What Is An Average Car Payment

Let's dive into the world of average car payments. Understanding this isn't just about idle curiosity; it’s a crucial aspect of responsible car ownership and financial planning. Whether you're contemplating a new purchase, refinancing your current loan, or simply trying to gauge the financial health of your vehicle, knowing the benchmarks helps you make informed decisions. Think of this as a baseline – a common data point to compare your own financial situation against, empowering you to negotiate better deals and manage your budget more effectively.

Purpose: Why Understanding Average Car Payments Matters

Think of understanding average car payments as having a vital diagnostic tool in your financial garage. Its purpose extends far beyond just knowing a number. Here's why it's important:

- Budgeting & Financial Planning: Knowing the average allows you to realistically assess whether a specific car fits into your monthly budget. It helps you avoid being "house poor," except in this case, "car poor," where a large portion of your income is tied up in your vehicle.

- Negotiation Leverage: When shopping for a car loan, knowing the prevailing average interest rates and loan terms gives you negotiating power. You can challenge offers that seem unreasonably high and potentially secure a better deal.

- Refinancing Opportunities: If interest rates have dropped since you took out your original loan, comparing your current payment to the average can highlight potential refinancing opportunities. Refinancing can lower your monthly payment or shorten your loan term, saving you money in the long run.

- Informed Decision-Making: Understanding the factors that influence the average car payment, such as credit score, loan term, and down payment, helps you make informed decisions about your car purchase. You can prioritize factors that will minimize your long-term costs.

- Long-Term Financial Health: A manageable car payment contributes to overall financial health. By avoiding excessive debt on your vehicle, you free up resources for other important financial goals, such as saving for retirement or investing.

Key Specs and Main Factors Influencing the Average

The "average car payment" is a dynamic figure influenced by several interconnected factors. Let's break down the key specs and main contributing elements:

1. Loan Amount (Principal)

This is the base amount you borrow after any down payment. A larger loan amount naturally translates to a higher monthly payment. This is represented as P in loan amortization formulas.

2. Interest Rate (APR)

The Annual Percentage Rate (APR) is the cost of borrowing money, expressed as a percentage. It directly affects your monthly payment and the total amount of interest you'll pay over the life of the loan. APR is calculated based on your credit score, the lender's risk assessment, and prevailing market rates. This is represented as r in loan amortization formulas.

3. Loan Term (Duration)

The loan term is the length of time you have to repay the loan, typically expressed in months. Shorter loan terms result in higher monthly payments but lower overall interest paid. Longer loan terms reduce monthly payments but increase the total interest paid over the life of the loan. This is represented as n in loan amortization formulas.

4. Credit Score

Your credit score is a numerical representation of your creditworthiness. A higher credit score signals to lenders that you're a low-risk borrower, qualifying you for lower interest rates and more favorable loan terms. Credit scores range typically from 300 to 850.

5. Down Payment

The down payment is the amount of money you pay upfront towards the purchase price of the car. A larger down payment reduces the loan amount needed, resulting in lower monthly payments and potentially better interest rates.

