What Is A Lease Acquisition Fee

Alright, let's talk about something that often raises eyebrows when leasing a car: the lease acquisition fee. Think of this article as your behind-the-scenes look at this cost, giving you the knowledge to understand it, negotiate it, and ultimately, feel more comfortable with your lease agreement.

Purpose – Decoding the Acquisition Fee

Understanding the lease acquisition fee is crucial for several reasons. First, it allows you to accurately compare different lease offers. A lower monthly payment might be tempting, but a higher acquisition fee could negate those savings. Second, it empowers you to negotiate more effectively. Armed with knowledge, you can question the fee's validity or potentially haggle for a lower price. Finally, understanding the fee helps you avoid surprises and feel confident in your leasing decisions. In essence, knowing about this fee protects you from feeling like you're being taken advantage of.

Key Specs and Main Parts

The lease acquisition fee is essentially a charge levied by the leasing company (usually the manufacturer's financial arm, like BMW Financial Services or Ford Credit) to cover the costs associated with initiating the lease. It's a non-refundable fee, meaning you won't get it back even if you terminate the lease early. Here's a breakdown of what it typically covers:

- Credit Check: The leasing company needs to assess your creditworthiness to determine if you're a reliable candidate to make payments. This incurs costs.

- Application Processing: There's paperwork involved in setting up a lease, and the acquisition fee helps cover the administrative expenses associated with processing your application.

- Vehicle Inspection (Pre-Lease): While not always the case, some lessors perform a pre-lease inspection to assess the vehicle's condition before handing it over to you. This is to protect them from claims of pre-existing damage upon return.

- Documentation and Legal Fees: Legal documents need to be prepared, and this incurs costs. The acquisition fee helps cover those expenses.

- Depreciation Calculation and Residual Value Setting: A significant portion of the lease involves calculating the expected depreciation of the vehicle over the lease term and setting the residual value (the estimated worth of the vehicle at the end of the lease). This calculation involves market analysis and risk assessment.

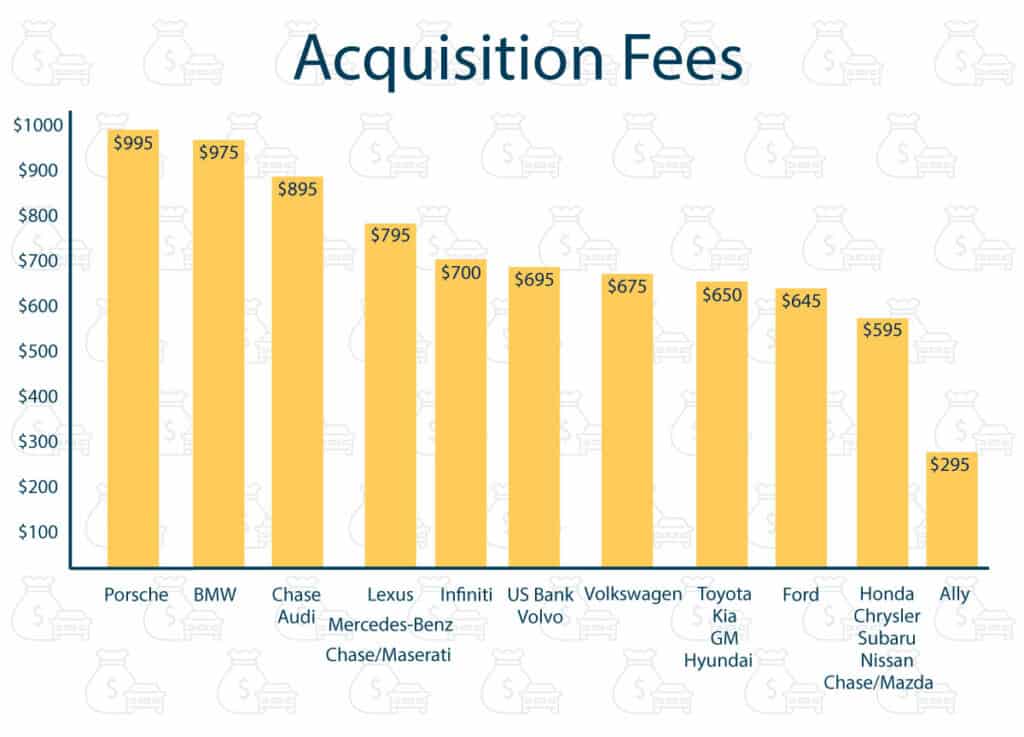

The amount of the acquisition fee can vary significantly depending on the make and model of the car, the leasing company, and even your credit score. It's typically a flat fee, ranging from a few hundred dollars to upwards of a thousand dollars.

