How To Lease A New Car

So, you’re thinking about leasing a new car, eh? Good choice! Leasing can be a smart move, especially if you like driving new vehicles every few years and aren't interested in long-term ownership headaches. But don't jump in blind. Think of this article as your virtual pit crew, giving you the inside scoop on how leasing *really* works. We'll break down the process from application to trade-in, so you can hit the dealership with confidence.

Purpose of Understanding Leasing

Why bother understanding the ins and outs of a lease agreement? After all, you’re not buying the car, right? Wrong! You're essentially renting it for an extended period, and that rental agreement – the lease – is a legally binding contract. Understanding the key lease terms protects you from nasty surprises like unexpected fees, mileage penalties, or excessive wear-and-tear charges. Knowing how the residual value is calculated can even help you negotiate a better deal upfront.

Key Specs and Main Parts of a Lease Agreement

Think of the lease agreement as a complex engine. Several critical components must work together seamlessly. Here’s a breakdown of the main players:

- MSRP (Manufacturer's Suggested Retail Price): This is the sticker price of the car. It's the starting point for negotiations, but rarely the price you'll actually pay.

- Capitalized Cost (Cap Cost): This is the agreed-upon price of the car for the lease. Think of it as the purchase price you'd pay *if* you were buying, but adjusted for the lease. Negotiate this down aggressively!

- Residual Value: This is the predicted value of the car at the end of the lease term. The higher the residual value, the lower your monthly payments will be, because you're only paying for the difference between the cap cost and the residual value.

- Money Factor: This is essentially the interest rate on the lease. It's usually expressed as a very small decimal (e.g., 0.0025). To get a rough estimate of the annual interest rate, multiply the money factor by 2400.

- Lease Term: The length of the lease, typically expressed in months (e.g., 24, 36, or 48 months).

- Mileage Allowance: The number of miles you're allowed to drive each year. Exceeding this allowance results in a per-mile charge at the end of the lease.

- Acquisition Fee: A fee charged by the leasing company to initiate the lease.

- Disposition Fee: A fee charged by the leasing company at the end of the lease to cover the cost of selling the car.

- Monthly Payment: The amount you'll pay each month for the duration of the lease. This is influenced by all the factors above.

Cap Cost Reduction: Similar to a down payment on a purchase, this is the amount of money you put down upfront to reduce the monthly payments. While it lowers the payments, it's often better to avoid a large cap cost reduction, as you won't get that money back if the car is totaled or stolen.

Decoding the Lease Agreement – What those lines REALLY Mean

Lease agreements are dense documents filled with legal jargon. Here’s how to interpret some key elements:

- Bolded Sections: Pay close attention to sections in bold, as they often highlight crucial terms and conditions, such as mileage limits and penalties.

- Fine Print: Don't skim over the fine print! This is where you'll find details about wear-and-tear charges, early termination fees, and other potential gotchas.

- Numbers, Numbers, Numbers: Cross-check all the numbers! Make sure the capitalized cost, residual value, money factor, and monthly payment match what you agreed upon during negotiations. A simple spreadsheet can be your best friend here.

How Leasing Works – From Start to Finish

The leasing process can be broken down into several key steps:

- Research and Selection: Determine the type of car you need and your budget. Compare leasing deals from different manufacturers and dealerships. Online resources like Edmunds and Kelley Blue Book are invaluable.

- Negotiation: Negotiate the capitalized cost of the car. This is where your research pays off. Don't be afraid to walk away if you're not happy with the deal. Remember, the MSRP is just a starting point.

- Credit Application: The dealership will run a credit check to determine your eligibility for leasing. A good credit score is essential for securing favorable lease terms.

- Lease Agreement Review: Carefully review the lease agreement before signing. Make sure you understand all the terms and conditions. If anything is unclear, ask for clarification.

- Vehicle Inspection (at Lease End): Before returning the vehicle, the leasing company will inspect it for excessive wear and tear. Be prepared for potential charges if the vehicle doesn't meet their standards. Document everything with pictures before returning the car.

- Vehicle Return/Purchase: You have the option to return the vehicle at the end of the lease or purchase it for the residual value. Carefully consider your options before making a decision.

Real-World Use – Basic Troubleshooting and Negotiation Tips

So, you're at the dealership. Here are some practical tips to navigate the process:

- Shop Around: Get quotes from multiple dealerships. Use these quotes to leverage better deals.

- Focus on the Cap Cost: Negotiate the capitalized cost, not the monthly payment. A lower cap cost will result in lower monthly payments.

- Understand the Money Factor: Ask for the money factor and calculate the approximate interest rate. Compare this rate to other leasing deals.

- Beware of Add-ons: Dealers often try to sell you add-ons like extended warranties or paint protection. These are often overpriced and unnecessary.

- Read the Fine Print: Don't sign anything until you've carefully read and understood the entire lease agreement.

