What Is Gap Insurance For Cars

Let's talk about something crucial that often gets overlooked when buying a car, especially if you're financing it: Gap Insurance. Think of this article as a technical deep dive, like reviewing a schematic diagram. We'll dissect the purpose, key elements, how it operates, and practical implications of Gap Insurance.

Purpose: Avoiding the Underwater Nightmare

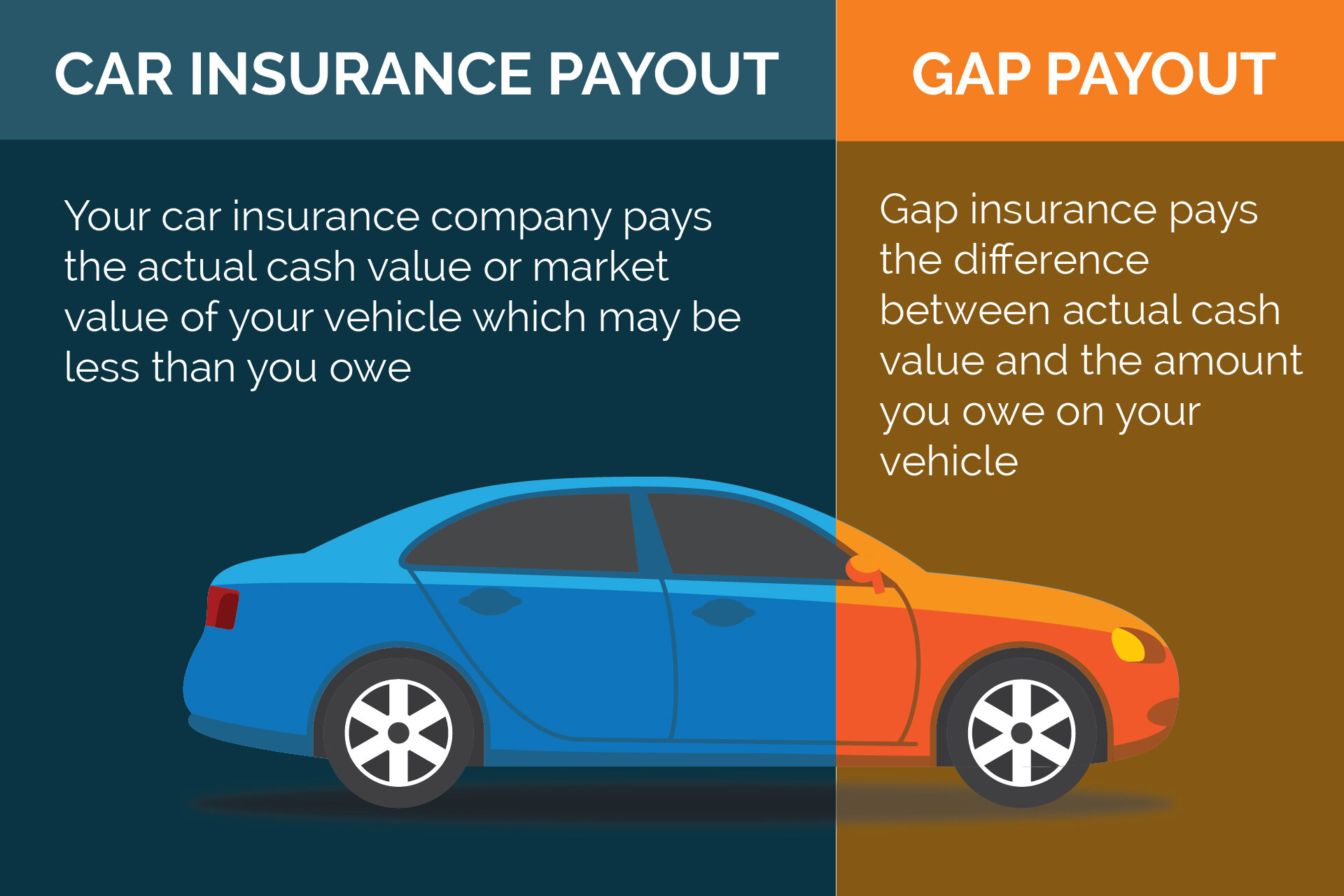

Why should you care about Gap Insurance? Imagine this scenario: You buy a brand-new car, finance it, and drive it off the lot. A few months later, disaster strikes – a major accident renders your car a total loss. Your comprehensive or collision insurance kicks in, right? Yes, but here's the catch: insurance companies typically pay the actual cash value (ACV) of the vehicle at the time of the accident. The ACV factors in depreciation, which, as we all know, hits cars *hard*, especially in the first few years.

This is where the "gap" comes in. The gap is the difference between what you still owe on your car loan and what the insurance company deems the car to be worth. Without Gap Insurance, you're on the hook for this difference. That means you're paying for a car you can no longer drive. Gap Insurance exists to cover this financial shortfall, preventing you from being "underwater" on your loan. The purpose here is financial protection against rapid depreciation and unforeseen accidents.

