How To Pay For Toyota Car Payment

Let's talk about something crucial, yet often overlooked in the world of car ownership: making those Toyota car payments. While it might seem simple on the surface, understanding the intricacies of your payment options and how they interact with your financial systems can save you headaches, money, and even improve your credit score. This isn't about showing you where the 'pay' button is; it's about giving you a deep dive into the various methods, potential pitfalls, and best practices, all geared towards a DIY-savvy car owner like yourself.

Understanding Your Toyota Car Payment Options

Think of this as your toolbox for managing your automotive finances. Just like you wouldn't grab a random wrench for a specific bolt, you need to choose the right payment method for your situation.

Key Specs and Main Parts (Payment Methods)

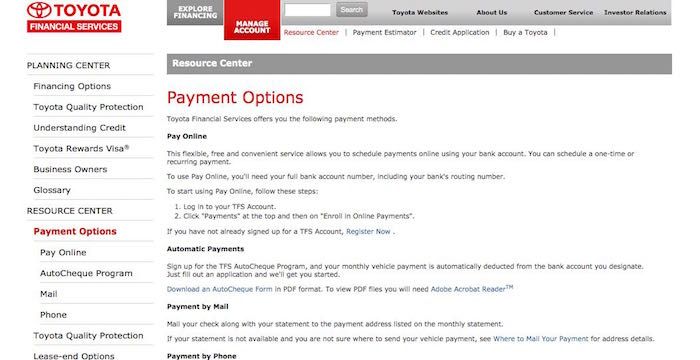

We're not dealing with engine components here, but rather the different avenues for channeling your hard-earned cash towards Toyota Financial Services (TFS). Here's a breakdown:

- Online Payment Portal (TFS Website/App): This is your digital dashboard. It allows you to manage your account, view statements, set up autopay, and make manual payments. Think of it as the ECU of your finance system.

- Automatic Payments (Autopay): A feature within the online portal that automatically debits your bank account on your due date. This is like cruise control for your payments, keeping you on track and avoiding late fees.

- Phone Payment: Calling TFS directly and making a payment over the phone with a customer service representative. This is your "analog" option, useful when you need direct assistance.

- Mail-in Payment: Sending a check or money order to TFS via snail mail. This is the oldest method, a bit like using a carburetor in a modern engine – functional, but not the most efficient.

- Toyota Dealership Payment: While less common, some dealerships may accept payments on behalf of TFS. It's worth checking if your local dealership offers this as a convenience.

- Third-Party Bill Pay Services: Using services like your bank's bill pay feature to send payments to TFS. These act as intermediaries, streamlining the process from your bank's end.

Symbols – Interpreting the Finance Flowchart

While we're not dealing with physical diagrams with lines and colors in the typical mechanic sense, let's create a mental model using analogous symbols to understand the flow of funds.

- Your Bank Account (Source): Represented by a battery icon (🔋) - the source of power (funds).

- Toyota Financial Services (Destination): Represented by a fuel pump icon (⛽) - the recipient of your financial fuel.

- Online Portal/Autopay (Automated Path): Represented by a cruise control icon (🚗💨) - smooth, automated, and consistent.

- Phone/Mail (Manual Path): Represented by a wrench icon (🔧) - requiring direct intervention and prone to human error.

- Payment Confirmation (Success): Represented by a green checkmark (✅) - indicating a successful transaction.

- Insufficient Funds/Error (Failure): Represented by a red warning light (⚠️) - indicating a problem that needs addressing.

How It Works: The Anatomy of a Payment

The process varies slightly depending on the method, but the fundamental principle remains the same: transferring funds from your account to TFS. Let's break down the most common method – online payment via the TFS portal.

- Login and Authentication: You access the TFS website or app and log in using your credentials (username/email and password). This is like using your key to start the engine – gaining access to the system. Two-factor authentication adds an extra layer of security, like an anti-theft system.

- Account Selection: You select the specific loan account you want to pay. This is equivalent to selecting the right gear before accelerating.

- Payment Amount and Date: You enter the amount you want to pay and the date you want the payment to be processed. This is like setting the fuel mixture – ensuring the right amount is delivered at the right time.

- Payment Method Selection: You choose the bank account you want to use for the payment. You might have multiple bank accounts linked, just like having multiple fuel tanks.

- Review and Confirmation: You review all the details to ensure they are correct. This is your pre-flight checklist – making sure everything is in order before takeoff.

- Payment Processing: TFS processes the payment request. This involves verifying the funds in your bank account and transferring them to TFS's account. This is the actual fuel transfer taking place.

- Confirmation: You receive a confirmation message (usually via email or on-screen) indicating that the payment has been successfully processed. This is your "mission accomplished" signal.

Real-World Use: Troubleshooting Payment Problems

Even with the best systems, things can go wrong. Here are some common scenarios and troubleshooting tips:

- Payment Not Processed: Check your bank account balance to ensure sufficient funds. Verify the account number and routing number entered on the TFS website. Contact TFS customer support for assistance. This is like diagnosing a faulty fuel pump – checking for blockages, power issues, and correct connections.

- Late Payment Fees: Set up automatic payments to avoid missing due dates. If you have difficulty making a payment, contact TFS immediately to discuss potential options. Communication is key. This is like preventative maintenance – addressing potential issues before they become major problems.

- Incorrect Payment Amount: Double-check the payment amount before submitting it. If you overpaid, contact TFS to request a refund or have the overpayment applied to your next payment. If you underpaid, make an additional payment to cover the remaining balance. This is like adjusting the air-fuel mixture – ensuring the correct ratio for optimal performance.

- Security Concerns: Always use strong, unique passwords for your TFS account. Enable two-factor authentication for added security. Be wary of phishing emails or suspicious phone calls requesting your account information. This is like installing an advanced alarm system – protecting your valuable assets from theft.

Safety: Handling Financial "Hot Wires"

Dealing with finances requires vigilance. Here are some areas that demand extra caution:

- Phishing Scams: Be extremely cautious of emails or phone calls that request your account information. TFS will *never* ask for your password or bank account details via email. This is akin to identifying a short circuit – preventing a potential fire.

- Data Security: Ensure that the device you use to access your TFS account is secure and protected with a strong password. Avoid using public Wi-Fi for sensitive financial transactions. This is like using proper grounding techniques – preventing electrical shocks.

- Fraudulent Activity: Regularly monitor your TFS account for any unauthorized activity. If you suspect fraud, contact TFS immediately and report the incident to your bank. This is like having a security camera system – detecting and deterring potential threats.

Understanding your Toyota car payment options and potential pitfalls empowers you to manage your finances effectively. Just as you wouldn't blindly trust any mechanic, you shouldn't blindly trust any payment system. Knowledge is power, and with this guide, you're well-equipped to navigate the world of automotive finance with confidence.

And just like we keep a library of technical diagrams, we have access to additional documentation and resources related to Toyota Financial Services. If you'd like to dive even deeper, feel free to reach out and we can provide further assistance.