What Does Car Gap Insurance Cover

Okay, so you're looking into GAP insurance, huh? Good on you for being proactive. It's one of those things that can seem a bit confusing, but understanding what it actually covers can save you a boatload of cash if things go south. Think of this as a preventative maintenance check-up for your finances, specifically regarding your vehicle.

What is GAP Insurance?

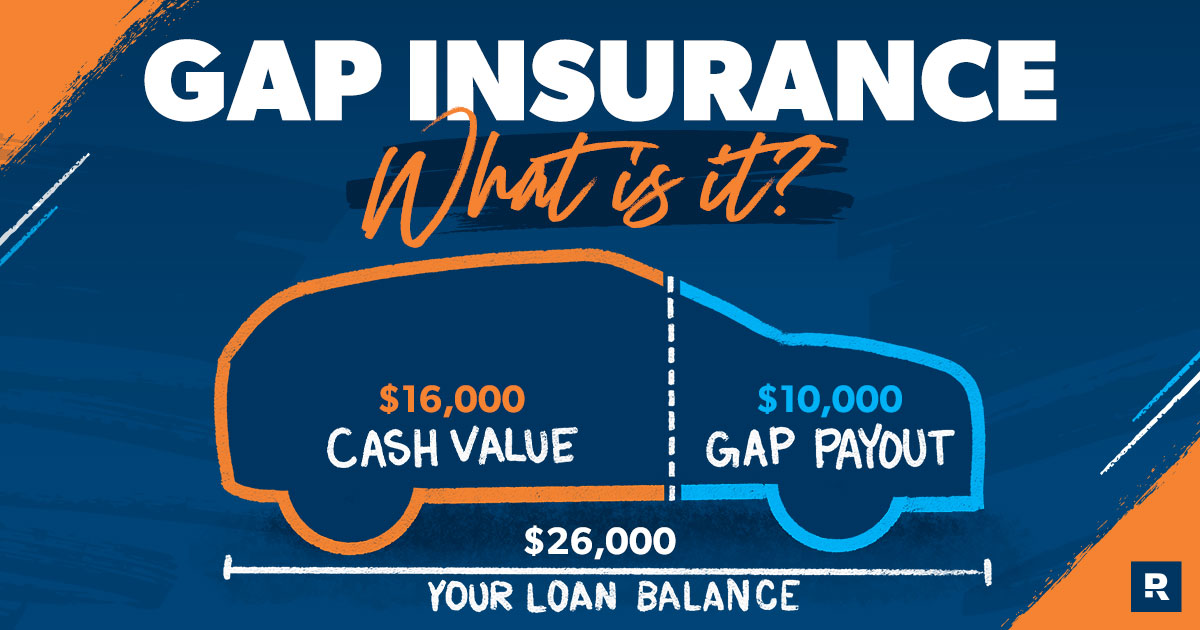

Before we dive into the specifics of what GAP insurance covers, let's define the acronym. GAP stands for Guaranteed Asset Protection. It's a type of auto insurance that covers the "gap" between what you owe on your car loan and what your insurance company pays out if your car is totaled or stolen and not recovered. This is crucial because vehicles depreciate quickly, especially in the first few years. This depreciation can create a significant difference between the car's actual cash value (ACV) and the outstanding loan balance.

Imagine this: You buy a new pickup truck for $50,000, financing the entire amount. Two years later, you're involved in an accident and the insurance company declares your truck a total loss. They assess the actual cash value (ACV) at $35,000. You still owe $40,000 on your loan. That's a $5,000 gap! Without GAP insurance, you'd be on the hook for that $5,000. That’s where GAP insurance steps in.

Key Specs and Main Coverage Areas

GAP insurance typically covers the difference between your loan balance and the ACV, up to a certain limit (more on that later). Here are the main things it covers:

- Total Loss Due to Accident: If your vehicle is deemed a total loss after a collision, GAP insurance pays the difference.

- Total Loss Due to Theft: If your vehicle is stolen and not recovered, GAP insurance covers the gap.

- Specific Loan Amounts: Most GAP policies have limits on the maximum amount they will pay out. It's usually a capped amount, for example, up to $50,000 of coverage. Make sure this limit is sufficient for your loan balance and the vehicle’s potential depreciation.

- Deductible Coverage: Some, but not all, GAP policies might even cover your primary insurance deductible, reducing your out-of-pocket expenses even further. Read the fine print carefully!

