What Is Gap Coverage On A Car

Let's talk about something that's often overlooked but can be a financial lifesaver: Gap Coverage on your car. If you're someone who enjoys modifying your vehicle, understands depreciation, or has ever considered the real-world risks involved in owning a car, you'll appreciate knowing the ins and outs of this type of insurance. Think of this as a crash course (pun intended!) in protecting yourself from a potential financial pitfall.

Purpose of Gap Coverage

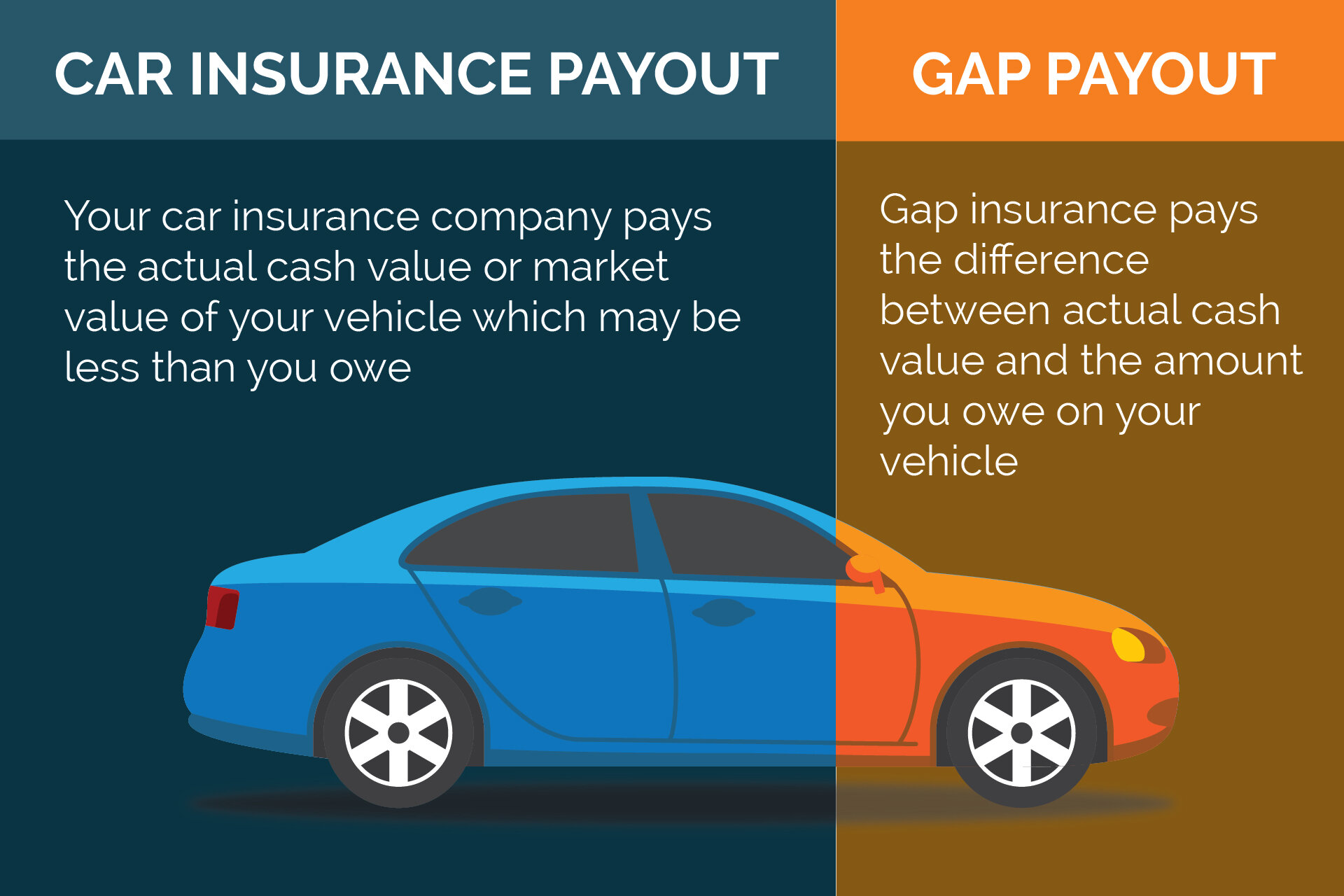

The core purpose of Gap Coverage, short for Guaranteed Auto Protection, is to bridge the financial "gap" between what you owe on your car loan and what your insurance company pays out if your car is totaled or stolen. This is crucial because vehicles depreciate rapidly, especially in the first few years of ownership. Your car's actual cash value (ACV) – the amount your insurer will pay – might be significantly less than the remaining balance on your loan. Without gap coverage, you'd be stuck paying the difference, which could be thousands of dollars.

