What Is Required To Lease A Car

So, you're thinking about leasing a car? It's a popular option, offering lower monthly payments than buying, but it’s not as simple as walking into a dealership and driving off with a shiny new vehicle. Think of it like this: You’re essentially renting the car for a set period. Just like with any major purchase or agreement, understanding the fine print and the underlying mechanics of a lease is crucial. This article breaks down exactly what's required to lease a car, giving you the knowledge to navigate the process like a pro.

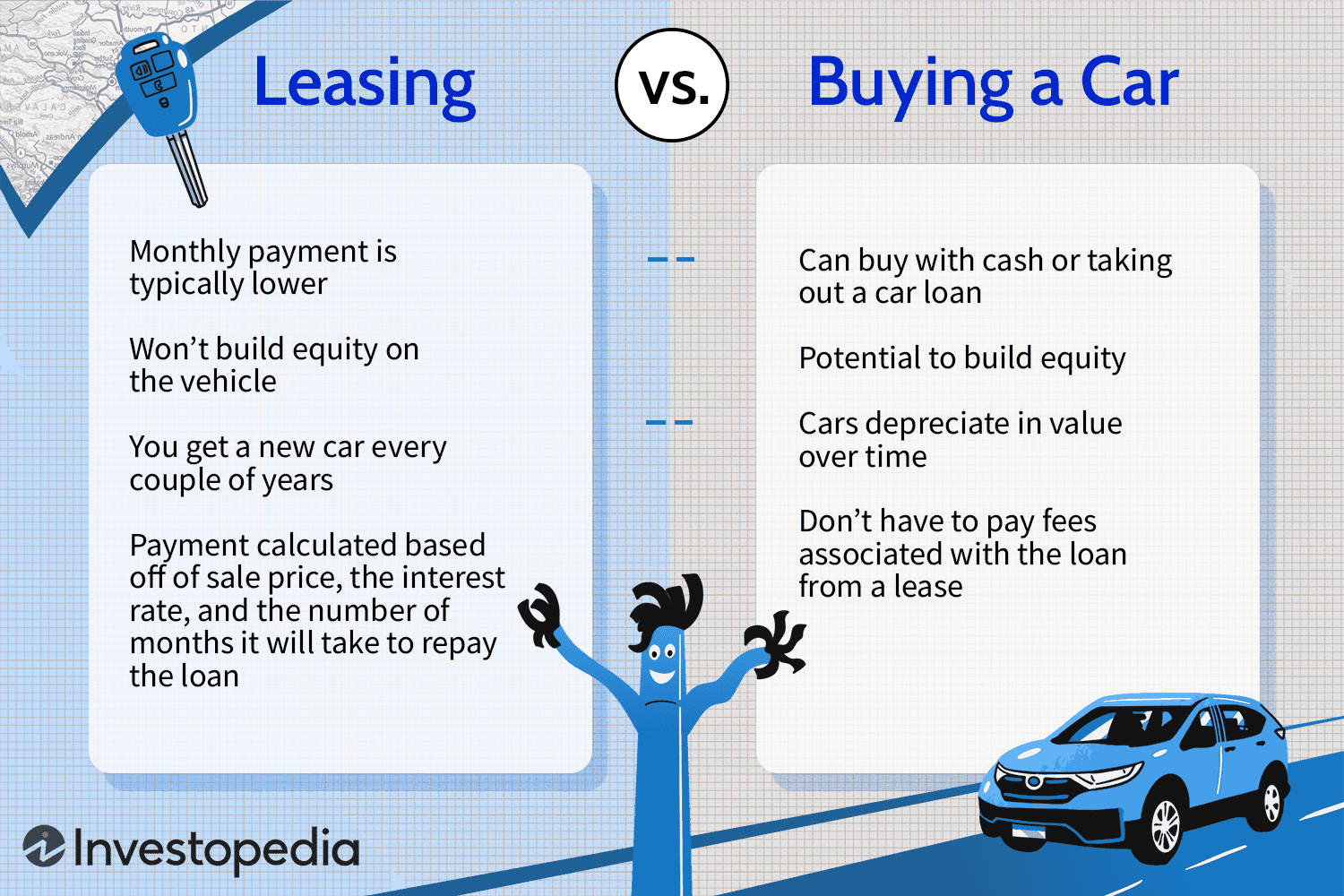

Purpose: Leasing – Understanding the Financial Diagram

Think of the lease agreement as a complex system, much like the intricate workings of your engine. Understanding what's required to lease a car is like having a detailed system diagram for that system. Knowing what each element represents empowers you to make informed decisions, negotiate effectively, and avoid costly surprises. Whether you're comparing lease offers, assessing the true cost of ownership, or even predicting future financial obligations, understanding this diagram is vital.

Key Specs and Main Parts of a Lease Agreement

Let's break down the key components of the "Lease Diagram". We're talking financial terminology here, so prepare for some new vocabulary.

- MSRP (Manufacturer's Suggested Retail Price): This is the sticker price of the vehicle. It’s a starting point for negotiations, not a fixed price.

