What Is Gap Insurance For Car

Alright folks, let's talk about something that doesn't directly involve horsepower or torque, but is crucial for protecting your investment: Gap Insurance. You might have heard whispers about it, perhaps during the financing process of your latest ride. Let's break it down like we're diagnosing a tricky engine problem, getting to the core of what it is, why you might need it, and how it works.

What Exactly IS Gap Insurance?

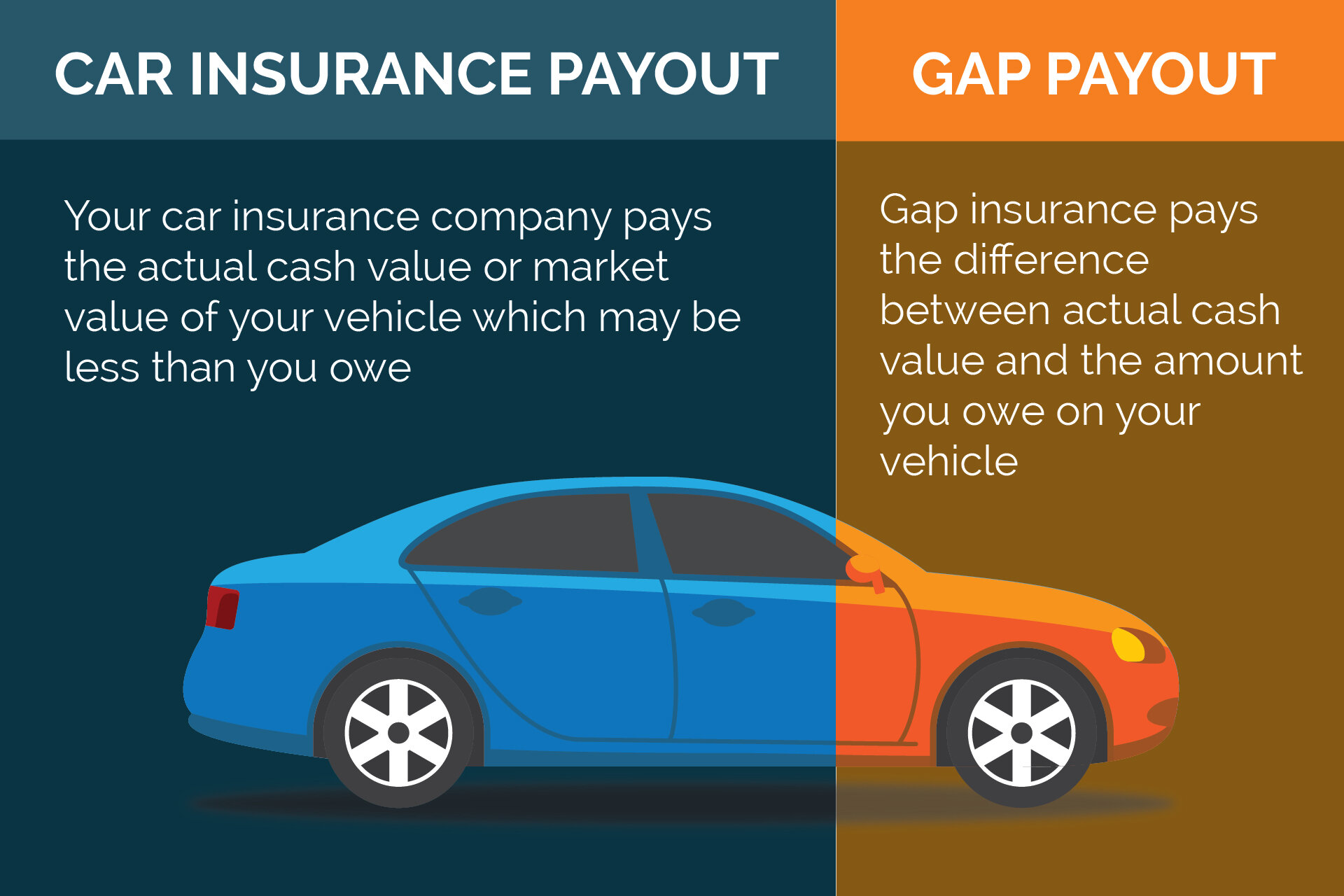

Gap insurance, short for Guaranteed Asset Protection insurance, is a supplemental insurance policy designed to cover the "gap" between what you owe on your car loan and what your insurance company pays out if your car is totaled or stolen. Let's say you're driving along, and BAM! An accident. Or worse, your prized project car vanishes from your garage overnight. Your standard auto insurance kicks in and deems the vehicle a total loss.

Here's where the potential headache begins. Insurance companies typically pay the actual cash value (ACV) of the vehicle at the time of the incident. This ACV considers depreciation – that inevitable decrease in value your car experiences over time. Let's say your car, originally worth $30,000, is now valued at $20,000 due to depreciation. Your insurance company will likely offer you $20,000.

