How To Pay Toyota Car Payment

Alright, let's talk about something that's less glamorous than horsepower but absolutely crucial: paying your Toyota car payment. While it doesn't involve wrenches or OBD-II scanners, understanding the process and available options is essential for maintaining your financial health and keeping your ride on the road. Think of this as preventative maintenance for your credit score.

Understanding Your Toyota Financial Services Account

Before diving into payment methods, it's vital to understand your Toyota Financial Services (TFS) account. TFS is the financing arm of Toyota, responsible for managing your loan or lease. Knowing how to access and navigate your account can save you a lot of headaches.

Purpose: Managing your TFS account is crucial for tracking your loan balance, payment history, due dates, and any potential fees. This knowledge empowers you to avoid late payments, plan for payoff, and potentially refinance your loan in the future.

Key Specs and Main Parts of Your TFS Account:

- Account Number: This is your unique identifier for your loan. Keep it handy!

- Loan Balance: The outstanding amount you owe on your vehicle.

- Monthly Payment Amount: The fixed amount due each month.

- Due Date: The date your payment is due. Missing this can trigger late fees and damage your credit.

- Interest Rate (APR): The annual percentage rate you're paying on the loan. This impacts the total cost of your vehicle.

- Payment History: A record of your past payments, crucial for tracking your financial obligations.

- Online Portal/Mobile App: TFS offers a user-friendly online portal and mobile app for managing your account (more on this later).

Symbols and Interpretation: Think of the TFS portal like a diagnostic interface for your finances. Dates represent milestones, amounts represent values, and any overdue notices are like error codes – they demand immediate attention.

How It Works: The TFS Ecosystem

The TFS system is designed for efficient payment processing. Here's a simplified overview:

- Loan Origination: When you purchase your Toyota and finance it through TFS, a loan agreement is created. This agreement outlines the terms of the loan, including the interest rate, payment schedule, and any associated fees.

- Payment Processing: When you make a payment through any approved method (online, mail, phone), the funds are processed and applied to your loan balance.

- Account Updates: The TFS system updates your account with the payment information, reducing your loan balance and updating your payment history.

- Reporting: TFS reports your payment history to credit bureaus, impacting your credit score.

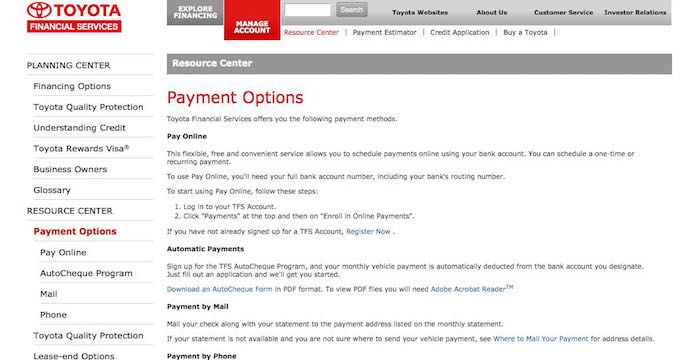

Payment Methods: Your Toolbox for Financial Responsibility

Now, let's explore the various methods available for paying your Toyota car payment. Each has its advantages and disadvantages, so choose the one that best suits your needs and preferences.

1. Online Payment via the TFS Website/App

This is arguably the most convenient and popular method. TFS provides a secure online portal and mobile app for managing your account and making payments.

Pros: Convenience, speed, real-time tracking, ability to set up recurring payments, view payment history.

Cons: Requires internet access, potential security risks if you're not careful about your password and device security.

Steps:

- Register for an account on the TFS website or download the TFS mobile app.

- Link your bank account or debit card to your TFS account.

- Initiate a payment by selecting the amount and date.

- Review the payment details and confirm.

2. Automatic Payment (ACH)

Setting up automatic payments, also known as ACH (Automated Clearing House) transfers, ensures that your payment is made on time every month without you having to manually initiate it. This is highly recommended to avoid late fees and protect your credit score.

