How To Pay My Toyota Car Payment

Navigating Your Toyota Financial Services: A Technical Guide to Payment Options

Let's face it, even the most exhilarating drive in your meticulously maintained (or modified!) Toyota eventually leads back to the mundane reality of bills. While not as glamorous as a cold air intake installation or tuning your ECU, understanding how to efficiently manage your Toyota Financial Services (TFS) car payments is crucial. This article serves as your technical manual to demystify the various payment options available, ensuring you avoid late fees and maintain your credit score.

Purpose – Why This Knowledge Matters

Understanding your payment options is more than just avoiding late fees. It allows you to:

- Optimize your cash flow: Choose a payment method that aligns with your financial strategy.

- Build your credit: Consistent, on-time payments are a cornerstone of a strong credit history.

- Minimize hassle: Automate payments for a set-and-forget solution.

- Avoid unnecessary fees: Understand the terms and conditions associated with each payment method.

Think of this knowledge as part of your preventative maintenance for your financial well-being, just as important as changing your oil or rotating your tires.

Key Specs and Main Payment Options

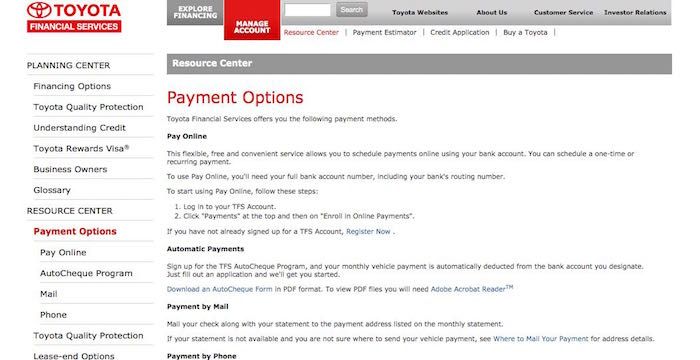

Toyota Financial Services (TFS) offers several payment methods, each with its own "specs" or characteristics. Here's a breakdown:

- Online Payment Portal: TFS provides a secure online portal where you can make payments directly from your bank account. This is often the most convenient and direct method.

- Specs: Requires registration, access to a valid bank account (checking or savings), and internet connectivity.

- Automatic Payments (ACH Debit): You can authorize TFS to automatically debit your bank account on a specific date each month. This ensures you never miss a payment and can often qualify you for lower interest rates or other incentives.

- Specs: Requires completion of an authorization form and provision of your bank account information (routing number and account number). ACH (Automated Clearing House) is the network used for electronic funds transfers.

- Phone Payment: You can make a payment over the phone using a debit card or electronic check. Note that this method *may* incur a convenience fee.

- Specs: Requires a debit card or bank account information and a working telephone.

- Mail a Check or Money Order: This is the most traditional method, but it's also the slowest and carries the highest risk of delay.

- Specs: Requires a check or money order made payable to Toyota Financial Services and proper mailing address. Always include your account number on the check/money order.

- Toyota Financial Services Mobile App: Similar to the online portal, the mobile app provides a convenient way to manage your account and make payments from your smartphone or tablet.

- Specs: Requires a smartphone or tablet, the Toyota Financial Services mobile app, and an internet connection.

Symbols and Terminology

Let's clarify some common terms and "symbols" you'll encounter:

- Account Number: This is your unique identifier within the TFS system. It's like the VIN of your financial account.

- Routing Number: A nine-digit code that identifies your bank. Think of it as the "area code" for your bank.

- ACH (Automated Clearing House): The electronic network used for transferring funds between banks.

- Principal: The original amount of your loan.

- Interest: The cost of borrowing money. It's expressed as an annual percentage rate (APR).

- Escrow (If Applicable): An account held by TFS to pay for your property taxes and insurance, if included in your loan agreement.

- Draft Date: The date your automatic payment is scheduled to be withdrawn from your bank account.

- Grace Period: The period after your payment due date during which you can make a payment without incurring a late fee. Always verify the specific length of your grace period in your loan agreement.

How It Works: The Payment Process

Regardless of the method you choose, the underlying process is essentially the same:

- Initiation: You initiate the payment through your chosen method (online portal, phone, mail, etc.).

- Authentication: TFS verifies your identity and payment information.

- Processing: The funds are transferred from your bank account or debit card to TFS. This usually happens through the ACH network.

- Application: TFS applies the payment to your account, first covering any outstanding fees or interest, and then reducing the principal balance.

- Confirmation: You receive confirmation that your payment has been successfully processed. This can be via email, SMS, or a notification within the TFS mobile app.

The speed of this process can vary depending on the payment method. Online payments and automatic payments are typically the fastest, while mailing a check can take several days.

Real-World Use: Basic Troubleshooting Tips

Even with the best systems, things can occasionally go wrong. Here are some common issues and troubleshooting steps:

- Payment Not Showing Up: Allow sufficient time for the payment to process. Contact TFS customer service if the payment hasn't appeared after a reasonable period (e.g., 2-3 business days for electronic payments, 7-10 days for mailed checks). Double-check the account number and payment date.

- Automatic Payment Failed: Verify that you have sufficient funds in your bank account. Check that your routing number and account number are correct in your TFS account settings. Contact your bank to ensure there are no holds or restrictions on your account.

- Unable to Access Online Portal: Ensure you have a stable internet connection. Try clearing your browser's cache and cookies. If you've forgotten your password, use the password reset function. If problems persist, contact TFS technical support.

- Incorrect Payment Amount: Review your loan statement to confirm the correct payment amount. If you believe there's an error, contact TFS customer service to dispute the charge.

Remember to document all communications with TFS, including dates, times, and the names of representatives you speak with. This can be invaluable if you need to escalate an issue.

Safety – Highlighting Risky Components and Best Practices

While making car payments might seem straightforward, there are potential security risks to be aware of:

- Phishing Scams: Be wary of emails or phone calls claiming to be from TFS that ask for your personal or financial information. Always access the TFS website or mobile app directly by typing the address into your browser or using a trusted bookmark.

- Unsecured Websites: Never enter your payment information on a website that doesn't have "https" in the address bar and a valid SSL certificate (indicated by a padlock icon).

- Compromised Devices: Ensure your computer and smartphone are protected with up-to-date antivirus software and strong passwords.

- Public Wi-Fi: Avoid making payments using public Wi-Fi networks, as these networks are often unencrypted and vulnerable to eavesdropping.

The riskiest component in this system is you, the user! Vigilance and attention to detail are your best defenses against fraud and identity theft.

Conclusion

Understanding your Toyota Financial Services payment options empowers you to manage your loan effectively and avoid unnecessary headaches. By utilizing the online portal, setting up automatic payments, and being aware of potential security risks, you can ensure a smooth and stress-free payment experience. Treat this guide like a maintenance manual for your financial well-being.

We have a detailed diagram outlining the entire Toyota Financial Services payment ecosystem, including data flow and security protocols. Contact us with "TFS Payment Ecosystem Diagram Request" in the subject line, and we'll send you the file for download.