Symbols – (Not Applicable but Think of It)

While there aren't "symbols" in the traditional sense like in an electrical diagram, consider the following "symbolic" representations:

Dollar Sign ($): Represents the actual monetary cost of the fee. The higher the number, the more you're paying upfront.

Contract Icon: Symbolizes the legal agreement you're entering into. The acquisition fee is a clause within that contract.

Clock Icon: Symbolizes the lease term. The acquisition fee is a one-time cost incurred at the beginning of that timeframe.

Visualizing these symbols can help you grasp the significance of the acquisition fee within the broader context of the lease.

How It Works

The acquisition fee is charged upfront, meaning you pay it at the time you sign the lease agreement. It's usually rolled into the total amount due at signing, along with the first month's payment, any down payment (if you choose to make one), taxes, and other fees. The acquisition fee does not affect your monthly payment. It's a separate, one-time expense.

The leasing company uses the fee to cover their initial costs. They then calculate your monthly payment based on the capitalized cost (the agreed-upon price of the vehicle), the residual value, and the lease interest rate (often called the money factor).

It's essential to understand that the acquisition fee is often negotiable, although not always easily. Leasing companies may be willing to lower the fee to secure your business, especially if you have excellent credit or if they're running special promotions.

Real-World Use – Basic Troubleshooting Tips

Here's how to apply this knowledge in real-world scenarios:

- Shop Around: Get lease quotes from multiple dealerships and compare not just the monthly payment, but also the acquisition fee. Don't be afraid to tell dealerships that you're comparing offers and ask them to beat a competitor's price.

- Read the Fine Print: Carefully review the lease agreement before signing it. Make sure the acquisition fee is clearly stated and that you understand all other fees involved.

- Negotiate: Don't assume the acquisition fee is set in stone. Try to negotiate it down, especially if you have excellent credit. Leverage competing offers to your advantage.

- Question Unexpectedly High Fees: If the acquisition fee seems significantly higher than what you've researched or been quoted elsewhere, ask the dealership to justify it.

- Consider Rolling It Into the Lease: While not always the best option, you can sometimes roll the acquisition fee into the monthly payments. This will increase your monthly payment but reduce the amount you need to pay upfront. Be sure to calculate the total cost over the lease term to see if this is worthwhile.

Troubleshooting Tip: If you're struggling to understand the acquisition fee or other aspects of the lease agreement, don't hesitate to ask for clarification. A reputable dealership should be transparent and willing to answer your questions.

Safety – (Related to Leasing Knowledge)

In the context of leasing, "safety" refers to protecting yourself from unfair or misleading practices. Here are some risky components to watch out for:

- Hidden Fees: Dealerships might try to sneak in additional fees that weren't disclosed upfront. Always scrutinize the lease agreement for any unexpected charges.

- Inflated Acquisition Fees: Some dealerships might inflate the acquisition fee to increase their profit margin. Research typical fees for the make and model you're leasing to avoid overpaying.

- Pressure Tactics: Be wary of dealerships that pressure you to sign the lease agreement without giving you time to review it thoroughly.

- Lack of Transparency: A dealership that's unwilling to answer your questions or provide clear explanations about the lease terms is a red flag.

Remember: Knowledge is your best defense. The more you understand about the leasing process, the better equipped you'll be to protect yourself from potential scams or unfair practices. Don't be afraid to walk away from a deal if you feel uncomfortable or pressured.

We have a detailed sample lease agreement breakdown available for download. This document provides a clear illustration of where the acquisition fee appears, how it's calculated, and its impact on the overall lease cost. With this resource, you can gain a deeper understanding of the leasing process and make informed decisions.