- Pre-Inspection at Lease End: Consider getting a pre-inspection from a third-party inspector before returning the vehicle. This can help you identify potential wear-and-tear charges and give you time to address them.

Safety – Potential Pitfalls and How to Avoid Them

Leasing can be a great option, but it's not without its risks. Here are some potential pitfalls to watch out for:

- Excessive Mileage: Exceeding your mileage allowance can result in significant per-mile charges. Accurately estimate your annual mileage needs.

- Excessive Wear and Tear: The leasing company will charge you for any damage beyond normal wear and tear. Take good care of the vehicle and address any minor repairs promptly.

- Early Termination Fees: Terminating the lease early can be very expensive. Be sure you're committed to the entire lease term.

- Hidden Fees: Be aware of all the fees associated with the lease, including the acquisition fee, disposition fee, and any other administrative charges. Never be afraid to ask for a complete breakdown of all costs.

- Negative Equity: If you trade in a leased car with negative equity (meaning the car is worth less than what you owe), that negative equity will be rolled into your next loan or lease. This is usually a bad idea!

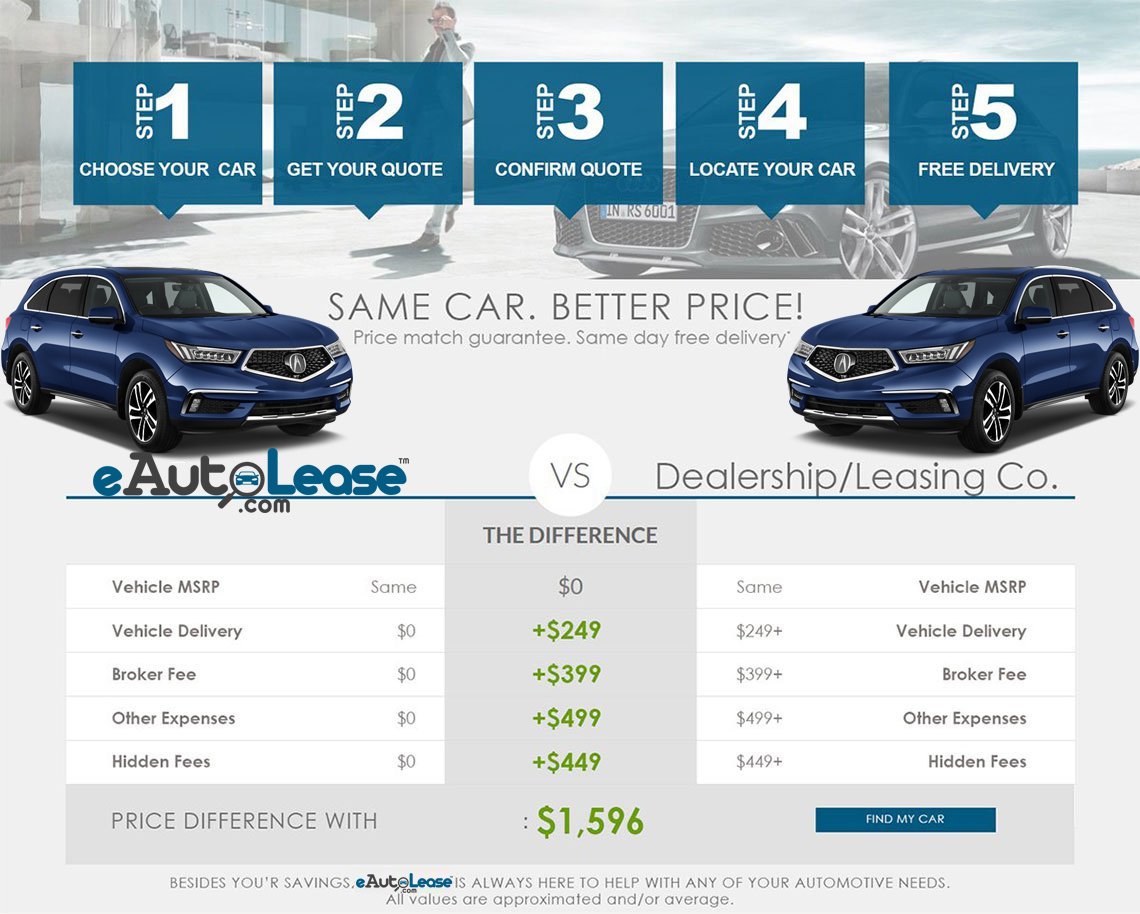

Diagram Download

For your convenience, we've prepared a handy diagram summarizing all the key elements of a lease agreement and the leasing process. This diagram will serve as a quick reference guide during your negotiations. You can download the file here. It's a schematic of the lease process, identifying key parameters and potential red flags.

With a little research and preparation, you can navigate the leasing process with confidence and get a great deal on your next car. Good luck!