What To Know About Leasing A Car

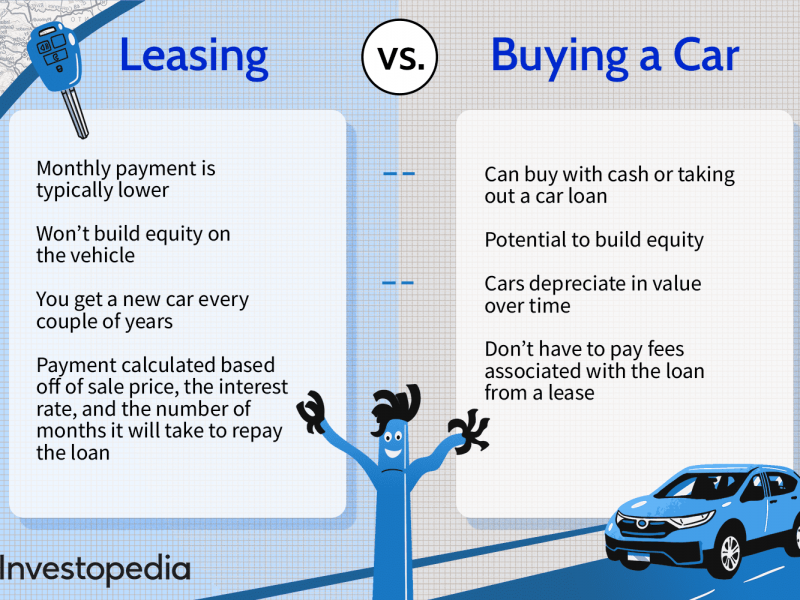

So, you're thinking about leasing a car. It's a different beast than buying, with its own set of rules and considerations. For an experienced DIYer like yourself, understanding the mechanics – not of the car itself, but of the lease agreement – is crucial to making a smart decision. This article is your wrench set for navigating the leasing landscape. We'll strip down the terms, specs, and potential pitfalls, turning you into a well-informed driver who knows exactly what they're getting into.

Understanding the Purpose of a Lease Agreement

Think of the lease agreement as a highly detailed blueprint for a complex system. Unlike a car repair manual, this "blueprint" doesn't tell you how to fix a broken engine. Instead, it outlines the responsibilities, obligations, and financial implications for both you (the lessee) and the leasing company (the lessor) during the lease term. Understanding it isn't about fixing a problem; it's about preventing problems in the first place. It's about knowing your rights, avoiding unexpected fees, and ultimately, deciding if leasing is the right move for your particular needs and circumstances. It helps in spotting potential scams or unfair terms.

Key Specs and Main Parts of a Car Lease

The lease agreement document itself can be dense, but it essentially breaks down into a few core components:

Capitalized Cost (Cap Cost):

This is basically the negotiated price of the vehicle you're leasing. It's similar to the selling price when you buy, but it's the starting point for calculating your monthly payments. Ideally, you want to negotiate this down as much as possible. Think of it as the cost of materials for your project – lower the cost, lower the overall expense.

Residual Value:

This is the estimated value of the car at the end of the lease term. It's determined by the leasing company and is based on factors like predicted depreciation. A higher residual value means lower monthly payments, but it can also make buying the car at the end of the lease less attractive. It's akin to estimating the resale value of a custom-built piece – it impacts the long-term return.

Money Factor:

Don't let the name fool you; this is essentially the interest rate you're paying on the lease. It's expressed as a small decimal (e.g., 0.0025). To get the approximate annual interest rate, multiply the money factor by 2400. So, 0.0025 x 2400 = 6%. A lower money factor is, of course, preferable. Consider this the cost of borrowing the tools – it directly impacts the total project cost.

Lease Term:

This is the length of the lease, typically expressed in months (e.g., 24, 36, or 48 months). Shorter terms usually mean higher monthly payments but less overall cost. It's like deciding how long you need to rent a particular tool – shorter rentals are often more expensive per day but cheaper overall.

Mileage Allowance:

This is the maximum number of miles you're allowed to drive the car during the lease term. Exceeding this allowance will result in per-mile overage charges, which can add up quickly. Choose a mileage allowance that accurately reflects your driving habits. This is akin to budgeting materials for your project – running out means extra costs.

Acquisition Fee:

This is a fee charged by the leasing company to cover the costs of initiating the lease. It's usually a few hundred dollars. It's similar to the initial setup fee for a subscription service.

