What Do I Need To Get A Car Loan

Alright, gearheads, let's talk about something that powers almost every automotive adventure: financing. Specifically, what you need to get a car loan. Forget horsepower for a minute; understanding this process is about unlocking your ability to actually *get* that sweet ride you've been eyeing. Think of this as diagnosing the financial engine that gets you rolling. We're not just talking about a simple checklist; we're diving into the nitty-gritty so you understand *why* each component is crucial, just like you would when tearing down an engine.

Why This Matters: Understanding Your Financial Engine

Just like a well-tuned engine performs better and lasts longer, a solid understanding of car loan requirements helps you secure better terms, avoid pitfalls, and ultimately drive away happy. This isn't just about getting approved; it's about getting approved smartly. Knowing the process empowers you to negotiate effectively, compare offers accurately, and avoid predatory lending practices. Understanding this process allows you to make informed decisions, just as you would consult wiring diagrams before tackling an electrical modification.

Key "Specs" and Main "Parts" of a Car Loan Application

Think of these as the core components that lenders use to assess your "financial vehicle":

1. Credit Score: The Engine's Diagnostic Code

Your credit score is a numerical representation of your creditworthiness. It's like the engine's diagnostic trouble code – a quick indicator of potential problems. Lenders use it to gauge the risk of lending you money. A higher score (typically 700 or above) signals a lower risk, leading to better interest rates and loan terms. Major credit reporting agencies include Equifax, Experian, and TransUnion. FICO and VantageScore are common scoring models.

Tech Talk: Credit scores are calculated using various factors, including payment history (the most significant), amounts owed, length of credit history, credit mix, and new credit. Missing payments or carrying high balances drastically lowers your score.

2. Credit History: The Maintenance Log

Your credit history is a detailed record of your borrowing and repayment behavior. It's like the car's maintenance log – documenting how well you've maintained your financial obligations. Lenders scrutinize this to see how you've handled credit in the past. A positive history with timely payments strengthens your application, while defaults, bankruptcies, and late payments raise red flags.

3. Income: The Fuel Injector

Your income is the fuel that keeps your financial vehicle running. Lenders need to see that you have a stable and sufficient income to comfortably repay the loan. They'll typically ask for pay stubs, W-2 forms, or tax returns as proof. The amount of income needed depends on the loan amount, interest rate, and loan term. Lenders often calculate a debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income. A lower DTI is generally favorable.

Tech Talk: Lenders prefer a DTI below 43%. To calculate your DTI, add up all your monthly debt payments (including the estimated car loan payment) and divide that by your gross monthly income.

4. Down Payment: The Jump Start

A down payment is the initial amount of money you put towards the purchase of the car. It's like a jump start – demonstrating your commitment and reducing the amount you need to borrow. A larger down payment lowers the loan amount, potentially resulting in lower monthly payments and interest rates. It also reduces the lender's risk, making them more likely to approve your application.

5. Vehicle Information: The Engine Specs

The lender needs information about the car you're planning to buy. This includes the make, model, year, and Vehicle Identification Number (VIN). They'll use this information to assess the car's value and determine the loan-to-value (LTV) ratio. The loan-to-value (LTV) ratio compares the loan amount to the car's value. A lower LTV is preferred because it reduces the lender's risk if you default on the loan.

6. Collateral: The Vehicle Itself

The vehicle itself serves as collateral for the loan. If you fail to repay the loan, the lender can repossess the car. The value of the collateral is a crucial factor in the lender's decision. They'll assess the car's condition and market value to determine its worth.

How It Works: The Loan Application Process

The process typically involves these steps:

- Pre-Approval: Get pre-approved for a loan to understand how much you can borrow and at what interest rate. This gives you a budget to work with and strengthens your negotiating position at the dealership.

- Application: Complete the loan application, providing all the required information.

- Underwriting: The lender reviews your application, credit history, income, and the vehicle information.

- Approval: If approved, the lender provides you with a loan offer outlining the terms and conditions.

- Closing: Review the loan documents carefully, sign them, and finalize the loan.

Real-World Use: Troubleshooting Your Loan Application

Just like troubleshooting a car problem, pinpointing the issue with your loan application can save you time and money.

- Low Credit Score: Work on improving your credit score before applying for a loan. Pay bills on time, reduce debt, and avoid opening new credit accounts.

- High DTI: Reduce your existing debt or increase your income to lower your DTI.

- Insufficient Down Payment: Save up a larger down payment to reduce the loan amount and increase your chances of approval.

- Negative Equity: If you're trading in a car with negative equity (meaning you owe more than it's worth), factor that into the new loan. Consider paying off the negative equity separately to improve your chances.

Safety: Avoiding Predatory Lending Practices

Just like working on your car requires safety precautions, securing a car loan requires vigilance.

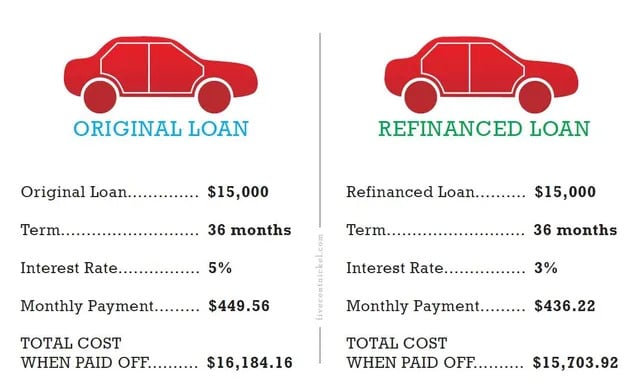

- High Interest Rates: Be wary of lenders offering excessively high interest rates, especially if you have a low credit score. Shop around and compare offers from multiple lenders.

- Hidden Fees: Carefully review the loan documents to identify any hidden fees or charges. Question anything you don't understand.

- Prepayment Penalties: Check for prepayment penalties, which are fees charged if you pay off the loan early.

- Loan Packing: Avoid lenders who try to "pack" the loan with unnecessary products or services, such as extended warranties or credit insurance.

Safety Tip: Never sign a loan agreement without carefully reading and understanding all the terms and conditions. If you're unsure about anything, seek advice from a trusted financial advisor.

Securing a car loan can seem daunting, but with a solid understanding of the requirements and a proactive approach, you can navigate the process confidently and drive away in the car of your dreams. Remember, just like maintaining your car, maintaining your financial health is crucial for long-term success.