How To Pay My Car Payment

Alright, let's talk about something crucial: making those car payments. You might think, "I just send a check or click a button," but understanding the *mechanics* of how your payment actually works behind the scenes can empower you, especially if you ever run into issues or need to negotiate terms. Think of this as understanding the engine of your finances – you don't need to rebuild it every day, but knowing the parts makes troubleshooting a lot easier.

Purpose: Why Understanding Payment Processes Matters

Why bother diving into the nuts and bolts of something that seems straightforward? Because a deeper understanding gives you:

- Negotiating Power: Knowledge is leverage. If you know how interest accrues, when late fees apply, and the lender's internal processes, you're better equipped to negotiate payment plans or dispute charges.

- Early Problem Detection: Missing a payment is bad, but knowing *why* it was missed (e.g., bank error, incorrect account number) allows for quicker corrective action.

- Preventative Measures: Understanding the timeline for payment processing helps you avoid late fees by ensuring your payments are submitted well in advance of the due date.

- Fraud Protection: Knowing the specific channels for making payments helps you identify and avoid fraudulent schemes.

Key Specs and Main Parts of the Payment Process

Let's break down the key players and their roles in this financial machine. We're talking about the equivalent of your engine's fuel system, but instead of gasoline, it's money flowing to keep your ride on the road.

Key Specs

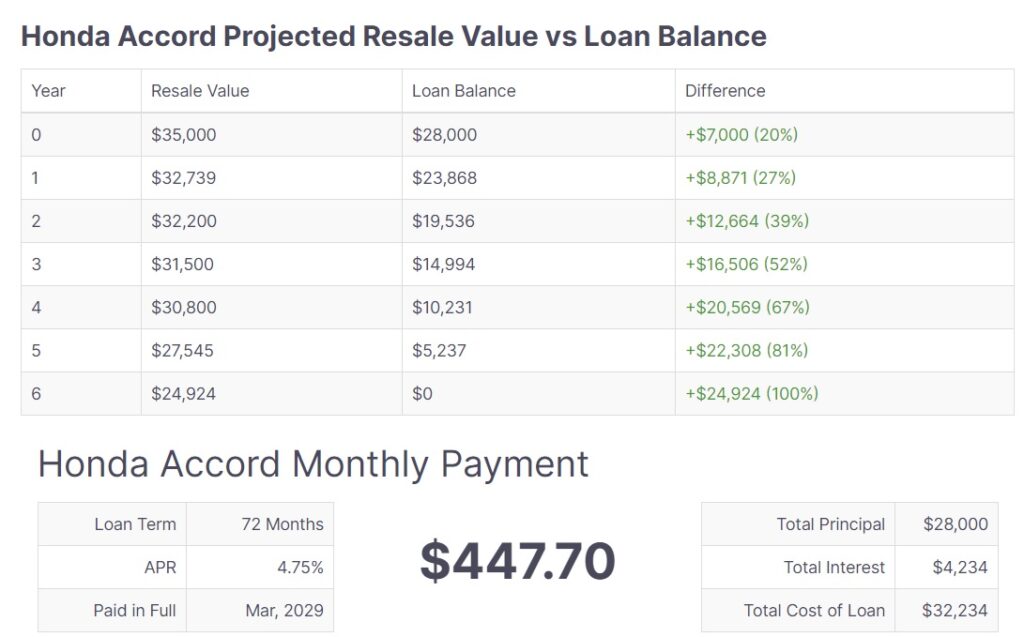

- APR (Annual Percentage Rate): This is the total cost of borrowing money, expressed as a yearly rate. It includes interest and other fees. Think of it as the overall "price" of the loan.

- Loan Term: The length of time you have to repay the loan (e.g., 60 months). Shorter terms mean higher monthly payments but lower overall interest paid.

- Principal Balance: The original amount of money you borrowed. Each payment you make reduces this balance.

- Interest Accrual Method: This determines how interest is calculated. Simple interest is generally more favorable than compound interest.

- Due Date: The date your payment is due each month.

- Grace Period: A period of time after the due date during which you can make a payment without incurring a late fee (if applicable).

- Payment Methods Accepted: The ways you can make payments (e.g., online, mail, phone).

Main Parts (Actors)

- Borrower (You): The person taking out the loan and responsible for making payments.

- Lender (Bank, Credit Union, Finance Company): The institution providing the loan.

