What All Does Gap Insurance Cover

Let's talk GAP insurance. You've probably heard the term thrown around when buying a car, especially if you financed it. But what *exactly* does it cover? Understanding this is crucial, especially for us DIY-minded folks who like to understand the nuts and bolts of everything, from engine mechanics to financial protection.

Purpose of Understanding GAP Coverage

Think of GAP insurance knowledge as a diagnostic tool in your financial toolkit. Just as you need to understand a car's wiring diagram to troubleshoot electrical issues, you need to understand GAP insurance to navigate the potentially tricky situation of a total loss. This knowledge is vital when:

- Financing a vehicle: Knowing what GAP covers helps you make informed decisions about your loan and insurance options.

- Experiencing a total loss: It clarifies what you can expect from your insurance company and whether GAP insurance will bridge the financial gap.

- Negotiating with insurance companies: Armed with knowledge, you can better advocate for your rights and ensure a fair settlement.

Ultimately, understanding GAP coverage allows you to protect yourself financially in the event of a worst-case scenario, preventing you from being stuck with a significant debt on a car you can no longer drive.

Key Specs and Main Parts of GAP Insurance

GAP, or Guaranteed Asset Protection, insurance isn't about fixing your car after an accident. It's about protecting you financially when your vehicle is declared a total loss – meaning the cost to repair it exceeds its market value, as determined by your primary auto insurance policy. Here's a breakdown:

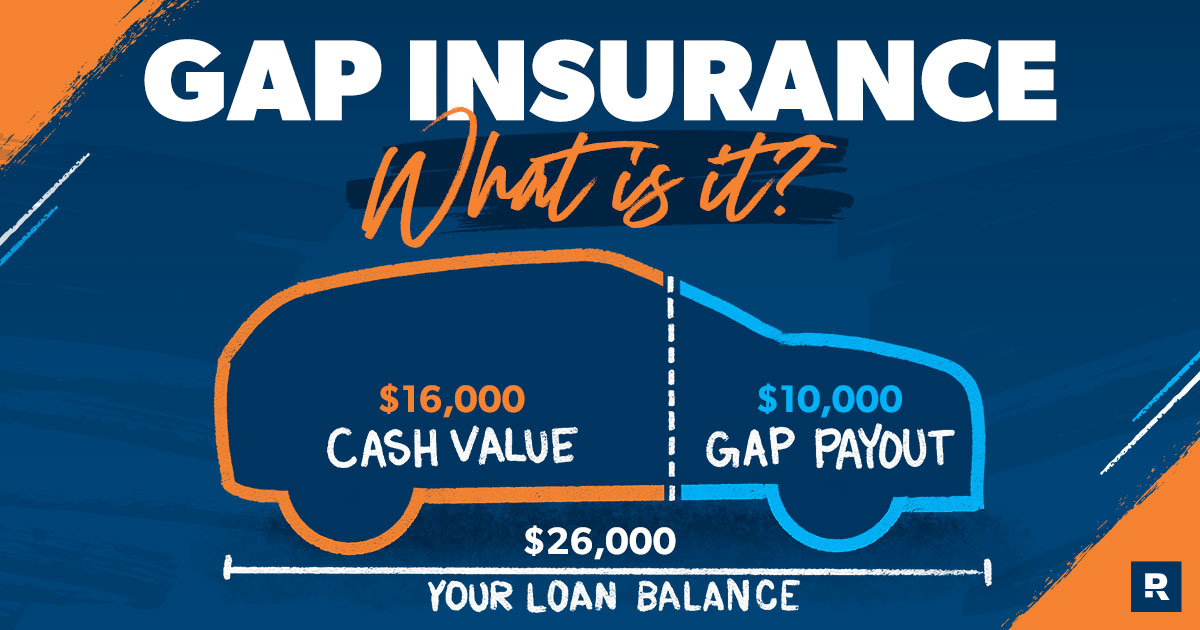

- The "Gap": This is the difference between what you owe on your car loan and what your primary insurance company determines the car is worth at the time of the total loss. This difference can be substantial, especially in the early years of a loan due to depreciation.

- Total Loss: A total loss is declared when the cost to repair the vehicle exceeds a certain percentage of its Actual Cash Value (ACV). This percentage varies by state and insurance company.

- Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of the accident, taking into account depreciation. Factors include the car's age, mileage, condition, and comparable sales in your area.

- Loan/Lease Balance: This is the outstanding amount you owe on your car loan or lease agreement.

