What Does Pmt Stand For Finance

Alright folks, let's dive into something that often pops up when talking about auto loans, but is fundamental to many areas of finance: PMT. When you hear PMT in a finance context, it stands for Payment. But simply knowing that it means "Payment" doesn't tell the whole story. We need to understand what it represents, how it's calculated, and why it's so important. Consider this your under-the-hood look at a crucial piece of the financial engine.

Purpose – Why Understanding PMT Matters

Think of understanding the PMT function like knowing how the fuel injection system in your car works. You don't necessarily need to know the intricate details every day, but when you're considering a new modification (like a different ECU tune) or diagnosing a problem (like poor fuel economy), that knowledge becomes invaluable. Similarly, understanding PMT is critical when:

- Evaluating Loan Options: Comparing different auto loan deals, mortgages, or any type of installment loan.

- Budgeting: Accurately forecasting your monthly expenses and ensuring you can afford a specific purchase.

- Financial Planning: Estimating the impact of large purchases on your long-term financial goals.

- Investment Analysis: Understanding the cash flows associated with an investment, especially if it involves periodic payments.

- Negotiating: Armed with the knowledge of how payments are calculated, you're in a better position to negotiate loan terms.

Whether you're trying to optimize your auto loan or just get a better handle on your personal finances, understanding PMT is a valuable skill.

Key Specs and Main Parts of the PMT Calculation

The PMT function is essentially a mathematical formula that calculates the periodic payment required to pay off a loan or investment, given certain parameters. Here are the core components:

- Rate (r): The interest rate per period. This is usually expressed as an annual percentage rate (APR), but you need to divide it by the number of payment periods per year (e.g., 12 for monthly payments). So, if your APR is 6%, your monthly rate would be 0.06 / 12 = 0.005.

- Number of Periods (nper or n): The total number of payment periods. For a 5-year auto loan with monthly payments, nper would be 5 * 12 = 60.

- Present Value (pv): The principal amount of the loan or investment. This is the amount you're borrowing (the loan amount) or the initial investment.

- Future Value (fv): The value of the loan or investment at the end of the term. For a loan, this is typically 0, meaning you've fully paid it off. For an investment, this could be a target amount you want to accumulate.

- Type: Indicates when payments are made – at the beginning (1) or end (0) of the period. Most loans use the end-of-period convention (0).

The formula itself can look intimidating, but many spreadsheet programs (like Excel or Google Sheets) and financial calculators have built-in PMT functions that automate the calculation.

