What Is Gap Insurance Used For

Alright, let's dive into the world of GAP insurance. You've probably heard the term thrown around when buying a car, but understanding exactly what it's for – and when you might need it – can save you a lot of headache (and money) down the road.

Purpose of GAP Insurance

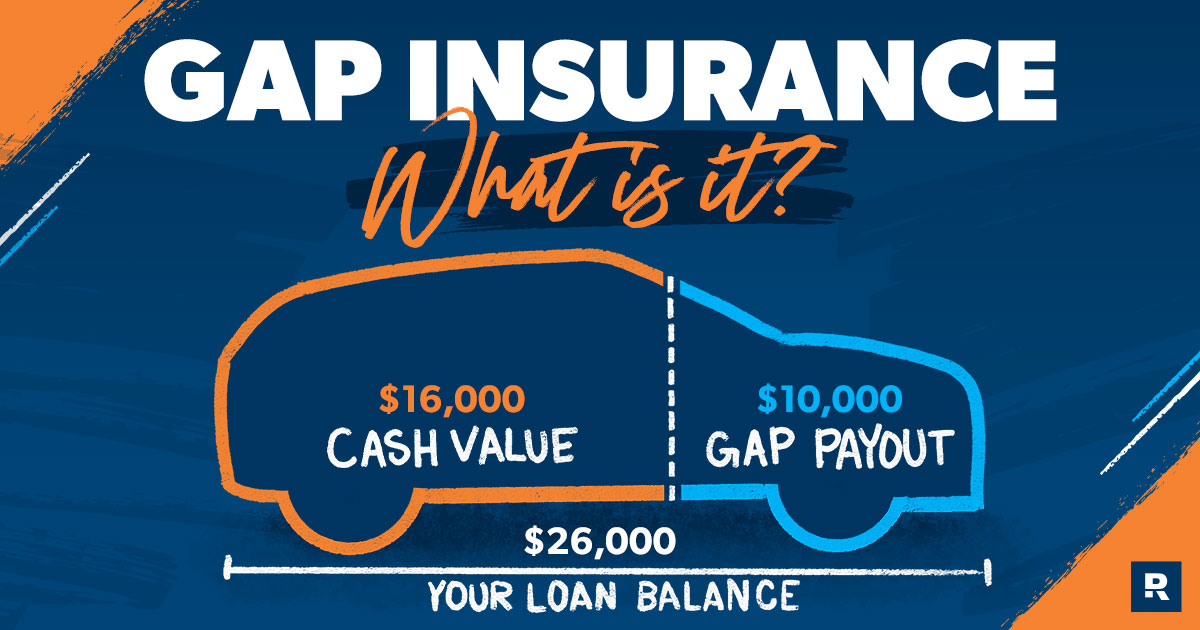

Think of GAP insurance as a safety net for your car loan. Its primary purpose is to cover the "gap" between what you owe on your vehicle and what your insurance company pays out if the vehicle is totaled or stolen and not recovered. This difference can be surprisingly significant, especially in the early years of a loan or if you put down a small down payment. This discussion is vital because understanding it protects you financially when you experience a total loss of your vehicle.

Key Specs and Main Parts (of the Scenario)

Unlike a mechanical system with physical parts, GAP insurance is based on a financial calculation. Here are the key inputs:

- Actual Cash Value (ACV): This is the fair market value of your car at the time of the incident. Your regular auto insurance company determines this value. Factors include the car's age, mileage, condition, and comparable sales in your area.

- Loan Balance: This is the amount you still owe on your auto loan at the time of the incident. Keep in mind that interest accrues, so the loan balance changes over time.

- GAP Coverage Limit: Your GAP insurance policy will have a maximum payout amount. This is a crucial detail to understand. Make sure it's high enough to cover a realistic potential gap.

- Deductible (if any): Some GAP policies have a deductible, just like your regular auto insurance. This is the amount you'll pay out of pocket before the GAP insurance kicks in.

The Underlying Formula

The core calculation is relatively simple:

GAP Payment = Loan Balance - Actual Cash Value - Deductible (if any)

Let's illustrate with an example:

You bought a car for $30,000. After a year, you still owe $25,000. Your car is totaled, and your insurance company determines the Actual Cash Value (ACV) to be $20,000. You have GAP insurance with no deductible.

