What Is A Lease Disposition Fee

Alright, let's talk about something that can sting you at the end of a car lease: the Lease Disposition Fee. You might've heard whispers about it, or maybe you're staring at one on your lease agreement right now, wondering what it is and why you're being charged for it. Consider this your in-depth guide, explained in a way that makes sense even if you're usually under the hood tweaking your engine instead of buried in paperwork. We're going to break down the lease disposition fee, its purpose, and how to navigate it, hopefully saving you some money and frustration along the way.

What Is a Lease Disposition Fee?

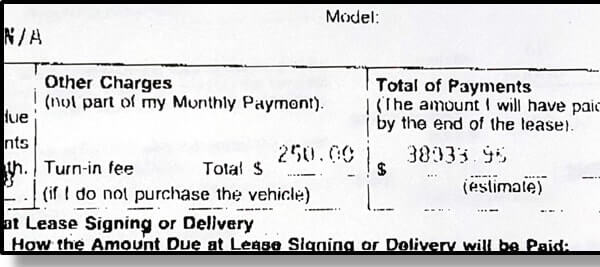

The Lease Disposition Fee, sometimes called a "Turn-in Fee" or "Lease Termination Fee," is essentially a charge levied by the leasing company at the end of your lease agreement. Think of it as a processing fee for handling the vehicle after you return it. It's designed to cover the costs associated with inspecting the vehicle, preparing it for resale (like cleaning and minor repairs), and ultimately selling it, either through auction or another channel.

It's crucial to understand that this fee is almost always outlined in your original lease agreement. Don't be caught off guard! Before signing a lease, always read the fine print, especially the sections detailing end-of-lease obligations and potential fees. Ignoring these details can lead to unwelcome surprises later on.

Purpose – Why This Matters

Understanding the lease disposition fee helps you in several ways:

* Budgeting: Knowing the fee upfront allows you to factor it into your overall cost of leasing. * Negotiation: Sometimes, you can negotiate the fee down or even have it waived, especially if you're leasing another vehicle from the same dealership. * Decision-Making: It can influence your decision on whether leasing is even the right option for you compared to buying. * Damage Mitigation: Knowing that the vehicle will be inspected upon return encourages you to maintain it properly to avoid excess wear and tear charges, which can be significantly more expensive than the disposition fee itself.Key Specs and Main Parts (of the Fee Structure)

Unlike a complex engine diagram, the "specs" of a lease disposition fee are relatively simple. The main "parts" are:

* The Fixed Amount: This is the most straightforward part. The lease agreement specifies a fixed dollar amount for the disposition fee. This can range anywhere from a few hundred dollars to upwards of $500 or even more, depending on the vehicle and the leasing company. * Potential Waivers: Some manufacturers or dealerships will waive the disposition fee if you lease or purchase another vehicle from them. This is a common incentive to retain customers. * Exceptions: There might be exceptions to the fee if you purchase the vehicle at the end of the lease. In this case, you're essentially buying the car outright, so the leasing company doesn't need to process it for resale. * Other End-of-Lease Charges: This isn't part of the *disposition* fee, but related. Be aware that excessive wear and tear, and exceeding mileage limits, will trigger separate charges.Symbols – Understanding the Lease Agreement

While a lease agreement doesn't use traditional symbols like an electrical diagram, it does employ specific wording and formatting that act as "symbols" to be interpreted carefully. Here's how to "decode" the relevant parts:

* "Lease Disposition Fee" or Similar Wording: This is the key phrase to look for. It might be under "End of Term Obligations," "Fees," or a similar section. * Dollar Sign ($) and Numerical Value: This indicates the amount of the fee. Pay close attention to this number! * Footnotes and Asterisks (*): These often point to additional conditions or exceptions related to the fee. Always read the footnotes. * Legal Jargon: Lease agreements are full of legal language. If you don't understand something, don't hesitate to ask the dealership for clarification, or even consult with a legal professional.How It Works

The process typically works like this:

1. Vehicle Return: You return the leased vehicle to the dealership (or another designated location). 2. Inspection: The leasing company (or a third-party inspector acting on their behalf) inspects the vehicle for damage exceeding normal wear and tear. Normal wear and tear generally refers to acceptable deterioration from regular use, while excessive wear and tear includes things like large dents, scratches through the paint, torn upholstery, or damaged wheels. 3. Assessment: The inspector assesses any damage and calculates the cost of repairs. 4. Billing: You receive a bill for any excessive wear and tear charges, as well as the disposition fee (assuming no waiver applies). 5. Payment: You pay the charges. Failure to pay can affect your credit score.Real-World Use – Basic Troubleshooting Tips

* Negotiate the Fee: As mentioned earlier, you can often negotiate the disposition fee, especially if you're leasing another vehicle. Don't be afraid to ask for a waiver. * Transfer the Lease: In some cases, you can transfer your lease to another individual. This allows someone else to take over the remaining payments and the responsibility for the vehicle, potentially avoiding the disposition fee. Websites like LeaseTrader and Swapalease facilitate these transactions. Be aware that you will still be responsible if the new lease holder does not complete their end of the contract. * Purchase the Vehicle: If you like the car and the purchase price is reasonable, buying it might be a better option than paying the disposition fee and potentially facing excessive wear and tear charges. * Document Everything: Before returning the vehicle, take photos and videos of its condition. This can be helpful if you dispute any wear and tear charges. * Repair Minor Damage: If you have minor scratches or dents, consider having them repaired before returning the vehicle. This can often be cheaper than paying the leasing company's repair charges. * Review Your Lease Agreement: Familiarize yourself with the terms of your lease agreement before you return the vehicle. This will help you understand your rights and obligations. * Dispute Charges: If you believe the wear and tear charges are unfair, you have the right to dispute them. Gather evidence (photos, repair estimates) to support your claim.Safety – Avoiding Financial Hazards

The biggest "safety" concern with a lease disposition fee is avoiding an unexpected financial hit. Here's how to stay safe:

* Read the Fine Print: As we've stressed repeatedly, carefully review your lease agreement. * Inspect the Vehicle Regularly: Keep an eye on the condition of the vehicle throughout the lease term. Address minor damage promptly to prevent it from becoming major. * Get a Pre-Inspection: Some leasing companies offer a pre-inspection service a few months before the end of the lease. This allows you to identify potential wear and tear charges and address them before returning the vehicle. * Set Aside Funds: Plan for the disposition fee and potential wear and tear charges. This will help you avoid financial stress at the end of the lease. * Don't Exceed Mileage Limits: Exceeding the mileage limits will result in additional charges, which can be substantial. Track your mileage carefully.By understanding the lease disposition fee and taking proactive steps, you can navigate the end of your lease smoothly and avoid any unwelcome surprises. Leasing a car isn't inherently bad, but you need to be informed.

We have a sample lease agreement excerpt highlighting the disposition fee clause available for download. This can serve as a useful reference when reviewing your own lease agreements and understanding how these fees are presented.