How To Trade A Car With A Loan

So, you're thinking about trading in your ride, but there's a slight wrinkle – you still have a loan on it. No sweat! Plenty of folks find themselves in this situation. Trading a car with an existing loan is absolutely doable, but it requires understanding the process, knowing your numbers, and being prepared for a few potential scenarios. This guide will walk you through the ins and outs, giving you the knowledge to navigate this process smoothly. Think of this as your advanced tuning guide for automotive finance!

Purpose of Understanding Loan Payoff and Trade-In Dynamics

Why dive deep into the nitty-gritty of car loans and trade-ins? Well, understanding the mechanics here is crucial for several reasons:

- Avoid Getting Upside Down: This is the big one. Being "upside down" (also known as "underwater") means you owe more on your car than it's worth. Trading in an upside-down car can lead to some tricky financial maneuvers, and understanding the risks is paramount.

- Negotiating Power: Knowledge is power. Knowing your car's actual value, the loan payoff amount, and the potential trade-in offer empowers you to negotiate a better deal at the dealership.

- Informed Decision Making: Trading in isn't always the best option. Sometimes, paying off the loan and selling privately yields a better return. This guide helps you evaluate all possibilities.

- Financial Planning: Understanding how a trade-in impacts your overall financial picture allows you to make responsible decisions and avoid future financial strain.

Key Specs and Main Parts of the Equation

Before you even think about stepping onto a dealership lot, gather this essential information:

- Current Loan Balance: This is the most crucial piece. Contact your lender (bank, credit union, or finance company) and request a 10-day payoff quote. This quote is valid for a limited time and includes any accrued interest. Don't rely on your monthly statement; it likely doesn't reflect the exact payoff amount.

- Car's Market Value: Research your car's value using reputable sources like Kelley Blue Book (KBB), Edmunds, and NADAguides. Get an accurate appraisal by factoring in the car's year, make, model, mileage, condition (excellent, good, fair, poor), and any options or packages. Be honest about the condition; dealerships will scrutinize it.

- Trade-In Value (Estimate): Remember, the trade-in value will likely be lower than the private sale value. Dealerships need to factor in reconditioning costs and profit margins. Get online estimates to get a ballpark figure, but expect some negotiation.

- New Car Price (If Applicable): If you're trading in for a new car, get a clear understanding of the Out-The-Door (OTD) price, which includes the vehicle price, taxes, registration fees, and any other charges.

- Interest Rate (On Existing and Potential Loans): Your interest rate significantly impacts your monthly payments. Know the interest rate on your current loan and shop around for the best rate on your new loan.

Understanding the "Value vs. Debt" Balance

This is where the "rubber meets the road". Compare your car's market value to your loan payoff amount. Here's what the scenarios look like:

- Equity (Good): Your car's value is higher than your loan payoff amount. This means you have positive equity, and you can use the difference to reduce the amount you need to finance on your new car (or pocket the cash if you sell privately).

- Upside Down (Bad): Your car's value is lower than your loan payoff amount. You have negative equity. This means you owe more than the car is worth. This difference is called the "negative equity gap", and this gap must be addressed.

Addressing the Negative Equity Gap

Okay, you're upside down. Don't panic. There are several ways to deal with it:

- Roll the Negative Equity into the New Loan: This is the most common approach, but it's not always the best. The dealership adds the negative equity to the loan amount for your new car. This increases your loan amount, which will result in higher monthly payments and more interest paid over the life of the loan. While this is convenient, be *extremely* careful. Ensure this is within your financial means; otherwise, you are potentially setting yourself up for more debt.

- Pay the Negative Equity Out of Pocket: This is the financially sound option. If you have the funds, paying the difference upfront avoids increasing your new loan amount and long-term interest costs.

- Wait and Pay Down the Loan: If you can afford to, continue making payments on your current loan to reduce the balance and build equity. This will improve your trade-in position down the road.

- Sell Privately: This can sometimes yield a higher selling price than a trade-in, potentially reducing the negative equity gap. However, you'll need to handle the sale process yourself, including advertising, showing the car, and negotiating with potential buyers.

