What Does Gap Insurance Stand For

You know your way around an engine bay, can change your oil blindfolded, and maybe even dabble in some light performance modifications. But have you ever thought deeply about the financial safety net that can protect you if your pride and joy is totaled? I'm talking about Gap Insurance. Let's dive into what it really stands for, how it works, and why it's a crucial consideration for any car owner, especially those with newer vehicles or those who have financed their purchase.

What Does "Gap" Stand For?

The "Gap" in Gap Insurance stands for Guaranteed Asset Protection. This deceptively simple acronym represents a powerful layer of financial security. To understand why it's necessary, let's look at the typical scenario of car ownership and depreciation.

When you drive a new car off the lot, it immediately begins to depreciate. Depreciation is the loss of value an asset experiences over time due to wear and tear, market conditions, and technological obsolescence. In the automotive world, this depreciation curve is often steepest in the first few years of ownership.

Now, consider this: you take out a loan to purchase your vehicle. This loan covers the purchase price, plus interest and potentially other fees. Over time, you make payments, gradually reducing the amount you owe (the loan balance). However, due to depreciation, the actual cash value (ACV) of your car, the amount an insurance company would pay if it's totaled or stolen, may decrease faster than your loan balance.

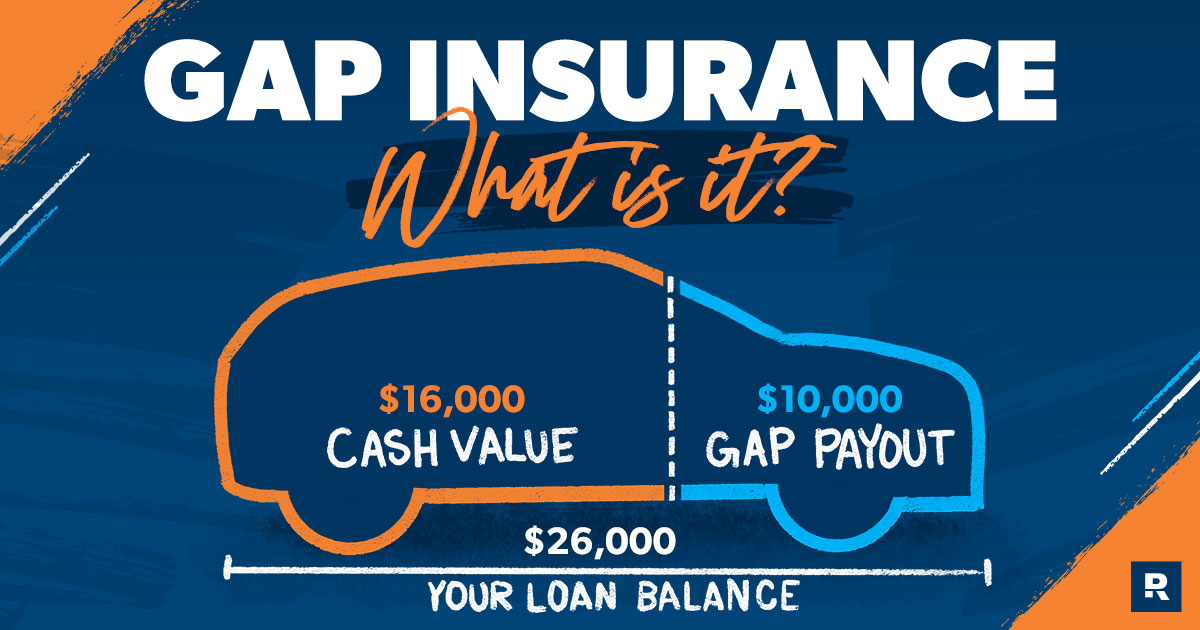

This is where the "gap" appears. If your car is totaled, your standard auto insurance policy will only pay out the ACV of the vehicle at the time of the incident. If the ACV is less than your outstanding loan balance, you're stuck paying the difference. That "gap" between what you owe and what the insurance pays is what Gap Insurance is designed to cover.

