What Is A Typical Car Payment

Alright, let's dive into the nitty-gritty of a "typical" car payment. You know, that monthly financial commitment that keeps your ride on the road (and the bank happy). Forget vague statements; we're going to break down exactly what contributes to that number, giving you the power to understand, negotiate, and maybe even save some serious cash.

Purpose: Why Understanding Your Car Payment Matters

Think of your car payment as more than just a bill. Understanding its components gives you a significant edge in several areas:

- Negotiation Power: Knowing how interest rates, loan terms, and other fees impact your payment arms you with knowledge during the car buying (or refinancing) process. You can spot sneaky charges and push for better deals.

- Budgeting and Financial Planning: A clear picture of your car payment allows for more accurate budgeting. You'll know exactly how much you're allocating each month, helping you manage your finances effectively.

- Refinancing Opportunities: Keeping tabs on prevailing interest rates and your loan's terms allows you to identify potential refinancing opportunities that could lower your monthly payment or shorten your loan duration.

- Early Payoff Strategies: Comprehending how principal and interest are allocated in each payment enables you to develop strategies for paying off your car loan faster, saving you money on interest in the long run.

Key Specs and Main Parts of a Car Payment

The 'typical' car payment isn't a static number; it's a complex formula with several moving parts. Here's a breakdown:

Principal

The principal is the original amount of money you borrowed to purchase the vehicle. It's the base figure upon which interest is calculated. Think of it as the actual cost of the car minus any down payment or trade-in value. A larger principal will invariably lead to a higher monthly payment.

Interest Rate (APR)

The Annual Percentage Rate (APR) is the cost of borrowing money expressed as a yearly rate. It's crucial to understand that the APR includes not only the interest rate but also any fees associated with the loan, making it a more accurate representation of the overall cost. A higher APR significantly increases the total amount you'll pay over the loan's life.

Loan Term

The loan term is the length of time you have to repay the loan, typically expressed in months (e.g., 36 months, 60 months, 72 months). A longer loan term will result in lower monthly payments, but you'll pay significantly more interest over the life of the loan. Conversely, a shorter loan term means higher monthly payments but less interest paid overall.

Down Payment

The down payment is the amount of money you pay upfront towards the purchase of the vehicle. A larger down payment reduces the principal amount you need to borrow, resulting in lower monthly payments and less interest paid. It also demonstrates to the lender that you're a responsible borrower.

Trade-In Value

Similar to a down payment, the trade-in value of your existing vehicle can reduce the principal amount you need to borrow. The dealership will assess the value of your current car and deduct it from the price of the new vehicle.

Taxes and Fees

These are additional costs associated with purchasing and financing a vehicle, including sales tax, registration fees, documentation fees, and potentially other administrative charges. These fees can add a substantial amount to the total cost of the car and are often rolled into the loan, impacting your monthly payment.

Optional Add-ons

Dealerships often offer optional add-ons such as extended warranties, gap insurance (covers the difference between the car's value and the loan balance if it's totaled), and service contracts. While these may seem appealing, they increase your loan amount and can significantly impact your monthly payment. Carefully consider whether these add-ons are truly necessary and shop around for better deals elsewhere.

How It Works: The Amortization Schedule

Car loans typically use an amortization schedule. This schedule outlines how each payment is allocated between principal and interest over the life of the loan. In the early stages, a larger portion of your payment goes towards interest, while a smaller portion goes towards principal. As you progress through the loan term, this allocation gradually shifts, with more of your payment going towards principal and less towards interest.

Understanding the amortization schedule is crucial for those looking to pay off their car loan early. By making extra principal payments, you can significantly reduce the amount of interest you pay and shorten the loan duration.

The formula for calculating a car payment is a bit complex, but here’s the breakdown:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Number of Months (Loan Term in Months)

Fortunately, most online car loan calculators do this work for you. But now you know the magic behind the scenes!

Real-World Use: Troubleshooting and Lowering Your Car Payment

So, you want to lower that monthly bill? Here are a few strategies:

- Negotiate the Price: Before even discussing financing, focus on negotiating the lowest possible selling price for the vehicle. Even a small reduction in the price can translate into significant savings over the life of the loan.

- Shop Around for Interest Rates: Don't settle for the first interest rate offered by the dealership. Get pre-approved for a car loan from your bank, credit union, or online lenders. This gives you leverage to negotiate a better rate with the dealership's financing department.

- Increase Your Down Payment: If possible, increase your down payment to reduce the principal amount you need to borrow. This will lower your monthly payments and reduce the total interest you pay.