Here's what it usually DOESN'T cover:

- Mechanical Failures: GAP insurance isn't a substitute for a warranty. It doesn't cover engine issues, transmission problems, or other mechanical breakdowns.

- Normal Wear and Tear: Scratches, dents, worn tires – GAP insurance doesn't cover these.

- Injuries or Property Damage: GAP insurance only covers the financial gap on the vehicle loan. It doesn't cover injuries or damage to other property in an accident. That's what your liability and comprehensive/collision coverage is for.

- Loan Default: If you simply stop making payments on your loan, GAP insurance won't bail you out. It only applies when the vehicle is a total loss or stolen.

- Negative Equity Rolled Over From a Previous Loan: If you rolled negative equity from a previous car loan into your current loan, some GAP policies may not cover that portion.

- Modifications or Upgrades: Aftermarket modifications or upgrades like a new sound system or performance parts are generally not covered. The ACV is based on the vehicle's original factory specifications. This is especially important for those in the modding community.

How It Works

The process for using GAP insurance is generally as follows:

- Accident or Theft: Your vehicle is involved in an accident or is stolen.

- Insurance Claim: You file a claim with your primary auto insurance company.

- Total Loss Determination: Your primary insurance company determines the vehicle is a total loss and calculates the ACV.

- GAP Insurance Claim: You file a claim with your GAP insurance provider, providing them with your primary insurance settlement information, loan documentation, and any other required paperwork.

- GAP Coverage Payment: The GAP insurance provider pays the difference between your loan balance (minus any refunds you receive, such as from extended warranties) and the ACV paid by your primary insurance company, up to the policy limits. The payment is usually made directly to the lender.

Important Note: GAP insurance is secondary to your primary auto insurance. You must have comprehensive and collision coverage for GAP insurance to be effective. It only covers the gap after your primary insurance has paid out.

Real-World Use – Basic Considerations

Here are some things to consider when deciding if you need GAP insurance:

- Down Payment: A larger down payment reduces the likelihood of a gap between your loan balance and the vehicle's value. If you put down a significant amount, you might not need GAP insurance.

- Loan Term: Longer loan terms mean slower equity build-up and higher interest costs, increasing the risk of owing more than the car is worth. GAP insurance is often a good idea with long-term loans.

- Vehicle Depreciation: Some vehicles depreciate faster than others. Check the projected depreciation rates for your specific make and model. Vehicles with rapid depreciation, like certain luxury cars, are better candidates for GAP insurance.

- Rolled-Over Negative Equity: As mentioned before, if you rolled over negative equity from a previous loan, GAP insurance becomes even more critical.

- Leasing: GAP insurance is almost always included in a lease agreement because the vehicle is owned by the leasing company, not you.

Troubleshooting Tip: Before purchasing GAP insurance, get a quote for the vehicle's ACV after one or two years. Compare this to your loan amortization schedule. This will give you a good idea of your potential gap and help you decide if GAP insurance is worth the cost.

Safety Considerations

There aren't really any "risky components" in the traditional safety sense when it comes to GAP insurance. However, there are a few things to be wary of:

- Understanding Policy Limits: Carefully review the GAP insurance policy limits. Make sure the maximum payout is sufficient to cover your potential gap.

- Exclusions: Be aware of any exclusions in the policy. Don't assume it covers everything.

- Price: Shop around and compare prices from different providers. GAP insurance can be purchased from dealerships, lenders, or insurance companies. The prices can vary significantly. Don't be pressured into buying an overpriced policy from the dealership.

- Cancellation: If you pay off your loan early or refinance, you may be able to cancel your GAP insurance policy and receive a prorated refund. Check your policy terms.

Final Thoughts

GAP insurance is a financial safety net that can protect you from owing money on a car you can no longer drive. It's particularly beneficial for those who make small down payments, finance for long terms, or purchase vehicles that depreciate rapidly. Weigh the costs and benefits carefully based on your individual circumstances. It's an important part of the total cost of ownership.

Consider GAP insurance as a safeguard against financial loss. It doesn't make your car faster or handle better, but it can save you from a financial headache down the road. If you finance your car, it is something to consider.

We have access to a detailed policy comparison chart that outlines different GAP insurance offerings and their specific terms. Feel free to ask, and we can make that available for download.