What Does The Gap Insurance Cover

Alright, let's dive into the world of Guaranteed Asset Protection (GAP) insurance. You’ve probably heard about it, maybe even been offered it at the dealership. But what *exactly* does it cover? Think of this as understanding the schematics of a system – it’s about knowing the individual components and how they all work together to give you peace of mind (or potentially, save you a boatload of cash).

Purpose: Bridging the Value Gap

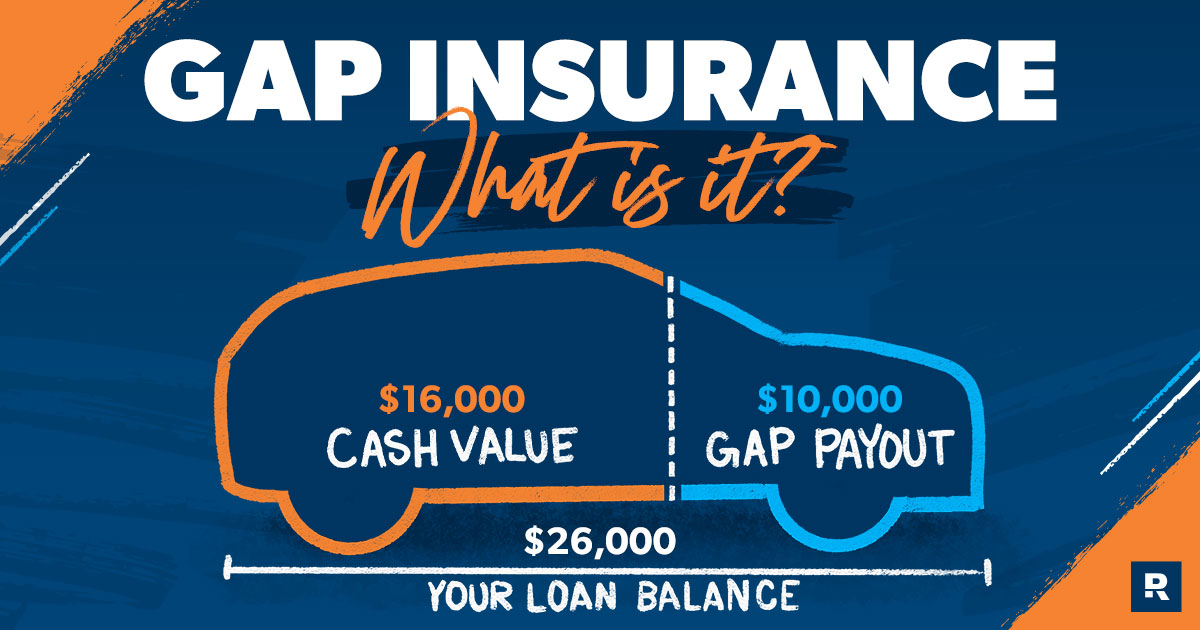

The core purpose of GAP insurance is to cover the difference between the actual cash value (ACV) of your vehicle and the outstanding balance on your auto loan in the event of a total loss. Now, why does this matter? Imagine you finance a brand-new truck, drive it off the lot, and a month later, it's totaled in an accident. Insurance pays out based on the truck's *current* value, not what you *paid* for it. That new vehicle depreciation is a killer! You can easily find yourself owing more to the bank than the insurance company is willing to pay out. GAP insurance fills this financial hole.

For DIYers and modders, understanding GAP insurance is crucial. Customizations, while adding personal value, often don't translate into increased ACV for insurance purposes. So, that sweet lift kit or those performance mods you installed might not be fully covered by your standard auto insurance, making GAP coverage even more critical.

Key Specs and Main Parts (Coverage Details)

Think of GAP insurance as having several key components, just like an engine:

- Eligibility Criteria: Most policies require you to have a financed or leased vehicle, and often limit coverage to vehicles under a certain age or mileage.

- Coverage Limit: This is the maximum amount the GAP insurance will pay out. It's crucial to understand this limit and ensure it's sufficient to cover the potential gap between your loan balance and the ACV. This limit is frequently expressed as a dollar amount (e.g., $50,000) or a percentage of the original loan amount.

- Covered Events: Typically, GAP insurance covers total losses resulting from accidents, theft, fire, or natural disasters. Read the fine print; some policies might exclude specific events.