- Shorten the Loan Term: Opting for a shorter loan term (e.g., 36 months instead of 60 months) will result in higher monthly payments, but you'll save a significant amount of money on interest in the long run.

- Refinance Your Loan: If interest rates have dropped since you took out your car loan, consider refinancing to a lower rate. This can significantly reduce your monthly payments and the total amount you pay over the life of the loan.

Safety: Loan Traps and Hidden Fees

Be wary of these red flags:

- High Interest Rates: Anything above the average for your credit score should be questioned.

- Hidden Fees: Always scrutinize the loan documents for hidden fees, such as prepayment penalties or excessive documentation fees.

- Long Loan Terms: While they offer lower monthly payments, long loan terms can lead to significant interest charges and potentially leaving you "upside down" on your loan (owing more than the car is worth).

- Forced Add-ons: Never feel pressured into purchasing unnecessary add-ons like extended warranties or gap insurance. Shop around for these services separately and only purchase them if they truly provide value.

By understanding the components of your car payment, you can make informed decisions that save you money and protect you from predatory lending practices.

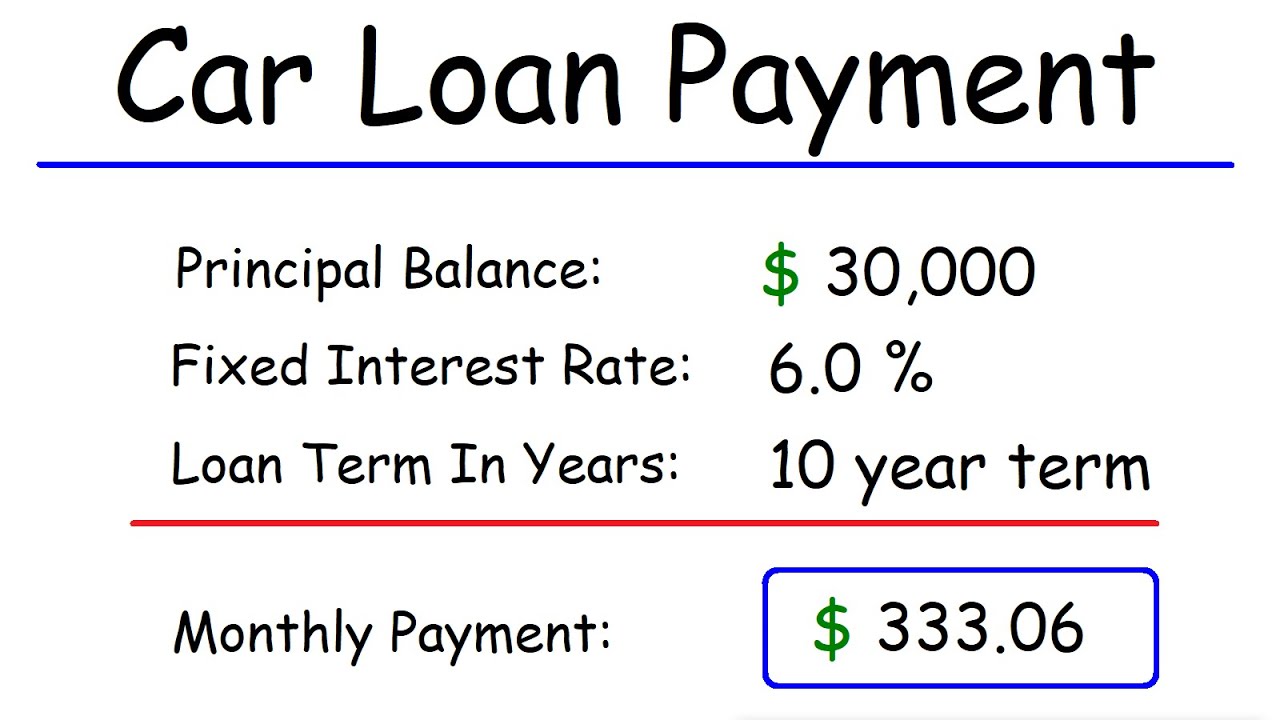

Now, to help you visualize all this, we've got a handy diagram detailing a typical car payment breakdown, including the influence of each element discussed. This diagram visually presents the relationship between principal, interest, loan term, down payment, and their overall impact on your monthly payment and the total cost of the loan.

[Note to Implementer: Placeholder for the downloadable diagram file.]

We have the diagram ready for you, which can be downloaded from [link to download]. It’s in [File Format] format for easy viewing and printing. Use it as a reference tool to help you understand your car payments better. Good luck!