What Is Gap Insurance For A Car

So, you're a car enthusiast, right? You get under the hood, maybe you’ve even tackled some serious modifications. But have you ever thought about what happens if your prized possession is totaled and your insurance payout doesn’t cover the full loan amount? That’s where Gap Insurance comes in. It’s not exactly a performance upgrade, but it's a vital piece of financial protection. Let's dive deep into what it is, how it works, and why you might need it.

Purpose of Understanding Gap Insurance

While this isn't a physical diagram in the traditional sense, understanding gap insurance is crucial for responsible car ownership. Just like knowing how your engine works helps you diagnose problems, knowing about gap insurance helps you avoid financial hardship in the event of a total loss. It allows you to make informed decisions about your insurance coverage and protect yourself from potentially owing thousands on a car you can no longer drive. This is particularly important if you've financed a car with little or no down payment, or if the car depreciates quickly.

Key Specs and Main Parts of Gap Insurance

Instead of physical parts, Gap insurance is defined by its key components and how they interact. Think of these as the 'specs' of the policy:

- Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of loss, determined by your insurance company. It considers depreciation, mileage, and condition.

- Loan/Lease Balance: This is the remaining amount you owe on your car loan or lease.

- Gap Amount: This is the difference between the ACV and your loan/lease balance. Gap insurance covers this difference (up to a certain limit).

- Coverage Limit: Most gap insurance policies have a maximum amount they will pay out, typically ranging from $50,000 to $75,000.

- Deductible: Some gap insurance policies have a deductible, which is the amount you pay out-of-pocket before the insurance coverage kicks in.

- Exclusions: Like any insurance policy, gap insurance has exclusions. These typically include things like overdue loan payments, carry-over balances from previous loans, and damage caused by negligence.

Understanding these terms is crucial for determining if you need gap insurance and for comparing different policies.

"Symbols" - Interpreting Gap Insurance Concepts

Instead of physical symbols on a diagram, we can use analogies to understand the flow of gap insurance:

- The ACV (Actual Cash Value) as a "ground": Think of the ACV as the baseline value. Everything else is relative to this value. It's the starting point for determining if there's a "gap."

- The Loan Balance as a "circuit": The loan balance represents the financial obligation you have. Gap insurance acts as a "bridge" in the circuit, completing it in case of a loss.

- The Gap Insurance as a "fuse": Gap insurance is the safety net. If the difference between the ACV and the loan balance exceeds the coverage limit, the "fuse blows" - meaning you might still owe money.

Visualizing these concepts helps understand the relationship between the key components of gap insurance.