Key Specs and Main Parts

Instead of physical parts, Gap Insurance has "components" that define its function and effectiveness. Understanding these is like understanding the different circuits in an electronic diagram:

- Loan/Lease Balance: This is the total amount you owe on your car loan or lease. This is the initial value from which the gap is calculated.

- Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of the total loss, as determined by your primary auto insurance provider. Factors include age, mileage, condition, and market conditions.

- Deductible: Some Gap Insurance policies will cover your primary auto insurance deductible. This can further reduce your out-of-pocket expenses.

- Maximum Coverage Limit: Gap policies have a maximum amount they will pay out. Make sure this limit is sufficient to cover the potential gap between your loan balance and the car's depreciated value. Check the fine print!

- Premium: The cost of the Gap Insurance policy.

Think of the Loan/Lease Balance as the starting voltage in a circuit, the ACV as the voltage drop after a resistor (depreciation), and the Gap Insurance as a backup power supply that kicks in when the voltage falls below a critical level.

Symbols: Interpreting the "Diagram"

While we don't have a literal circuit diagram, we can use symbols to represent the relationships involved:

- "+" (Addition): Represents the sum of the ACV and the Gap Insurance payout, aiming to equal or exceed the Loan/Lease Balance.

- "-" (Subtraction): Represents the calculation of the gap: Loan/Lease Balance - ACV = Gap.

- "=" (Equals): Represents the desired outcome: Loan/Lease Balance = ACV + Gap Insurance Payout (ideally).

- ">" (Greater Than): Used to indicate that the Loan/Lease Balance might initially be greater than the car's value.

- "<" (Less Than): Indicates that the ACV plus the Gap Insurance should always cover the outstanding loan.

A crucial "icon" to recognize is the depreciation curve. It's not a static value. It varies widely by make, model, and even trim level. Research your car's typical depreciation rate to better understand your Gap Insurance needs.

How It Works: Bridging the Financial Divide

The core function of Gap Insurance is straightforward: it pays the difference between your loan balance and the ACV determined by your primary auto insurance. The process usually involves these steps:

- Total Loss: Your car is declared a total loss by your primary auto insurance company.

- ACV Determination: Your primary insurer assesses the ACV of the vehicle at the time of the accident.

- Loan Balance Calculation: You provide documentation of your outstanding loan balance to the Gap Insurance provider.

- Gap Calculation: The Gap Insurance company calculates the difference between the loan balance and the ACV.

- Payout: The Gap Insurance company pays the difference (up to the policy's maximum coverage limit) to your lender.

It's vital to note that Gap Insurance typically doesn't cover things like missed payments, extended warranties, or other fees rolled into your loan. It's purely designed to address the depreciation gap. It's important to review the specific policy to understand exactly what is and is not covered.

Real-World Use: Basic Troubleshooting Tips

Think of these as diagnostic steps you'd take with a complex electrical system:

- Scenario: You believe your Gap Insurance payout is too low.

- Step 1: Verify the ACV: Review the ACV assessment from your primary auto insurer. Ensure it's accurate and reflects the condition of your car prior to the accident. Challenge the ACV if you believe it's unfairly low (e.g., providing evidence of recent repairs or upgrades).

- Step 2: Review the Policy: Carefully read your Gap Insurance policy to understand the maximum coverage limit and any exclusions.

- Step 3: Contact the Provider: Contact the Gap Insurance provider and inquire about the calculation. Ask for a detailed breakdown of the payout.

- Step 4: Escalate if Necessary: If you're still unsatisfied, consider escalating the issue within the Gap Insurance company or seeking assistance from a consumer protection agency.

- Scenario: You're considering cancelling your Gap Insurance policy.

- Step 1: Calculate the Potential Gap: Estimate the potential gap between your loan balance and your car's current market value. Is the gap still significant?

- Step 2: Assess Your Risk Tolerance: How comfortable are you with potentially being liable for the remaining loan balance in case of a total loss?

- Step 3: Review Cancellation Terms: Check your policy for any cancellation fees or penalties.

Safety: Understanding the Risks

While Gap Insurance itself isn't inherently dangerous, there are potential "safety" considerations in terms of financial risk mitigation:

- Overlapping Coverage: Avoid purchasing redundant coverage. If your loan has a built-in "deficiency waiver," you might not need Gap Insurance. A deficiency waiver is similar to Gap Insurance, but it's provided by the lender as part of the loan agreement.

- Insufficient Coverage: Ensure the maximum coverage limit of your Gap Insurance policy is sufficient to cover the potential gap, especially if you're financing a high-depreciation vehicle.

- Misunderstanding the Terms: Carefully read and understand the terms and conditions of your Gap Insurance policy. Don't assume it covers everything.

Think of Gap Insurance as a safety net. It's there to protect you when things go wrong. Like any safety system, it's crucial to understand how it works and its limitations.

We have a more detailed diagram available for download that outlines all the components and calculations involved in Gap Insurance. This diagram can serve as a valuable resource for understanding the intricacies of this financial protection and making informed decisions about your car insurance needs.