What Is The Illinois Tax On $29

Alright folks, let's talk about what a $29 purchase in Illinois means for your wallet in terms of taxes. Now, before you start thinking this is just a simple sales tax calculation, it's worth understanding the different layers that might be involved. While I'm not a tax professional, I can give you a breakdown of the likely components based on my understanding and common practices. Think of this as disassembling your car's engine – we're going to look at all the parts and see how they contribute to the whole.

Understanding Illinois Sales Tax

In Illinois, the main component of the tax on a $29 purchase is going to be the sales tax. However, unlike some states that have a single, statewide rate, Illinois has a complex system where sales tax rates can vary depending on the locality – the city, county, and even special taxing districts. Think of it like different engine configurations – they all do the same thing, but the specifics change things up.

Key Specs and Main Parts:

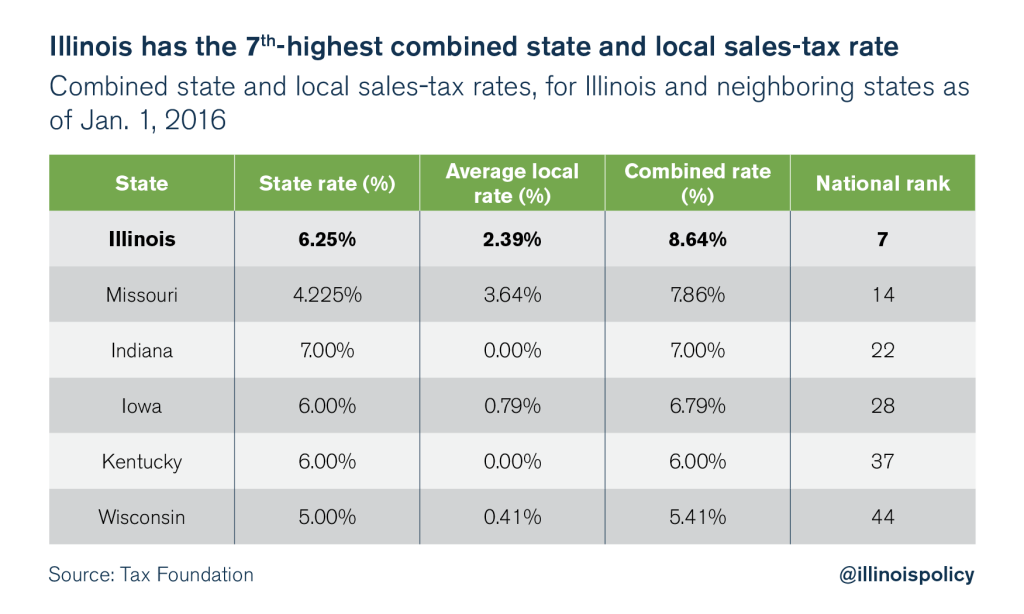

- State Sales Tax Rate: Illinois has a base state sales tax rate of 6.25%. This means that 6.25% of every dollar spent is collected by the state.

- Local Sales Tax Rates: This is where things get tricky. Cities and counties can add their own sales tax on top of the state rate. These local rates can range from 0% (in some very rare cases) to over 4%.

- Special Taxing Districts: On top of local government, there can be special taxing districts (e.g., for mass transit or other specific services) that also levy sales taxes. These are usually a smaller percentage, but they add up.

- Base: This is the $29 before any taxes. It's the raw material we're starting with, like the engine block before you add any parts.

- Taxable Amount: This is usually the same as the base, but there might be exceptions, like items that are exempt from sales tax.

Symbols and Calculation:

Let's say we're simplifying things to illustrate the principle. Assume a scenario with only the state sales tax (6.25%) and a local sales tax of 1.75% for a total of 8%. This is the simplified 'diagram' we're working with.

Total Tax Rate (%) = State Tax Rate (%) + Local Tax Rate (%)

If we were to represent this visually, you could imagine a pie chart where 6.25/8 of the pie is colored for the state tax and 1.75/8 is colored for the local tax.

The lines represent the flow of money to the state or local government.

The icon $ represents the total amount of money you're paying, including taxes.

The calculation would be:

Tax Amount ($) = Base ($) * (Total Tax Rate (%)/100)

Therefore, in our example:

Tax Amount = $29 * (8/100) = $2.32

The total cost would then be:

Total Cost ($) = Base ($) + Tax Amount ($) = $29 + $2.32 = $31.32

How It Works: The Tax Collection Process

When you make a purchase, the retailer is responsible for collecting the sales tax. Think of the retailer as a fuel pump – they take the gasoline (your money) and split it into different tanks (the government's coffers). The retailer then remits (pays) these taxes to the Illinois Department of Revenue on a regular basis. The Department of Revenue distributes the local sales tax to the appropriate local governments.

The actual rate you pay depends on where the sale is made, not necessarily where you live. For example, if you live in a town with a lower sales tax rate and drive to a neighboring city with a higher rate, you'll pay the higher rate in that city.

Real-World Use: Troubleshooting and Understanding Your Receipt

One important use of understanding sales tax is being able to verify your receipt. While most retailers have automated systems, errors can happen. You can use the formula above to check if the sales tax charged matches the rate for that location.

Here are some basic troubleshooting tips:

- High Tax: If the tax seems excessively high, double-check the location of the purchase. Also, ensure that you weren't accidentally charged tax on a tax-exempt item (e.g., some food items or prescription medications).

- Low Tax: It's less common, but if the tax seems suspiciously low, it could be an error. While you might be tempted to let it slide, it's ethically and legally best to bring it to the retailer's attention.

- Check for Itemization: A good receipt will break down the tax amount. If it doesn't, ask for an itemized receipt.

- Look up the Rate: The Illinois Department of Revenue has resources to help you find the sales tax rate for specific locations. Search for the "Illinois Sales Tax Rate Finder" on their website.

Safety: Handling Tax-Exempt Items

One area where you need to be careful is when dealing with tax-exempt items. Some items, like certain groceries or prescription medications, are exempt from sales tax. Others, like farm equipment, may have partial exemptions. If you're buying items that you believe should be tax-exempt, be prepared to provide documentation or inform the retailer. Providing false information about tax exemption is illegal and can result in penalties, similar to using the wrong type of fuel in your car which can cause damage to the engine.

Also, be aware of "use tax." If you buy something online from a retailer that doesn't collect Illinois sales tax, you are technically responsible for paying use tax, which is equivalent to the sales tax you would have paid if the retailer had collected it. While it's often overlooked, the Illinois Department of Revenue does audit these things, especially for businesses.

Finally, I want to reiterate, I'm just trying to provide you with an overview, consult a tax professional for specific tax advice.

Now that you have a breakdown of the sales tax system, you can use this as a starting point when understanding your purchases. It can be helpful to understand where your money is going and what factors are at play. This information isn't intended as tax advice. If you have questions about your specific tax situation, contact a tax professional.

We have a simplified diagram available for download which can help you visualize the flow of tax dollars. It will show the base amount, tax amount, and final total for a $29 purchase with varying local tax rates.