- Deductible: Some GAP policies might have a deductible, which is the amount you'll pay out-of-pocket before the GAP insurance kicks in.

- Exclusions: This is where things get tricky. Common exclusions include:

- Mechanical failures: GAP insurance isn't a warranty. It doesn't cover engine problems or transmission failures.

- Missed payments: If you're behind on your loan payments, the GAP insurance might not cover the full amount.

- Negligence: If the total loss was due to your negligence (e.g., driving under the influence), the claim might be denied.

- Wear and tear: Normal wear and tear is not covered. This is about *sudden* and *unforeseen* total losses.

- Carrying over negative equity: If you rolled over negative equity from a previous loan into your current loan, GAP insurance might not cover that portion.

Symbols (Policy Language Explained)

Understanding insurance policy language is like decoding symbols on a wiring diagram. Here are some key terms (symbols) to be aware of:

- Actual Cash Value (ACV): The fair market value of your vehicle at the time of the loss, taking depreciation into account. This is often determined by resources like Kelley Blue Book or NADAguides.

- Total Loss: A vehicle that's damaged beyond repair or stolen and unrecovered. The insurance company determines if a vehicle is a total loss based on the cost of repairs compared to the ACV.

- Loan-to-Value Ratio (LTV): This is the ratio of your loan amount to the value of the vehicle. A high LTV increases the risk of a gap between the loan balance and the ACV.

- Insured Value: The stated value of the vehicle covered by the policy. This is not what they pay out in a total loss.

Think of the fine print as the ground wires in your insurance policy. If you gloss over them, you can end up with a big surprise later.

How It Works: Filling the Void

Let's walk through a simplified scenario: You buy a car for $30,000, finance the entire amount, and total it a year later. At that point, the ACV is $20,000, but you still owe $25,000 on the loan.

- Your primary auto insurance pays out the ACV: $20,000.

- Your loan balance is $25,000.

- The gap is $5,000 ($25,000 - $20,000).

- Your GAP insurance kicks in and covers the $5,000 (minus any deductible).

- You're no longer responsible for the remaining loan balance.

Without GAP insurance, you'd be stuck owing $5,000 for a car you can no longer drive! That's why it's so important to understand this coverage.

Real-World Use: Basic Troubleshooting Tips

Think of these tips as basic diagnostics for your GAP insurance policy:

- Review Your Policy Regularly: Just like checking your fluids, regularly review your GAP insurance policy to ensure you understand the coverage limits, exclusions, and claims process.

- Understand the ACV: Use online resources to get an estimated ACV for your vehicle. This will help you assess your risk and whether you need GAP insurance.

- Keep Records: Maintain thorough records of your loan agreement, insurance policies, and any modifications you make to your vehicle.

- Claims Process: Familiarize yourself with the claims process. Know who to contact and what documentation you'll need to provide.

- Question Everything: Don't be afraid to ask your insurance agent questions about your coverage. Understanding the details can save you a lot of headaches later.

Safety: Risky Components and Common Pitfalls

The most dangerous "component" of GAP insurance is assuming you're covered when you're not. Here are some areas where you can easily get burned:

- High Loan-to-Value Ratio: If you put little to no money down on your vehicle, your LTV is high, and you're at greater risk of a gap. GAP insurance is most beneficial in these scenarios.

- Long Loan Terms: Longer loan terms mean slower principal repayment and increased depreciation. This increases the likelihood of a gap.

- Vehicle Depreciation: Some vehicles depreciate faster than others. Research the depreciation rate of your vehicle to assess your risk. Luxury cars and trucks are notorious for depreciating rapidly.

- Incorrect Policy Information: Make sure the policy accurately reflects the vehicle and loan details. Any discrepancies could lead to a denied claim.

Treat your GAP insurance policy like a high-performance engine. If you abuse it (by neglecting your loan payments, for example), it won't perform as expected when you need it most.

Finally, remember that GAP insurance is not a substitute for comprehensive and collision coverage. It only covers the gap after your primary insurance has paid out.

We have a sample GAP insurance policy diagram available for download. It visually outlines the claim process and key coverage elements. Understanding these components will empower you to make informed decisions about your vehicle financing and insurance needs.