What Is Gap Insurance On A Car

Alright, let's talk about something crucial, yet often overlooked, in the world of car ownership: Gap Insurance. Think of it as a safety net that catches you when your primary auto insurance doesn't quite cover the full cost of replacing your vehicle after a total loss. We're going to break down exactly what it is, why you might need it, and how it works. This isn’t about fixing a car part, but preventing a financial nightmare.

Purpose of Gap Insurance

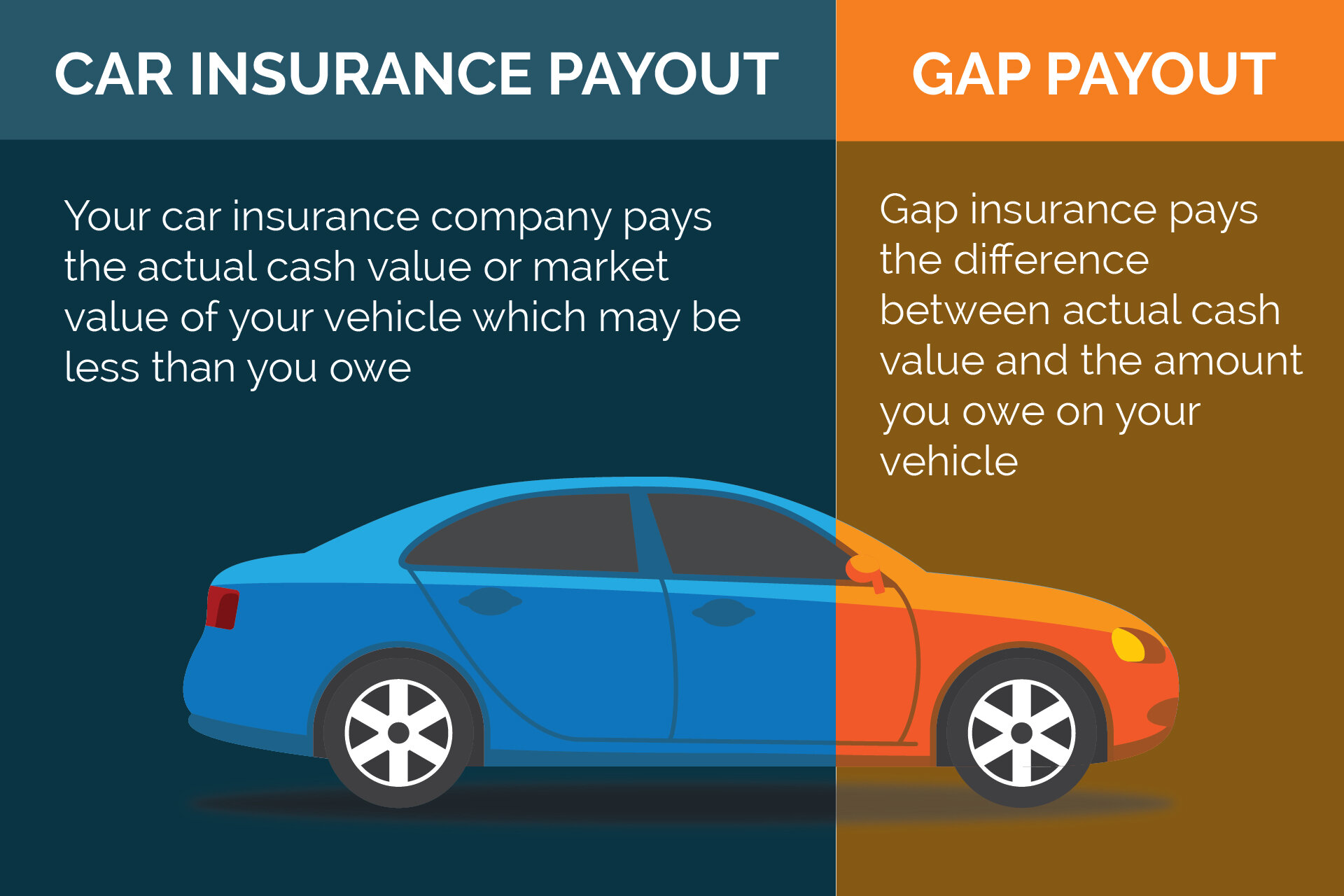

The primary purpose of Gap Insurance, or Guaranteed Asset Protection Insurance, is to bridge the "gap" between what you owe on your car loan or lease and what your insurance company determines the actual cash value (ACV) of the vehicle to be at the time of a total loss. A total loss, in insurance terms, means the vehicle is damaged beyond reasonable repair, or stolen and unrecovered.