GAP Payment = $25,000 (Loan Balance) - $20,000 (ACV) - $0 (Deductible) = $5,000

Without GAP insurance, you'd be responsible for paying that $5,000 difference to the lender even though you no longer have the car. That's why GAP insurance is so valuable in certain situations.

How It Works

Here's the typical process when a vehicle is totaled or stolen:

- Incident Occurs: Your car is totaled in an accident or stolen.

- Report to Insurance: You file a claim with your primary auto insurance company.

- ACV Determination: The insurance company assesses the Actual Cash Value (ACV) of the vehicle.

- Payout from Primary Insurance: Your insurance company pays out the ACV (minus your deductible, if any) to the lender.

- GAP Insurance Claim: If there's still a loan balance remaining, you file a claim with your GAP insurance provider. You'll need to provide documentation, including the insurance settlement paperwork and your loan agreement.

- GAP Payment: The GAP insurance company pays the remaining balance (up to the policy limit) directly to the lender.

Real-World Use – Basic Scenario Evaluation

Not everyone needs GAP insurance. Here's how to evaluate whether it's right for you:

- Large Depreciation: Cars depreciate most rapidly in the first few years. If you bought a car known for high depreciation, GAP insurance is more important. Think about vehicles like luxury cars or those with a tendency to lose value quickly.

- Long Loan Term: The longer your loan term (e.g., 60 or 72 months), the slower you build equity in the car. This increases the risk of being "upside down" (owing more than the car is worth).

- Small Down Payment: If you put down a small down payment (or none at all), you start with very little equity.

- Rolled-Over Debt: If you rolled over debt from a previous car loan into the new loan, you're starting out "upside down."

- Used Car Purchase (sometimes): While GAP insurance is often associated with new cars, it can also be beneficial for used cars, especially if you're financing a significant portion of the purchase price. Assess the used car's likely depreciation and the terms of your loan.

Troubleshooting Scenario: GAP claim denied? Review the policy terms carefully. Common reasons for denial include exceeding the policy limit, failing to meet the policy requirements (e.g., not having comprehensive and collision coverage on your primary insurance), or the loss not being covered by the policy (e.g., the car was repossessed, used for commercial purposes against policy terms, or loss occurred because of criminal activity). Gather all the supporting documentation to support your claim.

Safety Considerations

While GAP insurance itself doesn't involve physical risks like working on a car's engine, it's crucial to be aware of potential financial risks:

- Over-Insuring: Don't pay for GAP insurance if you don't need it. If you put down a substantial down payment and have a short loan term, the risk of a "gap" may be minimal.

- Hidden Fees: Understand the total cost of the GAP insurance. Sometimes, it's bundled into the loan, and you end up paying interest on the GAP insurance premium. Ask for a separate quote and compare it with other options.

- Policy Exclusions: Read the fine print! GAP policies often have exclusions. For example, they may not cover late fees, extended warranties, or negative equity rolled over from a previous loan. Be sure to know exactly what the policy covers and what it doesn't.

- Avoid "duplicate" coverage - Sometimes a dealership or lender will offer GAP insurance, but your existing auto insurance policy already provides similar coverage (like loan/lease payoff coverage). Evaluate these options to avoid unnecessary expense.

Choosing a GAP Provider

You can typically purchase GAP insurance from:

- Your Auto Lender: This is often the most convenient option, as the GAP insurance is bundled into the loan.

- Your Auto Insurance Company: Some auto insurance companies offer GAP insurance as an add-on to your existing policy.

- Third-Party Providers: Numerous third-party companies specialize in GAP insurance. Shop around to compare prices and coverage options.

The best choice for you depends on your individual circumstances and your comfort level with different providers. Compare quotes carefully and read the policy terms thoroughly.

Having a clear understanding of how GAP insurance works can empower you to make informed decisions about your auto financing and protect yourself against potentially significant financial losses. It's a valuable tool in the right circumstances, so take the time to evaluate your situation and determine if it's the right fit for you.

We have a handy flowchart of GAP insurance scenarios and coverage calculations available for download. Just let us know and we'll send you the file!