How To Use My Gap Insurance

Let's talk about something most car owners hope they never have to use: GAP insurance. Think of this article as your pre-emptive strike against financial headaches if the worst should happen to your ride. We're going to dissect how it works, why it matters, and how to navigate the process of using it, should the need arise. This isn't your average insurance brochure; we're getting into the nitty-gritty, assuming you're comfortable turning a wrench and understanding technical concepts.

Purpose of Understanding GAP Insurance

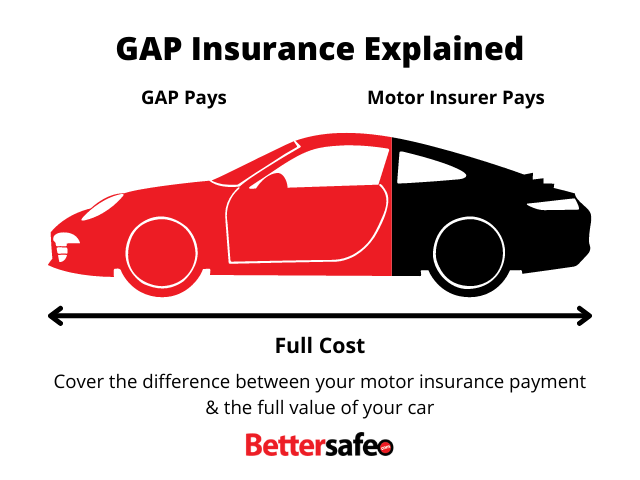

Understanding GAP insurance, like understanding a complex wiring diagram, is crucial for a few key reasons. Primarily, it's about financial security. In the unfortunate event of a total loss (accident, theft, natural disaster), your primary auto insurance will only pay out the actual cash value (ACV) of your vehicle at the time of the incident. The ACV is determined by factors like age, mileage, condition, and prevailing market values. If you owe more on your car loan than the ACV, you're stuck paying the difference – the "gap." GAP insurance is designed to cover this difference, preventing you from having to pay for a car you can no longer drive.

Beyond financial security, understanding the process empowers you to make informed decisions. You can better assess if you need GAP insurance in the first place (especially if you made a small down payment, have a long loan term, or drive a vehicle that depreciates quickly), and you'll be better equipped to navigate the claims process if necessary. Knowing your policy's terms and conditions is as important as knowing the torque specs for your lug nuts.

Key Specs and Main Parts of a GAP Insurance Policy

A GAP insurance policy, at its core, is a relatively straightforward agreement. However, understanding its components is key.

Here's a breakdown of the main parts:

- Coverage Amount/Limit: This is the maximum amount the GAP insurance will pay out. It's typically capped at a percentage of the vehicle's original MSRP (Manufacturer's Suggested Retail Price) or loan amount. For example, a policy might state a maximum payout of 25% of the original MSRP.

- Eligible Vehicles: GAP insurance isn't available for all vehicles. Some policies may exclude certain makes, models, or types of vehicles (e.g., high-end sports cars, commercial vehicles).

- Deductible (if any): Some GAP policies have a deductible, meaning you'll have to pay a certain amount out-of-pocket before the GAP insurance kicks in.

- Exclusions: These are the situations in which the GAP insurance will not pay out. Common exclusions include:

- Past-due payments on your loan: GAP insurance won't cover the gap if you were behind on your car payments at the time of the loss.

- Negative equity rolled over from a previous loan: If you rolled negative equity (the amount you owed on your previous car loan that exceeded its value) into your current loan, the GAP insurance might not cover that portion.

- Modifications and Add-ons: Typically, aftermarket modifications (performance upgrades, custom paint jobs) aren't covered by GAP insurance.

- Refundable portions of extended warranties or service contracts: These are usually handled separately.

- Premium: This is the cost of the GAP insurance policy, typically paid upfront as a one-time fee or rolled into your monthly car payment.

- Terms and Conditions: This is the fine print. Read it carefully. It outlines all the details of the policy, including your rights and responsibilities.

