What Is Gap Protection On A Car

Let's talk about GAP protection on your car. Not the clothing brand, but Guaranteed Asset Protection, a financial product that can be a lifesaver if your vehicle is totaled or stolen. As experienced DIYers, we often focus on the mechanical aspects of our rides. But understanding the financial side of car ownership, especially depreciation, is just as important. This article will provide a technical overview of GAP insurance, explaining how it works and when it can be useful. We’ll delve into the core concepts and practical applications, empowering you to make informed decisions regarding your vehicle.

Purpose of Understanding GAP Protection

Understanding GAP protection isn’t about performing repairs, but about safeguarding yourself financially against a significant loss. Here’s why it matters:

- Financial Security: Imagine you total your car shortly after buying it. Your insurance company will only pay the actual cash value (ACV) of the vehicle at the time of the accident. If your loan balance is higher than the ACV, you're stuck paying the difference. GAP insurance covers this "gap".

- Informed Decision-Making: Knowing about GAP insurance allows you to assess whether it's a worthwhile investment for your specific situation. Factors like loan terms, down payment, and vehicle depreciation rates all play a role.

- Avoiding Debt: Without GAP insurance, you could find yourself owing thousands of dollars on a vehicle you can no longer drive. This can severely impact your credit rating and financial stability.

Key Concepts and Main Parts

GAP insurance is a simple concept, but understanding the underlying terms is crucial:

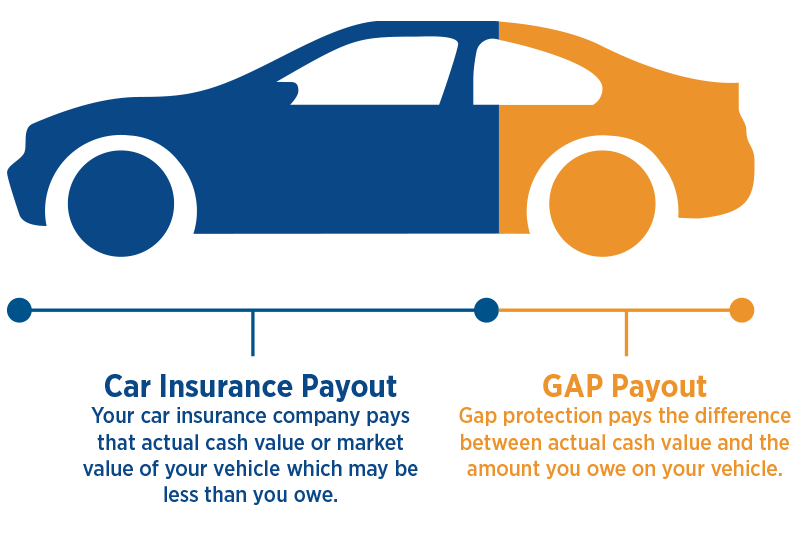

- Actual Cash Value (ACV): The market value of your vehicle at the time of a total loss. This is what your primary insurance company will pay. ACV is typically determined by factors like age, mileage, condition, and prevailing market prices for similar vehicles.

- Loan Balance: The outstanding amount you owe on your car loan.

- Gap: The difference between the loan balance and the ACV. This is the amount GAP insurance covers.

- Deductible: Some GAP policies have a deductible, which is the amount you pay out of pocket before the insurance coverage kicks in.

- Coverage Limits: GAP policies have coverage limits, which specify the maximum amount they will pay out. Ensure the coverage limit is sufficient for your loan amount.

The "parts" of a GAP insurance transaction are:

- The Insurance Provider: The company offering the GAP insurance policy.

- The Policyholder: The person purchasing the GAP insurance (you).

- The Lender: The financial institution holding the car loan.

- The Primary Insurance Company: Your standard auto insurance provider.

How GAP Protection Works

Let's illustrate with an example:

Suppose you buy a car for $30,000 and finance it with a loan. After a year, you total the car. Your insurance company determines the ACV to be $20,000. However, you still owe $25,000 on your loan.

- ACV: $20,000

- Loan Balance: $25,000

- Gap: $5,000

Without GAP insurance, you would be responsible for paying the $5,000 difference. With GAP insurance, the policy would cover this $5,000 (minus any deductible), relieving you of that financial burden.

The process typically involves these steps:

- Your vehicle is declared a total loss by your primary insurance company.

- Your primary insurance company pays you the ACV of the vehicle.

- You provide documentation to the GAP insurance provider, including the loan agreement, ACV settlement, and any other required documents.

- The GAP insurance provider calculates the gap amount and pays the lender directly to cover the remaining loan balance (up to the policy's coverage limit).

Real-World Use: Basic Troubleshooting Tips

GAP insurance is not something you directly "troubleshoot" in the same way you troubleshoot a mechanical issue. However, here are some things to keep in mind:

- Check Coverage Limits: Before purchasing GAP insurance, ensure the coverage limit is sufficient to cover the potential gap between your loan balance and the vehicle's depreciated value.

- Review Policy Terms: Understand the terms and conditions of the policy, including any exclusions or limitations. Some policies may exclude certain types of losses or damage.

- Document Everything: Keep copies of all relevant documents, including the loan agreement, insurance policies, and any communication with the insurance providers.

- File Claims Promptly: If your vehicle is totaled or stolen, file claims with both your primary insurance company and the GAP insurance provider as soon as possible.

- Compare Quotes: Shop around and compare quotes from different GAP insurance providers to find the best coverage at the most competitive price. Often, dealerships mark up these insurances significantly. Check with your primary insurer; they may offer it at a much lower cost.

Safety Considerations

GAP insurance is a financial product, so safety considerations are different than when you are working on your car. However, it is important to be wary of predatory lending practices that could steer you toward a GAP insurance policy that is not a good fit for you.

Risky Components:

- Dealership Add-ons: Dealerships often bundle GAP insurance with other add-ons, potentially inflating the price. Be sure to evaluate each item separately and negotiate accordingly.

- High-Interest Loans: If you have a high-interest loan, the gap between your loan balance and the ACV may be larger, making GAP insurance more beneficial. However, focus on improving your credit score and refinancing to secure a lower interest rate.

When Is GAP Insurance Necessary?

GAP insurance is generally recommended in the following situations:

- Long Loan Terms: Longer loan terms (e.g., 60 months or more) mean you'll be paying off the loan slower, increasing the risk of being upside down (owing more than the car is worth).

- Small Down Payment: If you put down a small down payment (or none at all), you'll borrow a larger amount, increasing the potential gap.

- Rapidly Depreciating Vehicles: Certain vehicles depreciate more quickly than others. Check depreciation rates for your specific make and model.

- Lease Agreements: GAP insurance is often included in lease agreements, as the lessee is responsible for the full value of the vehicle even if it's totaled or stolen.

Alternatives to GAP Insurance

While GAP insurance can be valuable, there are alternatives to consider:

- Larger Down Payment: Making a larger down payment reduces the amount you borrow and lowers the risk of being upside down.

- Shorter Loan Term: Opting for a shorter loan term accelerates the repayment process and minimizes the potential gap.

- Loan/Lease Payoff Coverage: Some insurance companies offer loan/lease payoff coverage as part of their standard auto insurance policies. This coverage can help pay off the remaining loan balance in the event of a total loss.

We have a sample GAP insurance policy document available for download that can help you further understand the details. This document is not a substitute for expert advice, but it can be a helpful resource as you learn more.