Disposition Fee:

This is a fee charged by the leasing company at the end of the lease to cover the costs of preparing the car for resale. It's also usually a few hundred dollars. Think of it as the cleaning fee for returning a rented tool.

Monthly Payment:

This is the amount you pay each month to lease the car. It's calculated based on all the factors mentioned above, plus taxes and other fees. This is the bottom line – the overall cost of using the tool.

GAP Insurance:

Guaranteed Asset Protection. This covers the difference between what you owe on the lease and what the car is worth if it's stolen or totaled. It's particularly important for leases because you're responsible for the full lease amount even if the car is gone.

Understanding the "Symbols" - Lease Agreement Jargon

Lease agreements are notorious for using specific terminology that can be confusing. Here are some key terms to be aware of:

Lessee: You, the person leasing the car.

Lessor: The leasing company (usually the car dealership or a financial institution).

Closed-End Lease: The most common type of lease, where you return the car at the end of the lease term and you're not responsible for its actual market value, unless you've exceeded the mileage or damaged the car beyond normal wear and tear.

Open-End Lease: A less common type of lease where you're responsible for the difference between the residual value and the actual market value of the car at the end of the lease. Avoid these like the plague.

Excess Wear and Tear: Damage to the car that goes beyond normal wear and tear, such as dents, scratches, or stains. You'll be charged for this at the end of the lease. The definition of "excess" can be subjective, so be sure to understand the leasing company's policy.

How a Lease Works: The Financial Mechanics

The basic principle behind a lease is that you're only paying for the depreciation of the car during the lease term. Here's a simplified explanation of how the monthly payment is calculated:

- Depreciation: Capitalized Cost - Residual Value = Depreciation. This is the amount the car is expected to lose in value during the lease.

- Finance Charge: (Capitalized Cost + Residual Value) x Money Factor = Finance Charge. This is the interest you're paying on the lease.

- Base Monthly Payment: (Depreciation / Lease Term) + Finance Charge = Base Monthly Payment.

- Total Monthly Payment: Base Monthly Payment + Taxes + Fees = Total Monthly Payment.

It's crucial to remember that this is a simplified calculation. The actual calculation can be more complex, but this gives you a general understanding of the factors involved.

Real-World Use: Basic Troubleshooting Tips

Here are some common issues you might encounter with a lease and how to address them:

- Negotiating the Cap Cost: Don't be afraid to negotiate the capitalized cost. Research the market value of the car and use that as leverage. Visit multiple dealerships and get competing offers.

- Mileage Overage: Track your mileage carefully. If you realize you're going to exceed your mileage allowance, consider purchasing additional miles before the end of the lease. It's usually cheaper than paying the per-mile overage charge.

- Excess Wear and Tear: Take good care of the car. Repair any minor damage promptly to avoid being charged for excess wear and tear at the end of the lease. Document any existing damage before you take possession of the car.

- Early Termination: Terminating a lease early can be very expensive. You'll typically be responsible for paying the remaining lease payments, plus penalties. Avoid this if possible.

Safety: Risky Components and Hidden Dangers

The biggest "safety" concern with leasing isn't about physical harm, but financial risk. Here are some potential pitfalls to watch out for:

- High Money Factor: A high money factor can significantly increase the overall cost of the lease. Shop around for the best financing rates.

- Hidden Fees: Be aware of all the fees associated with the lease, such as acquisition fees, disposition fees, and early termination fees.

- Inflated Residual Value: While a high residual value lowers monthly payments, it can also make buying the car at the end of the lease less attractive if the actual market value is lower.

- Not Understanding the Agreement: The biggest risk is signing a lease agreement without fully understanding the terms. Read the entire document carefully and ask questions if anything is unclear. Don't be pressured into signing anything you're not comfortable with.

- GAP Insurance Omission: Skipping GAP insurance can be financially devastating if your leased car is totaled or stolen. Ensure your lease includes it.

By approaching leasing with a DIYer's mindset – understanding the components, troubleshooting potential problems, and prioritizing safety – you can make an informed decision and avoid costly mistakes. Leasing isn't inherently bad, but it requires careful planning and attention to detail.

We have prepared a detailed lease agreement diagram for your reference. This diagram visually breaks down the lease process, highlighting key decision points and potential pitfalls. You can download the file here: [link to download file - placeholder, obviously!]. This diagram is meant to complement the information in this article and provide you with a comprehensive understanding of the car leasing process.