Purpose – Why Understand Gap Insurance?

Understanding Gap Insurance isn't about repairs in the traditional sense, but it's critically important for financial planning and risk management related to your vehicle. The purpose is to avoid a potentially devastating financial blow should your vehicle be totaled or stolen, especially if you have a loan or lease. This understanding empowers you to make informed decisions about protecting yourself and your assets. It's like understanding torque specs before bolting on a new turbocharger – preventing a catastrophic failure down the line.

Key Specs and Main Components

While Gap Insurance doesn't have physical components like a car engine, understanding its key aspects is essential. Here are the main elements:

- Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of loss. It's what your primary auto insurance policy will pay out.

- Loan/Lease Balance: The amount you still owe on your car loan or lease.

- Gap Coverage Amount: The maximum amount that the Gap Insurance policy will pay to cover the difference between the ACV and the loan/lease balance. This is usually capped at a certain percentage of the original vehicle value or a fixed dollar amount.

- Deductible (if applicable): Some Gap Insurance policies have a deductible, which is the amount you'll have to pay out of pocket before the Gap Insurance kicks in.

- Policy Terms and Conditions: The fine print of the policy, outlining what is covered, what is excluded, and the process for filing a claim.

How It Works

Let's illustrate with an example:

Suppose you buy a new truck for $40,000 and finance it with a loan. After two years, you still owe $30,000. Unfortunately, you're involved in an accident and the truck is totaled. Your insurance company assesses the ACV at $25,000.

Without Gap Insurance:

- Insurance pays: $25,000

- You still owe: $30,000

- Out-of-pocket cost: $5,000

With Gap Insurance (assuming it covers the entire gap):

- Insurance pays: $25,000

- Gap Insurance pays: $5,000

- You owe: $0

The process typically involves filing a claim with your primary auto insurance first. Once they settle and pay out the ACV, you'll then file a claim with your Gap Insurance provider, providing documentation of the ACV settlement and your loan/lease balance. The Gap Insurance company will then pay the difference, up to the coverage limit.

Real-World Use – Basic Troubleshooting Tips

While Gap Insurance doesn't involve physical troubleshooting, here are some key considerations:

- Check Your Coverage: Don't wait until after an accident to find out your Gap Insurance limits. Review your policy documents carefully to understand the coverage amount, deductible (if any), and any exclusions.

- Understand Exclusions: Most Gap Insurance policies don't cover things like extended warranties, rolled-over debt from a previous car loan, or negative equity (where you owed more on your previous car than it was worth).

- Shop Around: Gap Insurance is often offered by dealerships when you buy a car, but you can also purchase it independently from insurance companies or credit unions. Compare prices and coverage terms to find the best deal.

- Consider the Loan-to-Value Ratio: If you put down a large down payment on your car, the "gap" between the ACV and your loan balance may be smaller, making Gap Insurance less necessary.

- Document Everything: Keep copies of your loan agreement, insurance policy, and any other relevant documents in a safe place. This will make the claims process smoother if you ever need to use your Gap Insurance.

Safety – Risky Financial Components

The "risky component" in this context is the potential for financial exposure if you don't have Gap Insurance and your car is totaled or stolen. The financial burden of owing money on a car you can no longer drive can be significant, potentially impacting your credit score and overall financial stability. Just like neglecting to replace worn brake pads can lead to an accident, failing to protect yourself with Gap Insurance can lead to a financial "wreck." This risk is amplified with vehicles that depreciate rapidly or when you have a long-term loan.

Think of Gap insurance as the financial equivalent of installing an airbag in your car. It's there as a safety net, offering crucial protection in the event of an unforeseen accident.

While this article provides a detailed overview of Gap Insurance, it's important to consult with an insurance professional to determine the right coverage for your specific situation. Remember to read your policy documents carefully and ask questions to ensure you understand all the terms and conditions.