What Is Gap Coverage For Cars

Let's talk about something that can save you a lot of headache and money when the unexpected happens: Gap coverage for your car. While it might sound like just another insurance add-on, understanding Gap coverage is crucial, especially if you've financed your vehicle or leased it. Think of it as a safety net that catches you when your regular auto insurance falls short.

Purpose – Why Gap Coverage Matters

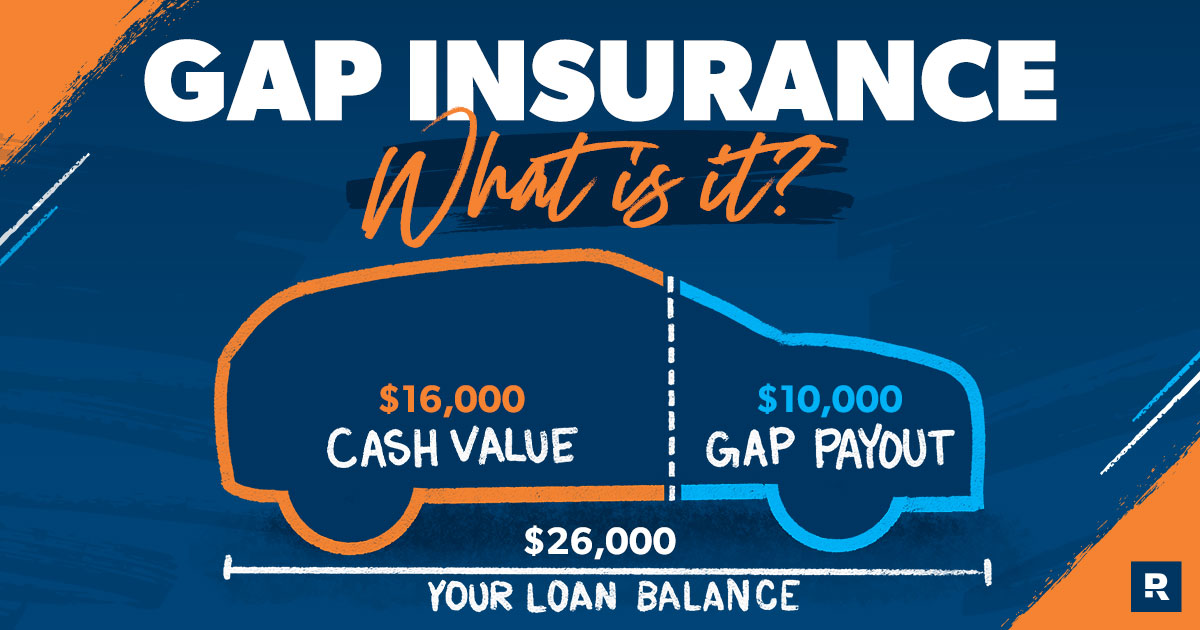

The primary purpose of Gap coverage, or Guaranteed Asset Protection, is to bridge the "gap" between what you still owe on your car loan or lease and what your insurance company deems the vehicle's actual cash value (ACV) to be after it's been declared a total loss. This situation typically arises after an accident where the car is beyond repair, or if the vehicle is stolen and not recovered. Without Gap coverage, you could be stuck paying off a loan for a car you no longer own. Gap coverage can save you from serious financial strain, particularly during an already stressful situation.

Key Specs and Main Parts

While Gap coverage isn't a physical part you can see or touch like a spark plug or a brake rotor, understanding its key specs and components is still important. Here's what you need to know:

- Eligibility: Gap coverage is typically available for new and used vehicles that are financed or leased. Some providers may have restrictions on vehicle age, mileage, or loan-to-value ratio.

- Coverage Limit: This is the maximum amount that the Gap coverage will pay out. It's crucial to ensure this limit is sufficient to cover the potential gap between your loan balance and the vehicle's ACV. Check with your lender or insurance provider for specific limits.

- Deductible: Some Gap coverage policies may have a deductible, which is the amount you'll pay out-of-pocket before the coverage kicks in.