- Deductible: GAP insurance *typically* covers your primary auto insurance deductible, up to a certain limit. Check your specific policy.

- Maximum Coverage Amount: GAP policies have a maximum coverage amount, typically ranging from $50,000 to $80,000. This is the most the policy will pay out, regardless of the size of the gap.

It's crucial to understand that GAP insurance doesn't cover everything. Let's look at what it *doesn't* cover.

What GAP Insurance Does *Not* Cover

This is just as important as knowing what it *does* cover:

- Vehicle Repairs: GAP insurance isn't collision or comprehensive coverage. It doesn't pay to fix your car. That's what your regular auto insurance is for.

- Injuries or Property Damage to Others: This is covered by your liability insurance.

- Vehicle Modifications or Add-ons: Generally, aftermarket parts and modifications are not covered by GAP insurance. If you've invested heavily in performance upgrades or custom modifications, you'll want to discuss additional coverage options with your insurance provider. Consider a stated value policy or additional equipment coverage.

- Loan Default: GAP insurance doesn't cover your loan if you simply can't make payments.

- Carry-Over Balances from Previous Loans: If you rolled over negative equity from a previous car loan into your current loan, GAP insurance usually doesn't cover that portion.

- Security Deposits: If you lease a vehicle, GAP insurance usually doesn't cover your initial security deposit.

- Extended Warranties: Usually, GAP does not cover extended warranties that you may have purchased at the time of financing the vehicle.

How It Works

Here's a simplified step-by-step explanation:

- Total Loss: Your vehicle is deemed a total loss due to an accident, theft, or other covered event.

- Primary Insurance Settlement: Your primary auto insurance company pays out the Actual Cash Value (ACV) of your vehicle, minus your deductible.

- The "Gap" Calculation: The lender or GAP insurance provider calculates the difference between your loan balance and the ACV payout from your primary insurance. Let's say your loan balance is $20,000, and your primary insurance pays out $15,000. The gap is $5,000.

- GAP Insurance Payout: Your GAP insurance policy covers the $5,000 gap, potentially plus your primary insurance deductible (depending on the policy).

- Loan Closure: The GAP insurance provider pays the lender the remaining balance, effectively closing out your car loan.

It's vital to remember that the process involves multiple parties (you, your primary insurance, the lender, and the GAP insurance provider). Communication is key to a smooth claim process.

Real-World Use – Basic Troubleshooting Tips

While you can't directly "fix" GAP insurance, here are some troubleshooting tips to ensure you're covered and understand the process:

- Review Your Policy: Carefully read your GAP insurance policy. Understand the terms, conditions, exclusions, and coverage limits. Know your deductible coverage, if any.

- Keep Records: Maintain copies of your loan agreement, insurance policies, and any documentation related to your vehicle's value (e.g., appraisals, sales receipts for aftermarket parts).

- Communicate with All Parties: Keep open communication with your primary insurance company, lender, and GAP insurance provider. Provide all requested documentation promptly.

- Dispute Valuation: If you disagree with the ACV determined by your primary insurance company, you have the right to challenge it. Provide evidence to support your claim, such as comparable sales listings or expert appraisals.

- Understand Reimbursement: Some GAP policies reimburse you *after* you've paid off the remaining loan balance. Know how your policy handles payment.

Example Scenario: You totaled your lifted truck with aftermarket wheels and tires. Your primary insurance only covers the stock value. GAP insurance *won't* cover the aftermarket parts. You'll likely have to negotiate with your primary insurance for those separately, or potentially pursue a separate claim if you had additional coverage for those modifications.

Safety Considerations

GAP insurance itself doesn't pose any physical safety risks, but it's important to be aware of potential financial pitfalls:

- Overlapping Coverage: Don't purchase GAP insurance if your loan-to-value ratio is low. If you've made a large down payment or your car has significantly depreciated, the "gap" may be minimal, rendering GAP insurance unnecessary.

- High Interest Rates: Some dealerships might try to bundle GAP insurance with loans that have high interest rates. Compare rates from different lenders to avoid overpaying.

- Reputable Providers: Purchase GAP insurance from a reputable provider. Research the company's reputation and financial stability before signing up.

Ultimately, GAP insurance is a safety net, but it shouldn't lull you into a false sense of security. Drive safely, maintain your vehicle, and understand your insurance coverage.

We have a detailed diagram illustrating the flow of a GAP insurance claim process available for download. This diagram visually represents the steps involved, from the total loss event to the final loan closure. Download it now to get a clearer picture of how GAP insurance works in practice.