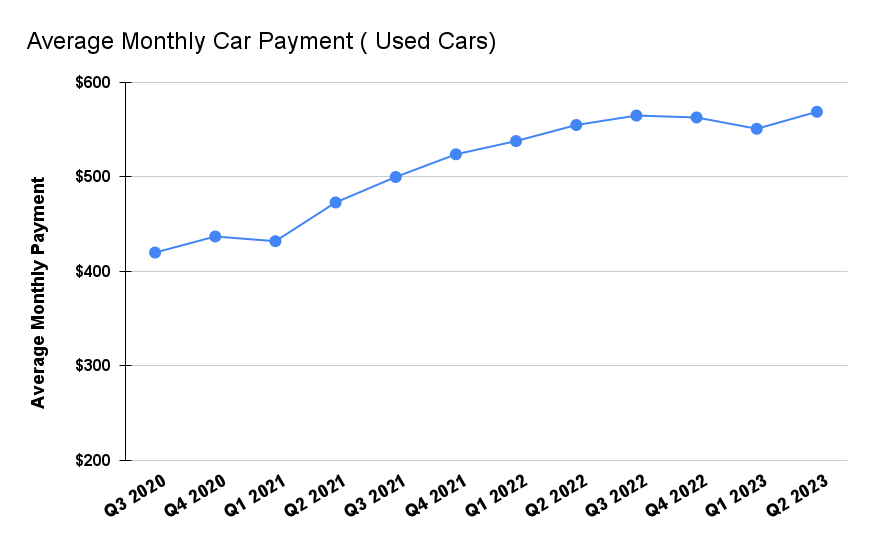

6. Type of Vehicle (New vs. Used)

New cars generally have higher purchase prices than used cars, leading to larger loan amounts and higher monthly payments. Used cars, however, may come with higher interest rates due to perceived higher risk.

7. Fees and Taxes

Sales tax, registration fees, documentation fees, and other charges can significantly increase the overall cost of the car and the loan amount, affecting your monthly payment.

8. Geographic Location

Sales tax rates and vehicle registration fees vary significantly by state and locality, impacting the total cost of ownership and the average car payment.

Formula for Calculating Car Payment

While online calculators are convenient, understanding the underlying formula empowers you to perform your own estimations. The standard formula for calculating a fixed monthly loan payment is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount

- i = Monthly Interest Rate (Annual Rate / 12)

- n = Number of Months (Loan Term)

How It Works: The Amortization Process

Car loans typically follow an amortization schedule. This means each monthly payment is allocated to both principal and interest. Initially, a larger portion of your payment goes towards interest, and a smaller portion goes towards reducing the principal. As you make payments over time, the proportion gradually shifts, with more of each payment going towards principal reduction and less towards interest. Understanding amortization helps you see how much interest you're paying over the life of the loan and the remaining balance on your principal.

Real-World Use: Basic Troubleshooting Tips

Here are some scenarios where understanding average car payments and loan dynamics can be invaluable for troubleshooting:

- High Monthly Payment: If your monthly payment seems excessively high compared to the average for a similar vehicle and loan term, investigate your interest rate. Check your credit report for any errors or opportunities to improve your score. Consider refinancing the loan if rates have dropped.

- Struggling to Make Payments: If you're having difficulty affording your car payments, explore options like refinancing to a longer loan term (be aware of the increased total interest paid), contacting your lender for a temporary hardship program, or even downsizing to a less expensive vehicle.

- Unexpected Fees: Before signing any loan agreement, carefully review all fees and charges. Question any fees that seem unreasonable or unexplained. Negotiation is often possible.

- Negative Equity: "Negative equity" (being upside down on your loan) means you owe more on the car than it's worth. This can happen if you have a long loan term or the car depreciates rapidly. Understanding the depreciation curve of different vehicles can help you avoid this situation.

Safety: Hidden Costs and Risky Loan Products

Navigating the world of car loans can be treacherous. Watch out for these potential pitfalls:

- Predatory Lending: Be wary of lenders offering suspiciously low payments or guaranteeing approval regardless of your credit score. These lenders may charge exorbitant interest rates and fees.

- Balloon Payments: Some loans have a large "balloon payment" due at the end of the loan term. Make sure you understand the implications of a balloon payment and have a plan to cover it when it comes due.

- Add-ons and Extras: Dealers often try to sell add-ons like extended warranties, paint protection, or gap insurance. Carefully evaluate whether these products are necessary and cost-effective.

- Loan Packing: This unethical practice involves adding unwanted or unnecessary products to your loan without your explicit consent. Always review the loan agreement carefully before signing.

- Variable Interest Rates: While less common than fixed-rate car loans, variable-rate loans can fluctuate over time, potentially increasing your monthly payments unexpectedly.

Remember, knowledge is power. By understanding the factors that influence average car payments and the dynamics of car loans, you can make informed decisions that protect your financial well-being.

We have compiled a detailed diagram outlining these aspects, including real-world examples and common scenarios. This diagram is available for download and will assist you greatly when analyzing your own car payment situation.