- Exclusions: Like any insurance policy, Gap coverage has exclusions. These might include mechanical failures, aftermarket modifications, overdue loan payments, or instances where the accident was caused by driving under the influence.

- Premium: This is the cost of the Gap coverage. It can be paid upfront as a lump sum or added to your monthly loan payments.

How Gap Coverage Works

Here's a step-by-step breakdown of how Gap coverage works in the event of a total loss:

- Vehicle is Deemed a Total Loss: Your primary auto insurance provider determines that your vehicle is beyond repair and declares it a total loss.

- Insurance Payout: The insurance company calculates the vehicle's ACV at the time of the loss. This is typically based on factors like the vehicle's age, mileage, condition, and market value.

- Loan Balance Calculation: Your lender calculates the outstanding balance on your car loan or lease.

- Gap Assessment: The Gap coverage provider compares the ACV payout from your primary insurance with your outstanding loan balance. If the loan balance exceeds the ACV, a "gap" exists.

- Gap Coverage Payment: The Gap coverage provider pays the difference between the ACV and the loan balance, up to the coverage limit specified in the policy.

Example: Let's say you owe $20,000 on your car loan. Your car is totaled in an accident, and your insurance company determines the ACV to be $15,000. The "gap" is $5,000. If you have Gap coverage with a coverage limit that exceeds $5,000, the Gap coverage provider will pay the $5,000 directly to your lender, effectively wiping out the remaining loan balance.

Real-World Use – Basic Scenarios

Here are a few real-world scenarios where Gap coverage can be a lifesaver:

- New Car Purchase: New cars depreciate rapidly in the first few years. If you total a new car shortly after buying it, the ACV will likely be significantly lower than the loan balance.

- Long-Term Loan: With longer loan terms (e.g., 60 or 72 months), you pay more interest upfront, and it takes longer to build equity in your vehicle. This increases the likelihood of a gap between the ACV and the loan balance.

- High Loan-to-Value Ratio: If you put little or no money down when purchasing your car, your loan-to-value ratio is high, meaning you owe a large percentage of the vehicle's value. This increases the risk of a gap.

- Leased Vehicles: Leases often have a higher gap between the car's value and what you owe, making Gap coverage particularly important.

Basic Troubleshooting: If your car is totaled, and you have Gap coverage, be sure to contact your Gap coverage provider immediately. Provide them with all the necessary documentation, including the police report, the insurance company's settlement offer, and your loan documents. Keep meticulous records of all communication with the insurance company and the Gap coverage provider.

Safety – Risky Considerations

While Gap coverage itself doesn't involve any physical components that pose a direct safety risk, it's essential to be aware of potential pitfalls:

- Overlapping Coverage: Be cautious about purchasing Gap coverage from multiple sources. Sometimes, dealerships automatically include it in the financing package. Before purchasing additional coverage, review your existing policies to avoid paying for redundant protection.

- Exclusions and Limitations: Read the fine print of your Gap coverage policy to understand any exclusions or limitations. For example, some policies may not cover theft if you left the keys in the ignition, or if you were using the vehicle for commercial purposes.

- Price Gouging: Shop around for Gap coverage to ensure you're getting a fair price. Dealerships may mark up the cost of Gap coverage significantly. Compare quotes from different providers before making a decision.

- Unnecessary Coverage: If you put a substantial down payment on your vehicle and have a relatively short loan term, the risk of a significant gap may be minimal. In such cases, Gap coverage might not be necessary.

Gap Coverage: A Wise Investment?

Ultimately, the decision of whether or not to purchase Gap coverage depends on your individual circumstances. If you're financing a new car with a long-term loan and a small down payment, or if you're leasing a vehicle, Gap coverage can provide valuable financial protection. However, if you have a substantial down payment, a short loan term, and a good credit rating, the risk of a significant gap may be minimal. Carefully weigh the potential benefits against the cost before making a decision.

We hope this comprehensive overview of Gap coverage has been helpful. We understand that navigating the world of car insurance can be complex, but by understanding your options and making informed decisions, you can protect yourself from unexpected financial losses.