How It Works: The Trade-In Process

Let's break down what happens at the dealership:

- Appraisal: The dealership will thoroughly inspect your car to determine its trade-in value. They'll check the condition of the engine, transmission, tires, brakes, body, interior, and any other relevant components. They'll also run a vehicle history report to check for accidents or damage.

- Negotiation: The dealership will present you with a trade-in offer. This is where your research comes in handy. Negotiate based on your car's market value and the payoff amount of your loan.

- Loan Payoff: If you agree to the trade-in offer, the dealership will contact your lender to pay off your existing loan. They will handle the paperwork and transfer of ownership.

- New Loan (If Applicable): If you're financing a new car, the dealership will work with lenders to secure a new loan. Review the loan terms carefully, including the interest rate, loan term, and monthly payments.

- Paperwork: Sign all the necessary documents, including the trade-in agreement, loan agreement (if applicable), and purchase agreement for the new car.

Real-World Use: Basic Troubleshooting Tips

- Lowball Trade-In Offer: Be prepared to walk away. If the dealership's offer is significantly lower than your research suggests, politely decline and explore other options. Get quotes from multiple dealerships.

- Hidden Fees: Scrutinize the OTD price. Question any unexpected fees or charges. Dealerships sometimes try to sneak in additional costs.

- High-Pressure Sales Tactics: Don't be rushed into a decision. Take your time to review the paperwork and ask questions. A reputable dealership will respect your decision.

- Mismatched Loan Payoff: Verify that the dealership is paying off the correct loan amount with your lender. Keep a copy of the 10-day payoff quote for your records.

Safety: Risky Components and Financial Pitfalls

Navigating a car trade-in with a loan involves some potential risks:

- Rolled-Over Negative Equity: This is perhaps the biggest danger. Rolling negative equity into a new loan increases your debt and can lead to a cycle of owing more than your car is worth. Be very cautious about this.

- High Interest Rates: Make sure to shop around and get pre-approved for a loan before you visit the dealership. Dealerships may try to offer you a higher interest rate than you qualify for.

- Extended Loan Terms: Longer loan terms result in lower monthly payments, but you'll pay significantly more in interest over the life of the loan. Avoid extending the loan term unnecessarily.

- Sales Tax Implications: Understand how sales tax is calculated on a trade-in. In some states, you only pay sales tax on the difference between the new car's price and the trade-in value. However, in other states, you pay sales tax on the full price of the new car.

Trading in a car with a loan requires careful planning and attention to detail. By understanding the process, knowing your numbers, and being aware of the potential risks, you can make informed decisions and navigate the trade-in process successfully.

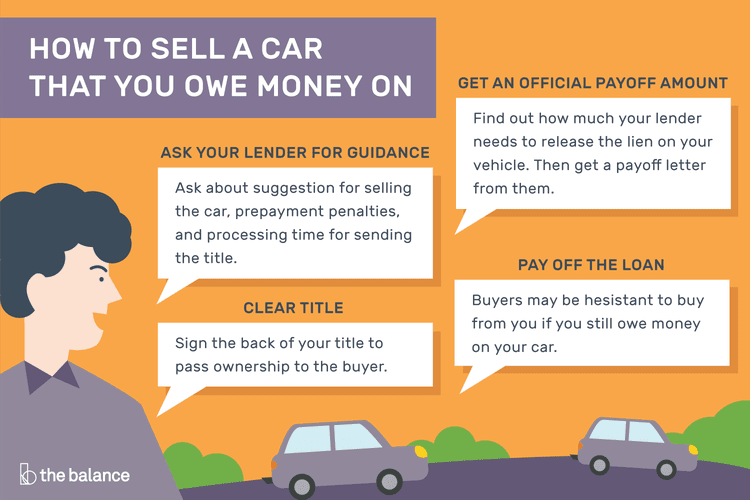

We have a detailed diagram outlining this process available for download. This visual aid breaks down each step and helps you understand the flow of funds and documentation. Contact us to obtain a copy.