Why is this important? Cars depreciate quickly, especially in the first few years. You might owe significantly more on your loan than the car is actually worth. If you total the car, your standard collision or comprehensive insurance will only pay out the ACV. This could leave you with a substantial amount still owed to the lender, even after the insurance payout. Gap insurance steps in to cover this difference.

Key Specs and Main Parts

There aren't physical "parts" to Gap Insurance like there are with a car engine. Instead, think of the key components as the terms and conditions of the policy. Here's what to look for:

- The Loan/Lease Balance: This is the outstanding amount you owe on your car. It’s the starting point for determining your potential gap.

- The Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of the loss, as determined by your primary auto insurance company. They typically use resources like the National Automobile Dealers Association (NADA) or Kelley Blue Book (KBB) to determine this.

- The Gap Coverage Limit: Most Gap Insurance policies have a maximum amount they will pay out. This limit might be something like $50,000, but it varies. Make sure it's sufficient to cover the potential gap between your loan balance and the ACV.

- Deductible: Some Gap Insurance policies have a deductible, similar to your regular auto insurance. This is the amount you'll pay out of pocket before the Gap Insurance kicks in.

- Exclusions: Read the fine print! Gap insurance usually has exclusions. Common exclusions include:

- Delinquent Payments: If your loan is in arrears, the Gap Insurance might not cover the entire amount.

- Negative Equity Rolled Over: If you rolled negative equity (owing more than your previous car was worth) into your current loan, the Gap Insurance might not cover that portion.

- Modifications/Accessories: Aftermarket modifications and accessories are rarely covered by Gap Insurance. This is crucial for those into car modification.

How Gap Insurance Works

Let's illustrate with an example:

Imagine you bought a car for $30,000 and financed the entire amount. Two years later, you total the car in an accident. Your insurance company determines the ACV of the car to be $20,000. However, you still owe $25,000 on your loan.

- Your primary auto insurance pays you $20,000 (the ACV).

- You still owe the lender $5,000 ($25,000 - $20,000).

- This $5,000 difference is the "gap."

- If you have Gap Insurance, it would cover this $5,000 (minus any deductible, if applicable).

Without Gap Insurance, you'd be responsible for paying that $5,000 out of pocket, even though you no longer have the car!

Real-World Use – Basic Troubleshooting Tips

Gap Insurance isn't something you "troubleshoot" in the traditional sense. It's more about understanding the policy and ensuring it meets your needs. Here's what to consider:

- Shop Around: Get quotes from multiple providers. You can often purchase Gap Insurance through your car dealer, your bank, or a standalone insurance company. Compare the coverage limits, deductibles, and exclusions.

- Understand Your Loan: Know your loan terms, including the interest rate and repayment schedule. This will help you estimate how quickly your car is depreciating relative to your loan balance.

- Review Your Primary Insurance Policy: Understand how your primary insurance company determines the ACV of your vehicle. Knowing this will give you a better idea of the potential gap.

- Consider Your Driving Habits: If you drive a lot or live in an area with a high risk of accidents or theft, Gap Insurance may be particularly important.

Safety – Highlight Risky Components (Financial)

The biggest "risk" with Gap Insurance isn't a physical component, but the potential financial risk of not having it when you need it. Here's what to watch out for:

- Overlapping Coverage: Make sure you're not paying for redundant coverage. For example, some auto loans include a "debt cancellation" feature that serves a similar purpose to Gap Insurance.

- High-Risk Vehicles: If you're financing a vehicle with a history of rapid depreciation (certain luxury cars or models with poor reliability ratings), the gap between the loan balance and the ACV could be significant.

- Long Loan Terms: The longer your loan term, the slower you pay down the principal, and the longer you're at risk of having a gap.

- Rolling Over Negative Equity: As mentioned before, this greatly increases the risk of needing the insurance, and often the insurance won't cover the rolled over amount.

Is Gap Insurance Right for You?

Gap Insurance isn't necessary for everyone. If you made a large down payment on your car, have a short loan term, or purchased a vehicle that holds its value well, you may not need it. However, if you financed a significant portion of the purchase price, have a long loan term, or are concerned about the rapid depreciation of your vehicle, Gap Insurance can provide valuable peace of mind.

Ultimately, deciding whether or not to purchase Gap Insurance is a personal decision based on your individual circumstances and risk tolerance. Understand your potential financial exposure and weigh the cost of the insurance against the potential benefit.

While we don't have a physical diagram to share for Gap Insurance (it's a financial product, not a mechanical one), hopefully, this explanation has provided you with the information you need to make an informed decision.