"Symbols" - Understanding Policy Jargon

Like any specialized field, insurance has its own unique jargon. Understanding this "symbol set" is crucial for deciphering your policy.

Here are some common terms you'll encounter:

- ACV (Actual Cash Value): The fair market value of your vehicle at the time of the loss, determined by factors like age, mileage, and condition.

- MSRP (Manufacturer's Suggested Retail Price): The original sticker price of the vehicle when it was new.

- Loan Balance: The outstanding amount you owe on your car loan.

- Total Loss: A situation where the vehicle is deemed unrepairable or the cost of repairs exceeds a certain percentage (typically 70-80%) of its ACV.

- Claim: A formal request for payment under the terms of your insurance policy.

- Underwriter: The insurance company that is assuming the risk and issuing the policy.

The "lines" in this analogy are the relationships between these terms. The "colors" are the different types of coverage and exclusions. The "icons" are the specific clauses and conditions within the policy.

How GAP Insurance Works

The process of using GAP insurance can be broken down into a few key steps:

- The Total Loss Event: Your vehicle is declared a total loss by your primary auto insurance company.

- Primary Insurance Payout: Your primary auto insurance company pays out the ACV of your vehicle.

- Calculate the Gap: This is the difference between your loan balance (including any applicable early payoff penalties) and the ACV payout from your primary insurance. This is where the GAP insurance steps in.

- File a GAP Insurance Claim: You'll need to file a claim with your GAP insurance provider. This typically involves providing documentation such as:

- A copy of your primary auto insurance settlement.

- A copy of your car loan agreement.

- A payoff statement from your lender.

- A copy of your GAP insurance policy.

- GAP Insurance Payout: The GAP insurance company will review your claim and, if approved, pay the difference between your loan balance and the ACV payout, up to the policy's coverage limit.

- Remaining Balance (if any): If the gap exceeds the GAP insurance policy's coverage limit, you'll still be responsible for paying the remaining balance on your loan.

Real-World Use - Basic Troubleshooting Tips

Let's get practical. Here are some troubleshooting tips for navigating the GAP insurance process:

- Know Your Policy: This is paramount. Don't wait until you need it to understand what your policy covers and excludes.

- Document Everything: Keep meticulous records of all communication with your insurance companies and lender. Save copies of all documents related to the claim.

- Negotiate with Your Primary Insurer: The ACV offered by your primary insurance company might be negotiable. Research comparable vehicles in your area to support your case for a higher payout. A few hundred dollars more from your primary insurance can significantly reduce the gap.

- Understand the Timeline: GAP insurance claims can take time to process. Be patient, but persistent. Follow up regularly with your insurance company to check on the status of your claim.

- Appeal Denied Claims: If your GAP insurance claim is denied, don't give up immediately. Review the reason for the denial and determine if you have grounds for an appeal. Provide additional documentation or clarification if necessary.

- Seek Professional Help: If you're struggling to navigate the claims process, consider seeking help from a consumer protection agency or an attorney specializing in insurance claims.

Safety - Risky Components

While GAP insurance itself isn't physically dangerous, there are "risky components" in the process that require careful attention.

- Over-Reliance: Don't assume GAP insurance is a magical shield. It won't cover everything. Be aware of the policy's limitations and exclusions.

- High-Pressure Sales Tactics: Be wary of dealerships that aggressively push GAP insurance, especially if you're already making a large down payment or have a short loan term. Assess your needs carefully.

- Misunderstanding the Fine Print: The terms and conditions of the policy are crucial. Failing to understand them can lead to unexpected claim denials.

- Fraudulent Claims: Attempting to file a fraudulent GAP insurance claim is a serious offense and can have severe legal consequences.

Ultimately, GAP insurance is a safety net. Understanding how it works allows you to make informed decisions and protect yourself from significant financial losses in the event of a total loss. It's another tool in your arsenal as a responsible and knowledgeable car owner.

We have a sample GAP insurance policy diagram available for download. This diagram visually represents the flow of funds and the key players involved in a GAP insurance claim. Download it, study it, and keep it handy – you might need it someday.