What Is A Car Note In America

Alright folks, let's dive into something that keeps many American drivers on the road: the car note, or as it's more formally known, the auto loan. This isn't about horsepower or torque; it's about how you *legally* obtain and maintain possession of that sweet ride. For those of you knee-deep in engine rebuilds and suspension upgrades, understanding the financing side is just as critical as knowing the firing order.

Purpose – The Foundation of Your Automotive Ownership

Why should you, a gearhead who can diagnose a misfire by ear, care about a car note? Several reasons:

- Understanding Your Rights: Knowing the terms of your loan empowers you to protect your interests if things go south – like a sudden job loss or unexpected financial hardship.

- Negotiating Power: Grasping the intricacies of auto financing gives you an edge when negotiating interest rates and loan terms with dealerships or lenders.

- Avoiding Predatory Lending: Being informed helps you spot red flags and steer clear of shady deals that could leave you underwater on your loan.

- Refinancing Opportunities: Knowledge of your loan details allows you to identify potential refinancing opportunities to lower your monthly payments or shorten the loan term.

- Future Vehicle Purchases: This understanding provides a solid foundation for making informed decisions about financing future vehicle purchases.

Key Specs and Main Parts of a Car Note

A car note, or auto loan agreement, isn't just a simple IOU. It's a legally binding contract that outlines the terms of your debt. Here's a breakdown of the crucial components:

1. Principal:

This is the initial amount you borrowed to purchase the vehicle. It's the foundation upon which all other charges are calculated.

2. Interest Rate:

Expressed as an annual percentage rate (APR), the interest rate is the cost of borrowing the money. This is where negotiation comes in – a lower APR can save you thousands over the life of the loan. The APR is determined by factors like your credit score, the lender's risk assessment, and prevailing market rates.

3. Loan Term:

This is the length of time you have to repay the loan, typically expressed in months (e.g., 60 months, 72 months). A longer term means lower monthly payments, but you'll pay more interest overall. A shorter term results in higher payments but less interest paid.

4. Monthly Payment:

The fixed amount you pay each month, comprising both principal and interest. This figure is calculated based on the principal, interest rate, and loan term.

5. Down Payment:

The amount of money you pay upfront towards the purchase price of the vehicle. A larger down payment reduces the principal amount borrowed and can lower your monthly payments and the total interest you pay.

6. Fees:

These can include application fees, origination fees, documentation fees, and prepayment penalties. Always scrutinize these fees as they can add significantly to the overall cost of the loan.

7. Collateral:

The vehicle itself acts as collateral for the loan. This means that if you fail to make payments as agreed, the lender has the right to repossess the vehicle.

8. Loan Amortization Schedule:

This is a detailed table showing how each monthly payment is allocated between principal and interest over the life of the loan. In the early years, a larger portion of each payment goes towards interest, while in later years, more goes towards principal.

9. Default Clause:

This section outlines the conditions under which the lender can declare you in default, typically involving missed payments. It also specifies the lender's rights and remedies in the event of default, including repossession and legal action.

Symbols – Interpreting the Fine Print

While car notes don't use literal diagrams with lines and colors like a wiring schematic, understanding the terminology is crucial. Think of financial jargon as the symbols on a schematic.

- APR (Annual Percentage Rate): Represents the *total* cost of the loan, including interest and certain fees, expressed as an annual percentage.

- LTV (Loan-to-Value Ratio): Compares the amount of the loan to the vehicle's value. A higher LTV may mean a higher interest rate.

- Credit Score: A numerical representation of your creditworthiness, used by lenders to assess your risk of default.

- Negative Equity (Underwater): When the outstanding loan balance exceeds the vehicle's market value.

How It Works – The Loan Lifecycle

The car note process follows a predictable path:

- Application: You apply for a loan, providing information about your income, credit history, and the vehicle you intend to purchase.

- Approval: The lender evaluates your application and determines whether to approve the loan and at what terms (interest rate, loan term, etc.).

- Closing: If approved, you sign the loan agreement and receive the funds to purchase the vehicle.

- Repayment: You make regular monthly payments according to the loan amortization schedule.

- Loan Satisfaction: Once you've made all the payments, the loan is considered satisfied, and you receive the title to the vehicle.

Real-World Use – Basic Troubleshooting Tips

Even with a solid understanding of your car note, issues can arise. Here are some basic troubleshooting tips:

- Late Payments: Contact your lender immediately if you anticipate being late on a payment. They may be willing to work with you to avoid late fees or repossession.

- Financial Hardship: If you experience a job loss or other significant financial hardship, explore options such as loan modification or refinancing.

- Repossession: If your vehicle is repossessed, you may have the right to redeem it by paying off the outstanding loan balance and any associated fees.

- Disputes: If you believe there are errors in your loan statement or that the lender has violated your rights, file a formal complaint with the lender and/or relevant regulatory agencies.

Safety – Risky Components and Practices

Just like dealing with high voltage, some aspects of car financing are inherently risky:

- High-Interest Loans: Be wary of loans with excessively high interest rates, especially those offered by subprime lenders. These can trap you in a cycle of debt.

- Predatory Lending Practices: Watch out for lenders who pressure you into accepting unfavorable loan terms or who fail to disclose all fees and charges.

- Upside-Down Loans: Avoid rolling negative equity from a previous vehicle into a new loan. This can leave you owing more than the vehicle is worth.

- Co-Signers: Be cautious about co-signing a loan for someone else, as you're legally responsible for the debt if they fail to pay.

Think of understanding your car note as being able to read the schematic of your financial life related to your car. It’s not just about getting from A to B; it’s about understanding the map and navigating the road responsibly.

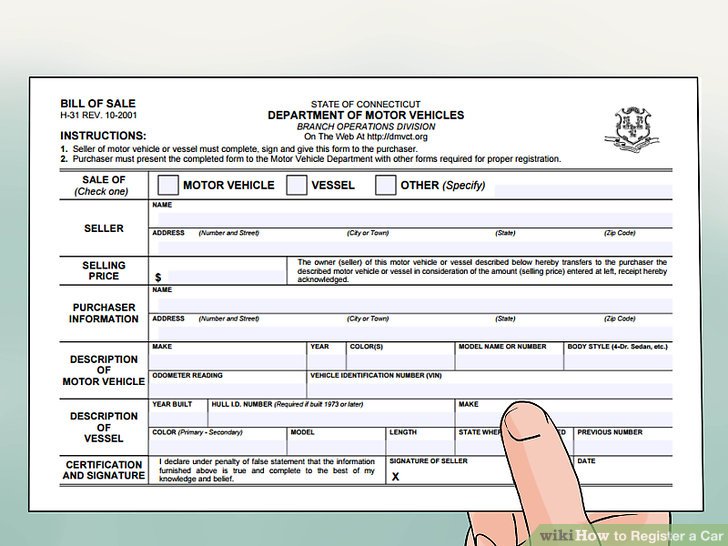

To further assist you in grasping the intricacies of your auto loan, we've prepared a comprehensive example document detailing a typical car note. This file includes a breakdown of key terms, calculations, and potential scenarios to help you better understand your financial obligations. You can download the example document to enhance your understanding of the concepts discussed in this article.