Imagine you bought a car for $30,000 and financed it. A year later, it's totaled in an accident. Your insurance company determines the ACV is now only $20,000. If you still owe $25,000 on the loan, you'd be responsible for the $5,000 difference. Gap coverage steps in to cover that $5,000, preventing you from being underwater on a loan for a car you can no longer drive.

Key Specs and Main Parts

Gap coverage isn't a tangible "part" of your car, but rather a contract between you and an insurance company. Here's a breakdown of its key aspects:

- Coverage Amount: This is the maximum amount the gap coverage will pay out. It's typically the difference between the ACV and the loan balance.

- Deductible: Some gap policies have a deductible, which is the amount you pay out of pocket before the coverage kicks in.

- Exclusions: Gap coverage usually has exclusions. Common ones include delinquent loan payments, lease agreements (which often already include gap-like protection), and instances where the car is repossessed. Also, if modifications significantly increase the car's value and lead to the total loss, gap coverage might not fully cover the difference, as the ACV may not reflect the modifications.

- Eligibility: There are often eligibility requirements, such as limits on loan-to-value ratios when the car was purchased. If you financed 150% of the car's MSRP, gap coverage may be harder to obtain.

Symbols and Definitions

Because Gap Coverage is an insurance product rather than a physical component of your vehicle, there are no specific mechanical diagrams or symbols. However, understanding the terminology is crucial. Think of these key terms as symbols in their own right:

- ACV (Actual Cash Value): The fair market value of the vehicle at the time of loss, considering depreciation.

- Loan Balance: The outstanding amount owed on the auto loan.

- Total Loss: When the cost to repair the vehicle exceeds its ACV, or when it's stolen and not recovered.

- Loan-to-Value (LTV): The ratio of the loan amount to the car's value. A higher LTV means a greater risk of being upside down on the loan.

- Underwriting: The process the insurance company uses to assess the risk of providing gap coverage.

How It Works

The operation of Gap Coverage is straightforward, but it involves several steps:

- Purchase: You purchase gap coverage either from your auto insurance provider, the dealership when you buy the car, or a separate gap insurance company.

- Total Loss: Your vehicle is declared a total loss due to an accident, theft, or other covered event.

- Insurance Payout: Your primary auto insurance company determines the ACV and pays out that amount to your lender.

- Gap Claim: You file a claim with your gap insurance provider.

- Gap Payment: The gap insurance provider pays the difference between the ACV payout and the loan balance, up to the coverage limit.

- Loan Satisfaction: Your auto loan is then paid off.

Real-World Use – Basic Troubleshooting Tips

While gap coverage doesn't involve hands-on car repair, here are some troubleshooting tips related to the process:

- Know Your Coverage: Review your gap insurance policy carefully. Understand the coverage amount, deductible (if any), and exclusions.

- Document Everything: Keep records of your loan agreement, insurance policies, and any communications with insurance companies.

- Challenge the ACV: If you believe the ACV determined by your primary insurance company is too low, gather evidence to support a higher valuation. This might include recent sales of similar vehicles in your area.

- Act Quickly: File your gap insurance claim as soon as possible after your primary insurance claim is settled.

- Address Loan Delinquency: Ensure your loan payments are up-to-date. Delinquent payments can void your gap coverage.

Example Scenario: Let’s say you add aftermarket wheels and a performance exhaust to your car. Later, it's totaled. Your primary insurance adjuster may not value those upgrades, using a standard ACV based on the stock vehicle. Your gap insurance will only cover the difference between that (lower) ACV and your loan balance. This is why it’s crucial to discuss aftermarket modifications with your insurance provider and potentially add supplemental coverage to protect your investment.

Safety – Risky Components

Gap coverage itself isn't a physical component that poses a safety risk. However, the financial vulnerability it addresses is a significant risk. Without gap coverage, you're exposed to the risk of owing money on a car you no longer have. This can impact your credit score and financial stability.

Furthermore, modifying your vehicle without considering insurance implications creates a financial risk. Upgrades can increase your car's value, but they might not be fully covered by standard insurance policies or gap coverage. Always discuss modifications with your insurance provider to ensure you have adequate protection.

Important Note: If you roll negative equity from a previous car loan into your current loan, gap coverage becomes even more critical. You’re already starting with a higher loan balance than the car's value, making you particularly vulnerable to depreciation.

We've covered the essential aspects of Gap Coverage. Understanding its purpose, coverage details, and potential pitfalls is crucial for making informed decisions about your financial protection. We have access to a sample Gap Coverage policy document that you can download to further review specific terms and conditions. This document will provide you with a clearer understanding of what to expect from this type of insurance.