Symbols – Breaking Down the Formula

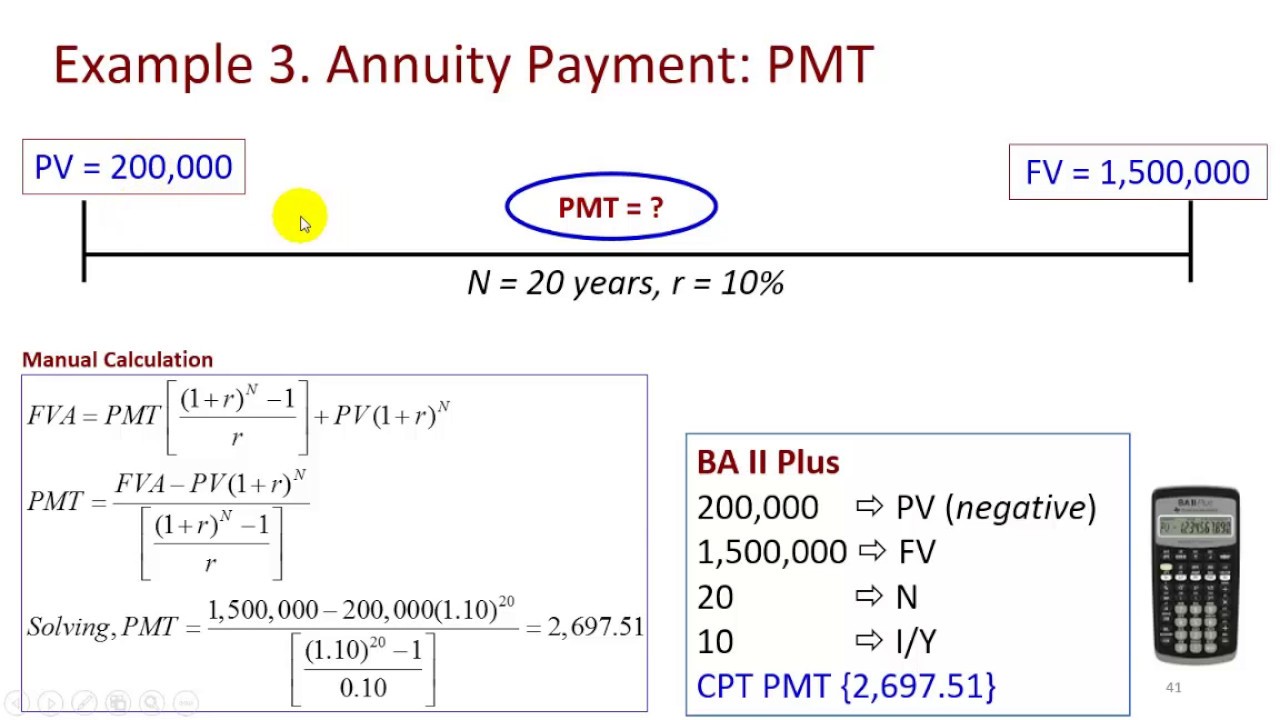

While you'll likely use a calculator or spreadsheet function, understanding the underlying formula helps to grasp the relationships between the different variables. The most common PMT formula is:

PMT = (r * pv) / (1 - (1 + r)^-nper)

Where:

- r is the interest rate per period (as explained above).

- pv is the present value (the loan principal).

- nper is the number of payment periods.

The ^ symbol represents "raised to the power of." So, (1 + r)^-nper means (1 + r) raised to the power of -nper. The negative exponent is crucial for correctly calculating the present value of future cash flows.

Don't be scared by the math! The important takeaway is that the PMT is directly proportional to the interest rate and present value (meaning if either increases, the payment increases) and inversely proportional to the number of periods (meaning if the number of periods increases, the payment decreases).

How It Works – The Mathematics Behind the Payment

The PMT calculation is based on the principles of time value of money. This concept recognizes that money received today is worth more than the same amount received in the future, due to its potential earning capacity (through investment or interest). The PMT formula essentially figures out what series of equal payments will have a present value equal to the loan amount, taking into account the interest rate over the life of the loan.

Each payment you make consists of two parts: principal and interest. In the early stages of a loan, a larger portion of each payment goes towards interest, while a smaller portion goes towards principal. As you make more payments, the proportion shifts, with more going towards principal and less towards interest.

This concept is also vital for understanding loan amortization schedules, which detail the allocation of each payment between principal and interest over the loan's term. You can easily create one in Excel, Google Sheets, or by searching for an online loan amortization calculator. Understanding this schedule allows you to see precisely how quickly you are paying down the loan principal, which can inform decisions about prepayment or refinancing.

Real-World Use – Basic Troubleshooting Tips

Let's look at some common scenarios where understanding PMT can be helpful:

- High Car Payment: If your car payment is higher than expected, double-check the interest rate and loan amount. Make sure you weren't charged a higher rate than agreed upon. Errors can occur! Also, confirm the loan term (number of months).

- Comparing Loan Offers: Don't just focus on the interest rate. A lower rate might come with a longer loan term, resulting in a higher total cost. Use the PMT function to calculate the monthly payment for each offer and compare the total cost of the loan (payment * number of payments).

- Prepayment Analysis: Wondering if you should make extra payments on your auto loan? Use a loan amortization calculator to see how much interest you'll save by paying it off early. You can calculate the PMT based on the reduced principal after making a lump sum payment.

- Refinancing: If interest rates have dropped, consider refinancing your auto loan to a lower rate. Use the PMT function to calculate the potential savings in monthly payments. Compare that to any fees associated with the refinancing process.

A common mistake is not accounting for taxes and fees when calculating the loan amount. Make sure your 'pv' includes all applicable costs to get an accurate payment estimation.

Safety – Highlight Risky Components

While the PMT function itself doesn't involve any physical risks, it's crucial to be aware of the potential financial risks associated with taking out loans:

- Debt Burden: Don't take on more debt than you can comfortably afford. Calculate your debt-to-income ratio to assess your financial capacity.

- Variable Interest Rates: Be cautious of loans with variable interest rates, as your monthly payments can fluctuate significantly. This adds uncertainty to your budget and increases the risk of default.

- Hidden Fees: Read the fine print carefully to identify any hidden fees, such as prepayment penalties or origination fees. These fees can increase the overall cost of the loan.

- Balloon Payments: Some loans may have a large balloon payment at the end of the term. Make sure you have a plan to cover this payment, or you could face foreclosure.

Being informed about the terms of your loan and understanding the implications of different payment scenarios is the best way to protect yourself from financial hardship.

We've covered a lot here, but hopefully, you now have a solid understanding of what PMT means and how it's used in finance. Remember that knowledge is power, especially when it comes to managing your finances. If you have any further questions or want to dive deeper into specific financial scenarios, feel free to ask!

We also have access to a detailed financial analysis spreadsheet including PMT calculations and amortization schedules. Contact us if you would like to access it.