- Payment Processor: A third-party service (often a bank or financial technology company) that facilitates the transfer of funds between your bank account and the lender. Examples include ACH networks, credit card processors, and check clearinghouses.

- Your Bank: The financial institution where you hold your checking or savings account.

- Credit Reporting Agencies (CRAs): Equifax, Experian, and TransUnion. Lenders report your payment history to these agencies, which affects your credit score.

How It Works: The Payment Flow Diagram

Let's visualize the payment process. Imagine a simplified diagram with these stages:

- Initiation: You initiate a payment through one of the accepted methods (online portal, mail, phone).

- Authorization: Your bank verifies that you have sufficient funds available (or credit limit) to cover the payment.

- Processing: The payment processor receives the authorization and initiates the transfer of funds from your account to the lender's account. This often involves the ACH (Automated Clearing House) network for electronic payments. ACH is a nationwide network that coordinates electronic payments and automated money transfers.

- Settlement: The funds are transferred from your account to the lender's account.

- Posting: The lender applies the payment to your loan account, reducing the principal balance and covering any accrued interest.

- Reporting: The lender reports the payment to the credit reporting agencies.

Example: Online Payment via ACH

You log into your lender's online portal and schedule an ACH payment from your checking account. The portal sends a request to the ACH network. The ACH network then pulls the funds from your bank account and deposits them into the lender's account. The lender then posts the payment to your account.

Real-World Use: Troubleshooting Payment Problems

Okay, your payment didn't go through. Here's a basic troubleshooting guide:

- Insufficient Funds: The most common issue. Verify that your account balance is sufficient to cover the payment *including* any fees the bank might charge.

Check the details of the transaction, some banks charge an overdraft fee when the account runs out of funds. Avoid overdraft fees by setting up overdraft protection.

- Incorrect Account Information: Double-check the account number and routing number you entered. A single digit error can cause the payment to fail.

- System Error: The lender's or payment processor's system might be experiencing technical difficulties. Try again later or contact customer support.

- Payment Hold: Your bank might have placed a hold on the payment due to suspected fraud or other reasons. Contact your bank to resolve the hold.

- Lender Error: The lender might have made a mistake in processing your payment. Contact the lender's customer support immediately.

- Late Reporting: Check your credit report for accurate payment history. If a payment is incorrectly reported as late, dispute it with the credit reporting agency.

Safety: Potential Risks and Precautions

Handling finances online always carries risks. Be aware of these potential dangers:

- Phishing Scams: Be wary of emails or phone calls claiming to be from your lender, asking for your account information.

Always verify the legitimacy of the communication before providing any personal details. Never click on links in suspicious emails.

- Unsecured Websites: Ensure that the lender's website is secure (look for "https" in the address bar and a padlock icon) before entering your payment information.

- Data Breaches: While you can't completely prevent data breaches, use strong, unique passwords and enable two-factor authentication whenever possible.

- Fraudulent Payment Processors: Only use payment methods that you trust and are offered directly by your lender. Be suspicious of third-party services that promise lower interest rates or faster payments.

- Automatic Payments: While convenient, set reminders to check your account balance before the automatic payment is scheduled to prevent overdraft fees. Ensure the automatic payment is cancelled when the loan is paid off.

Additional Tips for Managing Your Car Payments

- Enroll in Autopay: Many lenders offer a discount on your interest rate for enrolling in automatic payments. This also ensures that you never miss a payment.

- Set Up Payment Reminders: Even if you're enrolled in autopay, set up reminders to check your account balance before the payment is scheduled.

- Make Extra Payments: If you can afford it, make extra payments to reduce the principal balance and shorten the loan term.

Even small extra payments can save you hundreds or thousands of dollars in interest over the life of the loan.

- Refinance Your Loan: If interest rates have dropped or your credit score has improved, consider refinancing your loan to get a lower interest rate.

- Communicate with Your Lender: If you're having trouble making payments, contact your lender as soon as possible. They may be able to offer temporary assistance programs or payment plans.

By understanding the inner workings of the car payment process, you're not just a payer; you're an informed participant. You can make better financial decisions, avoid costly mistakes, and navigate any challenges that come your way. Think of it as equipping yourself with the right tools to maintain your financial "vehicle" and keep it running smoothly.

We have a detailed flow chart diagram illustrating the payment process, including all the key steps and potential points of failure. It’s available for download, providing a visual aid to reinforce your understanding. It's a valuable resource for anyone wanting a deeper dive into the technical aspects of car loan payments. Contact us for the file.