print. They can contain important details about fees, penalties, and limitations.

- Legal Jargon: Lease agreements are often written in legal language. Don't be afraid to ask for clarification if you don't understand something. Dealerships are legally obligated to explain the terms to you.

Think of bolded sections as vital components, like your spark plugs – essential for the whole system to fire correctly. Italicized sections are like sensors, providing important information you need to monitor. And the fine print? Those are like the tiny, often overlooked fuses that can blow the whole circuit.

How Leasing Works: The Mechanics of the Deal

Here’s the simplified process of how a lease works:

- Negotiate the Cap Cost: This is where your haggling skills come into play. Aim to get the lowest possible price for the vehicle, just like you would when buying parts online. Use Edmunds or Kelley Blue Book to research the fair market value.

- Calculate Depreciation: The difference between the cap cost and the residual value represents the depreciation of the vehicle during the lease term. This is the primary factor determining your monthly payments.

- Add Finance Charges: The money factor, converted to an approximate interest rate, is applied to the average of the cap cost and residual value to determine the finance charges.

- Calculate Monthly Payment: The monthly payment is calculated by adding the depreciation and finance charges, then dividing by the lease term (in months). Sales tax is then added to arrive at the final monthly payment.

Equation: Monthly Payment = ( (Cap Cost - Residual Value) + (Cap Cost + Residual Value) * (Money Factor) * (Lease Term) ) / Lease Term + Sales Tax

Remember that capitalized cost reductions (like a down payment) directly reduce the Cap Cost, and thus lower your monthly payments.

Real-World Use: Basic Troubleshooting Tips

Just like a car, leases can have issues. Here are some troubleshooting tips:

- High Monthly Payment: If the monthly payment seems too high, double-check the cap cost, residual value, and money factor. Ask for a breakdown of the calculations. A good lease calculator (easily found online) is your diagnostic tool here.

- Hidden Fees: Scrutinize the lease agreement for any unexpected fees, such as acquisition fees, documentation fees, or early termination fees. These are often negotiable.

- Mileage Overages: Monitor your mileage closely. If you're approaching the limit, consider purchasing additional miles upfront or adjusting your driving habits.

- Excess Wear and Tear: At the end of the lease, you'll be charged for any excessive wear and tear, such as dents, scratches, and interior damage. Take good care of the vehicle and consider getting a pre-inspection before returning it.

For example, if you see a sudden spike in your payments, it’s like hearing a strange noise under the hood. Investigate! Check the invoice carefully to see what caused the increase.

Safety: Risky Components and Potential Pitfalls

Leasing can be risky if you're not careful. Be aware of these potential pitfalls:

- Early Termination: Terminating a lease early can be very expensive. You'll typically be responsible for paying the remaining lease payments, plus penalties. This is like trying to rebuild an engine mid-project – messy and costly.

- Excess Mileage Charges: Exceeding the mileage allowance can result in significant charges at the end of the lease.

- Excess Wear and Tear Charges: Damage to the vehicle can result in costly repairs.

- Negative Equity: If the market value of the vehicle drops below the residual value, you'll be in a negative equity position. This can make it difficult to trade in the vehicle or purchase it at the end of the lease.

- Rollover Leasing: Rolling over negative equity from a previous lease into a new lease can create a cycle of debt. Avoid this at all costs.

Important: Never lease a car if you anticipate needing to terminate the lease early. The penalties are severe.

Think of these risks as potential engine failures. Preventive maintenance (careful planning and attention to detail) is crucial to avoid them.

Leasing a car is a complex process, but with a clear understanding of the key terms and potential pitfalls, you can make an informed decision. Remember to do your research, negotiate aggressively, and read the fine print carefully. Just like you wouldn’t install a new exhaust system without understanding its impact on your engine, don’t sign a lease without fully understanding the terms.

We have a detailed breakdown of the typical lease structure available for download. This document provides a deeper dive into the calculations and potential negotiation points involved in leasing a vehicle. It's a valuable resource to have when you're considering a lease, so you can go in armed with knowledge and confident in your decisions.