What Is A Typical Car Loan Rate

Understanding car loan rates is crucial, especially if you're someone who likes to tinker with their ride or is planning a major upgrade. Knowing the financial implications of your decisions can save you a lot of money in the long run and prevent you from overextending yourself on modifications or repairs. Think of it like understanding the electrical system before adding that aftermarket sound system – you need to know the basics to avoid blowing a fuse (or your budget).

Purpose of Understanding Car Loan Rates

Why bother diving into the world of APRs, terms, and credit scores? Several key reasons come to mind for the mechanically inclined car enthusiast:

- Budgeting for Modifications: Knowing your monthly car payment allows you to accurately budget for modifications. Can you afford that turbo upgrade *and* your car payment?

- Refinancing Opportunities: Understanding current market rates helps you identify if you can refinance your existing loan for a better deal, freeing up cash for projects.

- Avoiding Financial Strain: A realistic understanding of loan costs prevents overspending, ensuring you can still afford routine maintenance and unexpected repairs.

- Negotiating Power: Being informed about typical rates gives you more leverage when negotiating with dealerships and lenders.

Key Specs and Main Parts of a Car Loan Rate

Let's break down the components that make up your car loan rate. It's not just one number; several factors contribute to the final cost.

APR (Annual Percentage Rate)

The APR is the most important number. It represents the total cost of borrowing money, expressed as a yearly percentage. It includes the interest rate plus any fees associated with the loan (like origination fees or processing fees). Comparing APRs is the best way to compare different loan offers.

Interest Rate

The interest rate is the cost of borrowing money from the lender. It's a percentage of the loan amount that you'll pay back over the life of the loan. The interest rate *doesn't* include fees.

Loan Term

The loan term is the length of time you have to repay the loan. This is usually expressed in months (e.g., 36 months, 60 months, 72 months). Longer terms result in lower monthly payments but higher overall interest paid. Shorter terms mean higher monthly payments but less interest paid over the life of the loan.

Loan Amount (Principal)

This is the amount of money you borrow. It's the price of the car minus your down payment (if any).

Credit Score

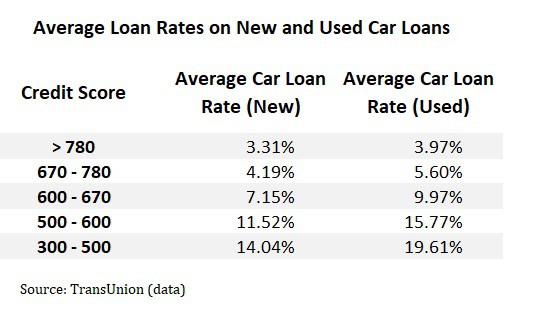

Your credit score is a numerical representation of your creditworthiness. Lenders use it to assess the risk of lending to you. A higher credit score typically results in a lower interest rate. Common credit scoring models are FICO and VantageScore.

Down Payment

A down payment is the amount of money you pay upfront towards the purchase of the car. A larger down payment reduces the loan amount, which can lead to a lower interest rate and smaller monthly payments.

Fees

Various fees can be associated with car loans, including:

- Origination Fees: Fees charged by the lender for processing the loan.

- Application Fees: Fees charged to process the loan application.

- Prepayment Penalties: Fees charged if you pay off the loan early (though these are becoming less common).

Factors Influencing Car Loan Rates

Several factors influence the car loan rate you'll receive:

- Credit Score: The most significant factor. Excellent credit scores (750+) typically get the best rates.

- Loan Term: Shorter terms usually have lower interest rates than longer terms.

- Type of Car (New vs. Used): New cars often have lower interest rates than used cars.

- Lender: Rates vary between banks, credit unions, and dealerships. It's important to shop around.

- Economic Conditions: Interest rates are affected by broader economic factors like inflation and the Federal Reserve's monetary policy.

How Car Loan Rates Work

Lenders use a formula to calculate your monthly car payment. A simplified version of the formula is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1 ]

Where:

- M = Monthly payment

- P = Principal loan amount

- i = Monthly interest rate (annual interest rate / 12)

- n = Number of months in the loan term

This formula considers the loan amount, interest rate, and loan term to determine your fixed monthly payment. While you don't need to calculate this by hand (online calculators are readily available), understanding the formula helps you see how each factor affects your payment.

Real-World Use – Basic Troubleshooting Tips

Let's say you're looking to buy a new set of wheels and need to finance it. Here's how understanding loan rates can help:

- High Interest Rate Quote: If you receive a high interest rate quote, check your credit report. Errors can negatively impact your score. Address any inaccuracies and consider delaying your purchase until your score improves.

- Compare Offers: Get quotes from multiple lenders. Don't settle for the first offer you receive. Even a small difference in interest rate can save you thousands of dollars over the life of the loan.

- Negotiate: Use competing offers as leverage to negotiate a better rate with your preferred lender.

- Long vs. Short Term: Carefully consider the loan term. While a longer term reduces your monthly payment, you'll pay significantly more interest overall. Calculate the total interest paid for different loan terms to make an informed decision.

Example: You're looking at a $20,000 loan. A 4% APR over 60 months results in a monthly payment of around $368. However, a 6% APR over 72 months (seemingly more affordable at around $332/month) will cost you significantly more in total interest paid.

Safety Considerations

Taking on a car loan is a significant financial commitment. It's crucial to borrow responsibly and avoid putting yourself in a precarious situation.

- Don't Overextend Yourself: Only borrow what you can comfortably afford to repay each month. Consider your other expenses and financial obligations.

- Avoid Payday Loans or Title Loans: These types of loans often have extremely high interest rates and can quickly lead to a debt spiral.

- Read the Fine Print: Carefully review the loan agreement before signing. Understand all the terms and conditions, including any fees or penalties.

Think of your loan as a critical component, just like your engine. If you neglect its maintenance (i.e., miss payments), the consequences can be severe (repossession and damage to your credit score).

By understanding the factors that influence car loan rates, you can make informed decisions, negotiate effectively, and ultimately save money on your car purchase. Just like a well-tuned engine, a well-managed car loan can provide years of reliable service.

Just as you would rely on detailed schematics for repairing your car, understanding the intricacies of car loan rates empowers you to make informed financial decisions. This knowledge can save you money and prevent you from overextending yourself on modifications or repairs.