How Gap Insurance Works

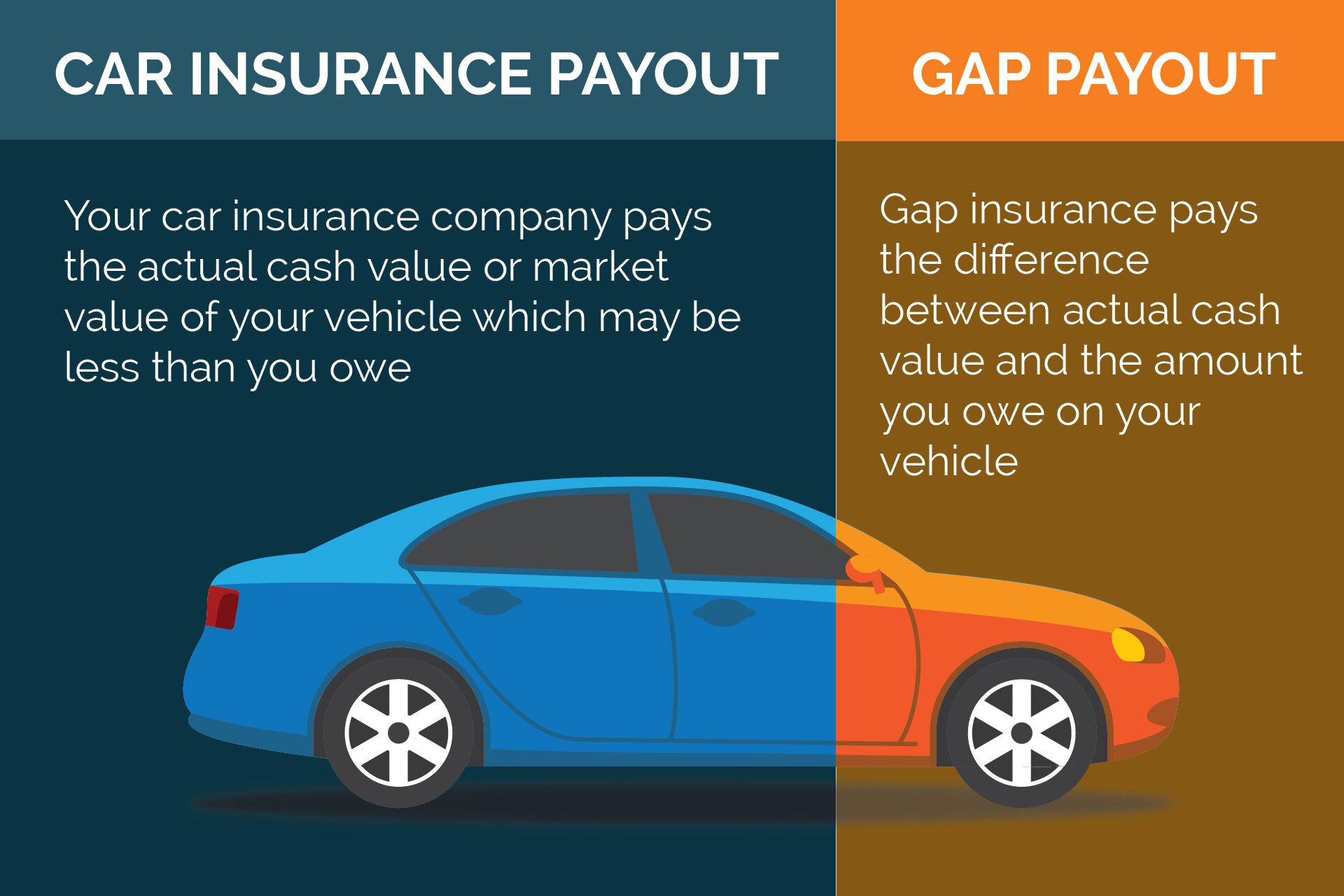

Let's say you bought a car for $30,000 and financed the entire amount. A year later, your car is totaled in an accident. Your insurance company determines the ACV (Actual Cash Value) of the car to be $22,000 due to depreciation. However, you still owe $25,000 on your loan.

Without gap insurance, you'd receive $22,000 from your insurance company, but you'd still owe $3,000 to the lender ($25,000 - $22,000 = $3,000). This is the "gap."

With gap insurance, the policy would cover this $3,000 gap (subject to any deductible and coverage limits). You'd receive $22,000 from your primary auto insurance and $3,000 from your gap insurance, allowing you to pay off your loan completely.

The process generally involves:

- Your car is declared a total loss by your primary auto insurance company.

- You file a claim with your gap insurance provider.

- The gap insurance provider calculates the difference between the ACV and your loan balance.

- The gap insurance provider pays the difference (up to the coverage limit) to your lender.

Real-World Use – Basic Considerations

Troubleshooting the Need for Gap Insurance: The main "symptom" that indicates you might need gap insurance is a high loan-to-value ratio. This means you borrowed a large percentage of the car's original price. Other factors include:

- Little or No Down Payment: If you put down a small down payment (or none at all), you're more likely to owe more than the car is worth early in the loan term.

- Long Loan Term: Longer loan terms mean slower principal reduction, increasing the risk of being "upside down" on your loan.

- Rapidly Depreciating Vehicle: Some cars depreciate faster than others. Check depreciation rates for your specific make and model.

- Leasing: Gap insurance is almost always included in a lease agreement, as the lessee (you) are responsible for the difference between the car's value and the remaining lease payments.

"Testing" if you need gap insurance: Before buying gap insurance, calculate the potential "gap" between your loan balance and the estimated ACV after a year or two. You can use online car valuation tools to estimate the ACV. If the potential gap is significant, gap insurance might be a wise investment.

"Safety" – Misconceptions and Limitations

While gap insurance provides valuable financial protection, it's crucial to understand its limitations:

- Gap insurance doesn't cover bodily injury or property damage. It only covers the difference between the ACV and the loan balance.

- Gap insurance typically doesn't cover deductibles from your primary auto insurance.

- Gap insurance won't cover modifications or upgrades. If you've spent a lot of money on aftermarket parts, they won't be included in the ACV calculation. This is particularly important for DIY mechanics and modders. Your primary auto insurance may offer additional coverage for these modifications, but gap insurance won't.

- Overdue payments will likely void the gap coverage. Maintain your car payments.

- Gap insurance doesn't protect against mechanical failures. It is only for a total loss incident such as a collision or theft.

The "riskiest component" is arguably assuming gap insurance covers everything. It’s essential to read the policy carefully and understand its exclusions and limitations. Don't rely solely on the salesperson's explanation.

In conclusion, gap insurance is a valuable tool for mitigating financial risk, especially if you've financed a car with little or no down payment or have a long loan term. By understanding its key components, how it works, and its limitations, you can make an informed decision about whether it's right for you.

We have additional resources and a sample gap insurance policy breakdown available for download. This detailed document provides a real-world example of a gap insurance policy, outlining its terms, conditions, and coverage limits. It's a valuable resource for understanding the fine print and ensuring you're making an informed decision about your insurance coverage.