Pros: Convenience, avoids late fees, simplifies budgeting.

Cons: Requires sufficient funds in your bank account, can be difficult to cancel immediately if needed.

Steps:

- Log in to your TFS account online or through the app.

- Navigate to the "Payment Options" or "Automatic Payments" section.

- Enter your bank account information (routing number and account number).

- Select the payment date and amount.

- Confirm the automatic payment setup.

3. Mail a Check or Money Order

While less convenient than online options, mailing a check or money order is a reliable method, especially if you prefer traditional methods or have limited access to technology.

Pros: No reliance on internet access, physical record of payment.

Cons: Slower processing time, risk of mail delays, less convenient.

Steps:

- Make the check or money order payable to "Toyota Financial Services."

- Write your TFS account number on the check or money order.

- Mail the payment to the address provided on your billing statement. Important: Use the correct address! Incorrect addresses will cause delays.

4. Pay by Phone

TFS allows you to make payments over the phone, although this method may incur a small processing fee. This is a good option if you need to make a payment quickly and don't have access to the internet.

Pros: Convenient if you lack internet access, immediate confirmation.

Cons: Potential processing fees, longer wait times on the phone.

Steps:

- Call the TFS customer service number (found on your billing statement or the TFS website).

- Follow the prompts to make a payment.

- Provide your account number and payment information.

- Confirm the payment details.

5. Western Union/MoneyGram

These services allow you to send money electronically, which can be useful in emergency situations or if you don't have a bank account. However, they typically charge higher fees than other payment methods.

Pros: Widely available, can be used without a bank account.

Cons: Higher fees, potential for scams if not used carefully.

Steps:

- Visit a Western Union or MoneyGram location.

- Provide your TFS account number and the recipient information (Toyota Financial Services).

- Pay the amount you wish to send, plus any applicable fees.

- Retain the transaction receipt for your records.

Real-World Use: Basic Troubleshooting Tips

Even with the best planning, things can sometimes go wrong. Here are a few common scenarios and how to address them:

- Late Payment: If you miss a payment due date, contact TFS immediately. They may be able to work with you to set up a payment plan or waive late fees, especially if it's a one-time occurrence. A missed payment can hurt your credit.

- Payment Not Reflected: Allow a few business days for your payment to be processed and reflected in your TFS account. If it's not showing after that, contact TFS customer service with proof of payment (e.g., bank statement, money order receipt).

- Incorrect Payment Amount: Double-check your bank statements and TFS account to ensure the correct amount was paid. If there's a discrepancy, contact TFS customer service.

- Account Locked: If you enter your password incorrectly multiple times, your account may be locked. Follow the instructions on the TFS website or app to reset your password.

Safety: Protecting Your Financial Information

When dealing with financial transactions, security is paramount. Here are some essential safety tips:

- Use Strong Passwords: Create strong, unique passwords for your TFS account and other online financial accounts. Avoid using easily guessable information like your birthday or pet's name.

- Beware of Phishing Scams: Be wary of emails or phone calls claiming to be from TFS asking for your personal information. TFS will not typically request sensitive information via email or phone. Always access the TFS website directly by typing the address into your browser.

- Monitor Your Account Regularly: Check your TFS account and bank statements regularly for any unauthorized activity.

- Secure Your Devices: Protect your computer and mobile devices with strong passwords, anti-virus software, and firewalls.

- Shred Documents: Shred any physical documents containing your TFS account information before discarding them.

Conclusion

Paying your Toyota car payment is a fundamental aspect of vehicle ownership. By understanding the available payment methods, utilizing the TFS resources, and practicing safe financial habits, you can ensure a smooth and stress-free payment experience. Remember, proactive management of your finances is just as important as maintaining your vehicle's mechanical components.

We have a detailed payment process diagram available for download. This diagram provides a visual representation of the payment lifecycle, from initiation to reconciliation. It can be a valuable tool for understanding the flow of funds and identifying potential bottlenecks. Contact us and we will provide the file.