What Is A Normal Car Payment

Understanding what constitutes a "normal" car payment is crucial for any car owner, especially those who like to tinker or are planning a vehicle upgrade. It goes beyond simply knowing if you're paying too much; it equips you to make informed decisions about financing, refinancing, and even the overall affordability of a vehicle before diving into performance modifications or aesthetic enhancements. Knowing the benchmarks helps you avoid financial strain that could ultimately impact your ability to maintain or modify your ride.

What Affects Your Car Payment?

Several factors intertwine to determine your monthly car payment. These elements act as cogs, each influencing the final output:

Principal Loan Amount

The principal loan amount is the initial sum you borrow to purchase the vehicle. Obviously, the more expensive the car, the larger the loan, and therefore, the higher your payments will be. This is the bedrock upon which all other payment calculations are built. If you're considering a new exhaust system or aftermarket wheels, remember to factor that potential cost into your overall budget, which may influence your initial loan amount or necessitate a smaller down payment.

Interest Rate (APR)

The Annual Percentage Rate (APR) is the annual cost of borrowing money, expressed as a percentage. It includes the interest rate plus any other fees associated with the loan. A lower APR translates directly into lower monthly payments and less money paid over the life of the loan. Your credit score heavily influences the APR you qualify for. Maintaining a good credit score is as important as maintaining your engine.

Loan Term

The loan term is the duration of the loan, typically expressed in months. Common loan terms range from 36 to 72 months (3 to 6 years). A shorter loan term means higher monthly payments but less total interest paid. Conversely, a longer loan term results in lower monthly payments but significantly more interest accrued over time. Think of it like gearing in your transmission – shorter gears provide quicker acceleration (faster payoff, higher payment), while longer gears offer better fuel efficiency (slower payoff, lower payment, but ultimately more cost).

Down Payment

The down payment is the initial amount of money you pay upfront towards the purchase of the vehicle. A larger down payment reduces the principal loan amount, leading to lower monthly payments and less interest paid. A substantial down payment can also improve your chances of securing a lower APR.

Taxes and Fees

Sales tax, registration fees, and other administrative costs are often rolled into the total loan amount. These taxes and fees can significantly impact your monthly payment. Don't overlook these – they are akin to the maintenance costs you factor in for your car repairs.

Vehicle Type (New vs. Used)

New cars typically have lower interest rates but depreciate faster. Used cars have higher interest rates but are generally less expensive initially. The vehicle type directly impacts both the loan amount and the APR, influencing the final monthly payment.

What is Considered a "Normal" Car Payment?

Defining "normal" is tricky, as it's highly dependent on individual circumstances. However, we can look at industry averages and guidelines to establish a benchmark.

- Rule of Thumb: A common guideline suggests that your total monthly car expenses (including payment, insurance, and fuel) shouldn't exceed 15% of your gross monthly income. The car payment itself should ideally be below 10%.

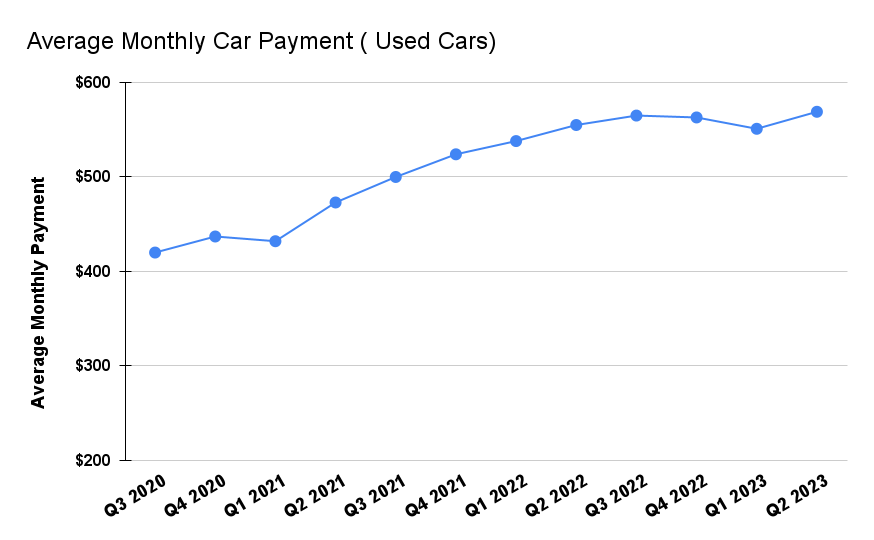

- Average Payment: According to recent data, the average new car payment hovers around $700-$800, while the average used car payment is around $500-$600. However, these are just averages and don't account for individual financial situations.

- Debt-to-Income Ratio (DTI): Lenders often consider your DTI – the percentage of your gross monthly income that goes towards debt payments. A lower DTI indicates better financial health and increases your chances of loan approval at favorable rates.

Calculating Your Affordability

Several online car loan calculators can help you estimate your monthly payment based on the factors mentioned above. Experiment with different loan terms, down payment amounts, and interest rates to see how they impact your affordability. Consider these calculations before you start modifying your vehicle; unexpected financial strain can halt your projects.

Here’s a basic formula to get you started:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly payment

- P = Principal loan amount

- i = Monthly interest rate (annual interest rate / 12)

- n = Number of months in the loan term

Real-World Use: Troubleshooting and Financial Planning

Understanding car payment dynamics can help you in several real-world scenarios:

- Negotiating a Better Deal: Armed with knowledge of interest rates and loan terms, you can negotiate more effectively with dealers and lenders.

- Refinancing Your Loan: If your credit score has improved or interest rates have fallen, refinancing your loan can lower your monthly payments or shorten the loan term.

- Evaluating Modification Costs: Before investing in upgrades, assess whether the additional expense will strain your budget. Can you truly afford that turbocharger and your monthly payment?

- Troubleshooting Financial Difficulties: If you're struggling to make payments, understanding the breakdown of your loan can help you explore options like deferment or restructuring.

Safety: Avoiding Financial Pitfalls

Just as you take precautions when working on your car, be mindful of the potential risks associated with car loans:

- Predatory Lending: Be wary of lenders offering loans with excessively high interest rates or unfavorable terms, especially if you have a low credit score.

- Upside-Down Loans: Avoid getting "upside down" on your loan, where you owe more than the car is worth. This can happen if you take out a long-term loan or if the car depreciates rapidly.

- Overextending Yourself: Don't borrow more than you can comfortably afford. A car is a depreciating asset, not an investment.

Accessing Additional Resources

For a detailed breakdown of car loan terms and a visual aid to understanding these concepts, we have a comprehensive car payment diagram available for download. This diagram visually represents the interplay of the principal, interest rate, loan term, and other factors that impact your monthly payment. Download it and use it as a reference when planning your next car purchase or modification project. You can use this information to inform you on what is considerd a normal car payment.