But what if you still owe $25,000 on your loan? That's where gap insurance shines. It covers that $5,000 difference, preventing you from being stuck paying off a loan for a car you no longer own.

Why Is This "Gap" a Problem?

Several factors contribute to this potential "gap," making gap insurance a worthwhile consideration, especially for:

- New Vehicles: Cars depreciate most rapidly in their first few years.

- Long-Term Loans: The longer your loan term, the slower you build equity, increasing the likelihood of a gap.

- Large Negative Equity Rollover: If you rolled negative equity (owing more than the trade-in value) from a previous vehicle into your current loan, you're almost guaranteed to have a gap.

- High Depreciation Vehicles: Some vehicles depreciate faster than others, exacerbating the issue. Think of it like this: some engines are just more prone to oil leaks!

Key Specs and Main Parts (of the Gap Insurance Concept)

Think of the gap insurance process as a circuit. You have several key components:

- The Vehicle's Original Purchase Price: This is your starting point.

- Loan Amount: How much you borrowed to buy the car.

- Actual Cash Value (ACV): Determined by the insurance company at the time of the loss. This is the fair market value of the car, taking depreciation into account. Factors affecting ACV include mileage, condition, and comparable sales.

- Loan Payoff Amount: The remaining balance on your loan at the time of the incident.

- Gap Insurance Policy Coverage: The maximum amount the policy will pay out. Most gap policies have limits.

- Primary Insurance Coverage: The amount your standard collision or comprehensive insurance covers.

- Deductible: The amount you pay out of pocket before the gap insurance kicks in (usually, this is the same deductible as your primary insurance policy).

The key equation is: (Loan Payoff Amount – ACV) – Deductible = Potential Gap.

How It Works: The Flow of Funds

Let's walk through a simplified scenario:

- You finance a car for $35,000.

- Two years later, your car is totaled.

- Your primary insurance determines the ACV is $25,000.

- You still owe $30,000 on your loan.

- Your deductible is $500.

- The calculation: ($30,000 - $25,000) - $500 = $4,500

- Your gap insurance policy would then cover the $4,500 difference, paying off the remaining balance on your loan after your primary insurance payout.

Real-World Use: Troubleshooting and Considerations

Gap insurance isn't always a slam dunk. Here are some things to keep in mind:

- Policy Exclusions: Carefully read your policy. Many gap policies exclude things like:

- Deferred payments

- Carry-over balances from previous loans (unless explicitly included)

- Add-ons or modifications that increase the vehicle's value but weren't factored into the original loan. Think aftermarket turbos or custom paint jobs! These usually *aren't* covered by either your primary insurance or gap insurance.

- Total Loss Determination: Your primary insurance company makes the call on whether a vehicle is a total loss. Gap insurance only applies if it's declared a total loss.

- Overlapping Coverage: Some lenders may include gap insurance as part of the financing package. Make sure you're not paying for it twice!

- Early Loan Payoff: If you pay off your loan early, you may be entitled to a refund on the unused portion of your gap insurance premium. Check with your provider.

- Depreciation Myth: While the main goal is to cover depreciation, gap insurance itself doesn't directly influence the depreciation rate. It just protects you against its financial consequences in case of a total loss.

Safety: Avoiding Financial Wrecks

The "risky components" here are the financial unknowns. Not having gap insurance when you need it is like driving without a seatbelt. It can lead to serious consequences if things go wrong.

- Loan-to-Value Ratio: Be mindful of your loan-to-value ratio. The higher the ratio, the greater the risk of a gap. Try to make a larger down payment to reduce this risk.

- Vehicle Depreciation: Research the depreciation rates of different vehicles before you buy. Some are notorious for losing value quickly.

- Policy Shopping: Compare gap insurance policies from different providers. Dealers often offer gap insurance, but you can also purchase it independently from insurance companies or credit unions. Shop around to get the best rate and coverage.

- Understanding the Fine Print: Read the entire policy document carefully. Pay close attention to the exclusions, limitations, and cancellation policies. Don't just skim it like you skim those forum threads – understand every line.

Conclusion

Gap insurance is a safeguard, a safety net for your car loan. It's not a replacement for collision or comprehensive insurance, but rather a supplement that can prevent you from being financially underwater if the worst happens. Evaluate your individual circumstances, consider the factors we've discussed, and decide if it's the right protection for you. Like any tool in your garage, it's most effective when used correctly and understood thoroughly.

We have a detailed diagram available showing the flow of funds and the factors influencing a gap insurance claim. You can download it here: [Insert Download Link Placeholder Here]. This diagram will help visualize the process and further clarify the key elements involved. Remember, knowledge is power when it comes to protecting your investment.