What Do You Need To Get Car Loan

So, you're thinking about getting a car loan? Whether you're upgrading your ride, finally ditching that beater, or starting a new project build, understanding the loan application process is just as crucial as knowing how to wrench on your engine. This article will break down the key ingredients lenders look for, so you can approach the process with confidence and secure the best possible terms. Think of it as your car loan blueprint – knowledge is power, and knowing what to expect will give you a serious edge.

The Foundation: Credit Score & Credit History

Just like the engine block is the foundation of your car, your credit score is the bedrock of your loan application. It's a three-digit number that summarizes your creditworthiness, reflecting how reliably you've repaid past debts. In the US, credit scores generally range from 300 to 850, with higher scores indicating lower risk to lenders. A good credit score significantly improves your chances of approval and unlocks lower interest rates.

Key Specs: What's a "Good" Credit Score?

While the exact cutoff points can vary by lender, here's a general guideline:

- Excellent: 750+ - Expect the best interest rates and terms.

- Good: 700-749 - Still considered a solid score, leading to favorable terms.

- Fair: 650-699 - Approval is possible, but interest rates will likely be higher.

- Poor: 550-649 - Securing a loan will be more challenging, and expect significantly higher interest rates.

- Very Poor: Below 550 - Loan approval is unlikely without a significant down payment or co-signer.

Credit history is the detailed record of your borrowing and repayment behavior that informs your credit score. It includes information like open accounts, payment history, credit utilization (the amount of credit you're using compared to your total available credit), and any negative marks like late payments, collections, or bankruptcies.

Symbols & "Lines": Understanding Your Credit Report

Think of your credit report as a detailed schematic of your financial past. The "lines" represent your credit accounts, showing when they were opened, the credit limit (or loan amount), the current balance, and your payment history. Different credit bureaus (Experian, Equifax, TransUnion) may use slightly different formats, but the core information is the same.

- Positive Symbols (Green Flags): Consistent on-time payments, low credit utilization, a mix of credit types (credit cards, loans).

- Negative Symbols (Red Flags): Late payments, high credit utilization, defaults, collections, bankruptcies, frequent credit inquiries.

Income & Employment: Showing You Can Pay

Lenders need assurance that you have the ability to repay the loan. This is where your income and employment history come into play. They want to see a stable source of income that's sufficient to cover your monthly loan payments, along with your other financial obligations.

Key Specs: Debt-to-Income Ratio (DTI)

DTI is a crucial metric lenders use. It's calculated by dividing your total monthly debt payments (including the potential car loan payment) by your gross monthly income (before taxes). A lower DTI indicates you have more disposable income and are less likely to struggle with repayments.

Formula: DTI = (Total Monthly Debt Payments / Gross Monthly Income) * 100

Ideally, lenders prefer a DTI below 43%. However, some lenders may accept higher DTIs depending on your credit score and other factors.

How It Works: Verifying Income and Employment

Lenders will typically require documentation to verify your income and employment. This may include:

- Pay stubs: Usually covering the past 30-60 days.

- W-2 forms: From the previous two years.

- Tax returns: For self-employed individuals or those with complex income situations.

- Bank statements: To verify direct deposits and consistent income.

- Proof of employment: A letter from your employer confirming your position, salary, and tenure.

The Vehicle: Collateral for the Loan

The car itself acts as collateral for the loan. If you fail to make your payments, the lender has the right to repossess the vehicle to recover their losses. Therefore, the car's value plays a significant role in the loan approval process.

Key Specs: Loan-to-Value Ratio (LTV)

LTV compares the loan amount to the car's value. It's calculated by dividing the loan amount by the car's value. A lower LTV is generally preferred by lenders, as it means they have more security in the event of default.

Formula: LTV = (Loan Amount / Car's Value) * 100

The car's value is typically determined using resources like Kelley Blue Book (KBB) or NADAguides. Lenders may also conduct their own appraisals to assess the vehicle's condition and market value.

How It Works: Appraisal and Inspection

For used cars, lenders may require an independent inspection to ensure the vehicle is in good condition and doesn't have any hidden mechanical issues that could affect its value. This is especially important if you're financing a project car that's undergone modifications.

Down Payment & Other Considerations

A down payment is the upfront cash you contribute towards the purchase of the car. It reduces the loan amount, lowers your monthly payments, and can potentially help you secure a lower interest rate. A larger down payment also decreases the LTV, making you a less risky borrower.

Key Specs: How Much Should You Put Down?

While the ideal down payment amount varies depending on your financial situation and the car's price, a general guideline is to aim for at least 10-20% of the vehicle's value. However, even a smaller down payment can be beneficial.

Other factors lenders consider include:

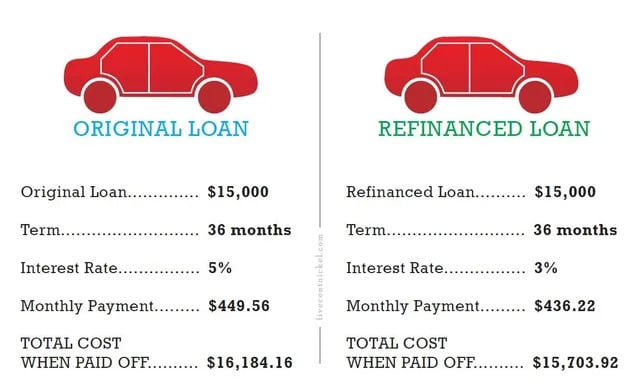

- Loan term: The length of time you have to repay the loan. Shorter terms typically result in higher monthly payments but lower overall interest costs.

- Interest rate: The cost of borrowing money, expressed as a percentage. Shop around for the best rates!

- Fees: Origination fees, application fees, prepayment penalties. Understand all the associated costs before committing to a loan.

Real-World Use: Troubleshooting Your Loan Application

Facing a loan denial? Don't despair! Here's some basic troubleshooting:

- Check your credit report: Identify any errors or inaccuracies and dispute them with the credit bureaus.

- Improve your credit score: Pay down debt, make on-time payments, and avoid opening new credit accounts unnecessarily.

- Increase your down payment: This can offset a lower credit score or a higher DTI.

- Find a co-signer: A co-signer with good credit can improve your chances of approval.

- Shop around: Don't settle for the first offer you receive. Compare rates and terms from multiple lenders.

Safety: Avoiding Predatory Lending

Be cautious of lenders who offer guaranteed approval, high-pressure sales tactics, or excessively high interest rates. These could be signs of predatory lending practices. Always read the fine print carefully and ensure you fully understand the terms of the loan before signing anything.

By understanding these key factors, you'll be well-equipped to navigate the car loan application process successfully. We have a detailed car loan application diagram that visually summarizes all of these factors. This will help you to better understand the interactions between these factors and prepare you to be approved for a loan. You can download the diagram by clicking [link to diagram]. Good luck and happy wrenching!