- Capitalized Cost: This is the agreed-upon price of the vehicle for the lease. It's usually negotiable, and you want to get it as low as possible. Think of it as the selling price before the lease terms are applied.

- Capitalized Cost Reduction: This is any amount that reduces the capitalized cost, such as a down payment, trade-in value, or manufacturer rebates. Warning: Down payments on leases are generally discouraged, as you won’t recoup that money if the car is totaled.

- Residual Value: This is the predicted value of the car at the end of the lease term, determined by the leasing company. It's a crucial factor in calculating your monthly payments, but it is typically non-negotiable. A higher residual value results in lower monthly payments.

- Money Factor: This is the interest rate on the lease, expressed as a decimal. To find the equivalent APR (Annual Percentage Rate), multiply the money factor by 2400. This is a point where you can sometimes negotiate, especially if you have excellent credit.

- Lease Term: The length of the lease, typically expressed in months (e.g., 24, 36, or 48 months). Shorter terms generally have higher monthly payments but less overall interest paid.

- Mileage Allowance: The number of miles you're allowed to drive each year. Exceeding this limit results in per-mile overage charges at the end of the lease. Be realistic about your driving habits when choosing a mileage allowance.

- Monthly Payment: The amount you pay each month for the lease. This includes depreciation (the difference between the capitalized cost and the residual value), rent charge (interest), and sometimes taxes.

- Acquisition Fee: A fee charged by the leasing company to initiate the lease. It’s usually non-negotiable.

- Disposition Fee: A fee charged at the end of the lease to cover the cost of preparing the vehicle for resale. This fee is usually outlined in the lease agreement.

Symbols: Deciphering the Lease Agreement Labyrinth

The “symbols” here aren’t pictograms, but rather the acronyms and terminology used in the lease agreement. Think of it like reading a wiring diagram – each line and symbol represents a specific component or connection. Understanding what each acronym stands for and how they relate to one another is essential.

- Lines and Arrows: Visualize the flow of money. The Capitalized Cost Reduction "flows" into reducing the Capitalized Cost. The Lease Term influences the Monthly Payment, and so on.

- Color Coding: While not typically used in standard lease agreements, you could mentally color-code items: Green for negotiable items (like Capitalized Cost), Red for typically non-negotiable items (like Residual Value and Acquisition Fee), and Yellow for items to carefully consider (like Mileage Allowance).

How It Works: The Math Behind the Monthly Payment

The monthly payment is calculated using a specific formula. While you don’t need to memorize it, understanding the components that contribute to it helps in negotiations.

Here's a simplified version of the formula:

Monthly Payment = (Depreciation + Rent Charge + Sales Tax)

Where:

- Depreciation = (Capitalized Cost - Residual Value) / Lease Term

- Rent Charge = (Capitalized Cost + Residual Value) * (Money Factor)

- Sales Tax = (Depreciation + Rent Charge) * Tax Rate

This formula shows that the lower the Capitalized Cost and the higher the Residual Value, the lower the monthly payment. The Money Factor directly impacts the Rent Charge, and therefore, the overall monthly payment.

Real-World Use: Troubleshooting Lease Offers

Let's say you're presented with two lease offers for the same car. Both have the same MSRP, but one has a lower monthly payment. Here’s how you can troubleshoot the offers:

- Compare the Capitalized Costs: Is one dealer offering a better price on the car? This is the first place to look for savings.

- Check the Residual Value: Is the residual value significantly higher on one offer? A higher residual value translates to lower monthly payments, but it also suggests the leasing company is more optimistic about the car's future value.

- Examine the Money Factor: Convert the money factor to APR by multiplying by 2400. Compare the APRs to see which offer has the lower interest rate.

- Scrutinize the Fees: Are the acquisition and disposition fees the same? Sometimes, dealers will inflate these fees to offset a seemingly lower monthly payment.

- Mileage: Is the mileage allowance the same? A lower mileage allowance will result in a lower monthly payment, but could be very expensive at lease end.

If one offer seems too good to be true, question it. Dealers sometimes use deceptive tactics to make an offer appear more attractive than it actually is.

Safety: Avoiding Lease Agreement Pitfalls

Lease agreements are legally binding contracts, and it’s crucial to understand your obligations. Here are some potential "risk zones" to be aware of:

- Excess Mileage Charges: Carefully estimate your annual mileage and choose an appropriate allowance. Overage charges can be significant.

- Excess Wear and Tear: Leases have strict guidelines for acceptable wear and tear. Repair any minor damage before returning the vehicle to avoid costly penalties.

- Early Termination Fees: Terminating a lease early can be extremely expensive. You’re typically responsible for the remaining payments, plus early termination fees.

- Hidden Fees: Always read the fine print and ask about any fees that aren’t clearly explained. Don’t be afraid to negotiate or walk away if you’re not comfortable with the terms.

Just like working on your car, knowledge is power. Knowing what to look for and understanding the potential risks empowers you to make informed decisions and avoid costly mistakes.

We have the complete, detailed lease agreement template and financial diagram available for download. This resource will help you visualize the entire process and equip you with the knowledge to confidently navigate your next lease negotiation.